Editor's PiCK

Last week, global virtual asset investment products saw a net inflow of $572 million

Summary

- CoinShares announced that last week, global virtual asset investment products saw a net inflow of $572 million, reversing the trend to net inflows.

- They explained that after the U.S. government allowed cryptocurrency investments in 401k plans, $1.57 billion flowed back in, with strong inflows originating from the United States.

- In particular, Ethereum (ETH) products recorded a net inflow of $268 million and set an all-time high in cumulative inflows since the beginning of the year.

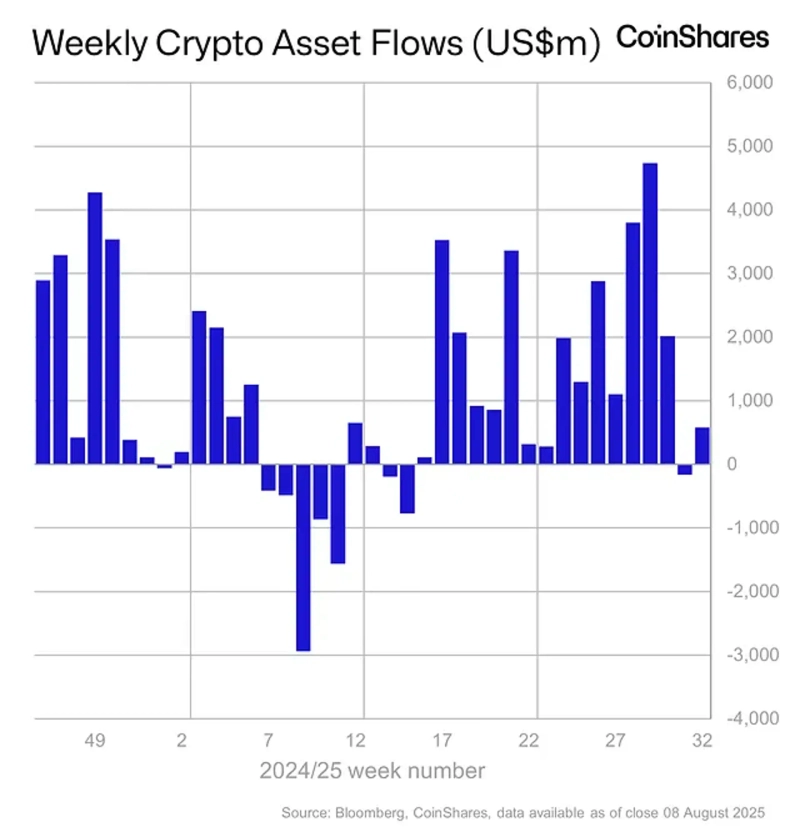

Last week, global virtual asset (cryptocurrency) investment products recorded an inflow of $572 million (₩795.4 billion).

On the 11th (local time), CoinShares stated in its report, "Last week, virtual asset investment products attracted $527 million, turning the trend back to net inflows." Notably, the allowance of cryptocurrency investment for defined contribution (DC) pension plans such as 401k had a positive impact.

The report said, "Earlier in the week, concerns of an economic slowdown due to weak U.S. employment led to an outflow of $1 billion from virtual asset products," but added, "Simultaneously, the U.S. government's approval of cryptocurrency investment in 401k resulted in a reinflow of $1.57 billion." It also noted that trading volume for exchange-traded products (ETPs) decreased by 23% compared to the previous month.

By asset, Ethereum (ETH) products ranked first with a net inflow of $268 million. The report explained, "Since the start of the year, cumulative inflows into Ethereum investment products have reached $8.2 billion, hitting an all-time high," and "due to price increases, assets under management (AUM) have also risen by 82% compared to last year, setting a new record at $32.6 billion."

Bitcoin (BTC) products attracted $260 million, ranking second. The report added, "Last week, Bitcoin products reversed two consecutive weeks of net outflows," and "short (sell) Bitcoin products recorded a net outflow of $4 million."

Major altcoins also showed positive momentum. XRP and Solana (SOL) each saw net inflows of $18.4 million and $21.6 million, respectively.

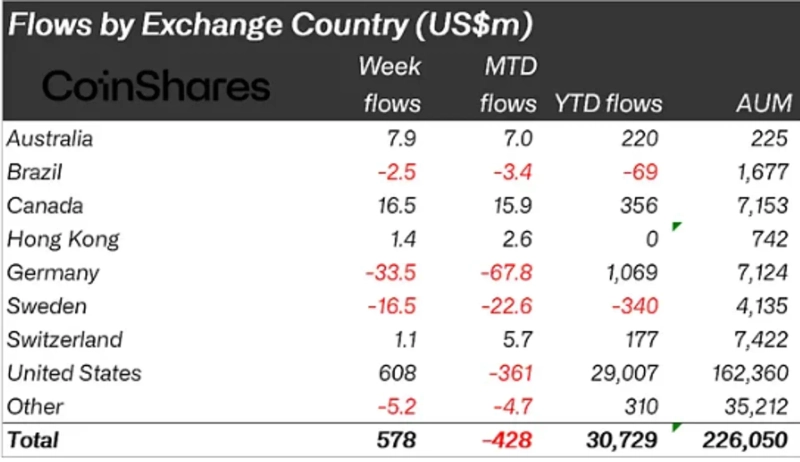

By country, the United States led with strong inflows. U.S.-based virtual asset products alone recorded net inflows of approximately $608 million, while Canada and Australia saw inflows of $16.5 million and $7.9 million, respectively. On the other hand, Germany, Sweden, and Brazil posted net outflows of $33.5 million, $16.5 million, and $2.5 million, respectively.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)