Editor's PiCK

Korean crypto trading volume surges amid Succinct’s rally: Korean Crypto Weekly [INFCL Research]

Summary

- Last week, Upbit reported overwhelming trading volume, highlighting the strong performance of newly listed PROVE.

- The rising momentum of small-cap altcoins—including DeFi and Layer 2 tokens—pointed to active investor demand and growing appetite for high-risk assets.

- Increasing initial capital through airdrops and a community-driven meetup meta are drawing attention as practical opportunities for investment gains.

1. Market Overview

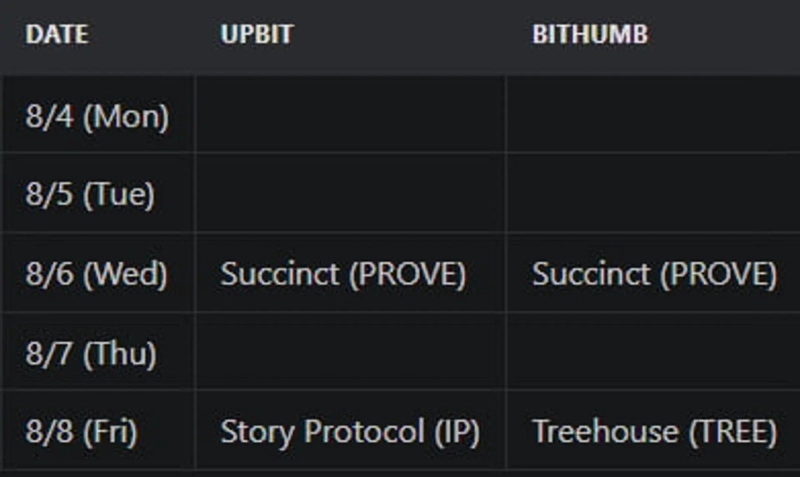

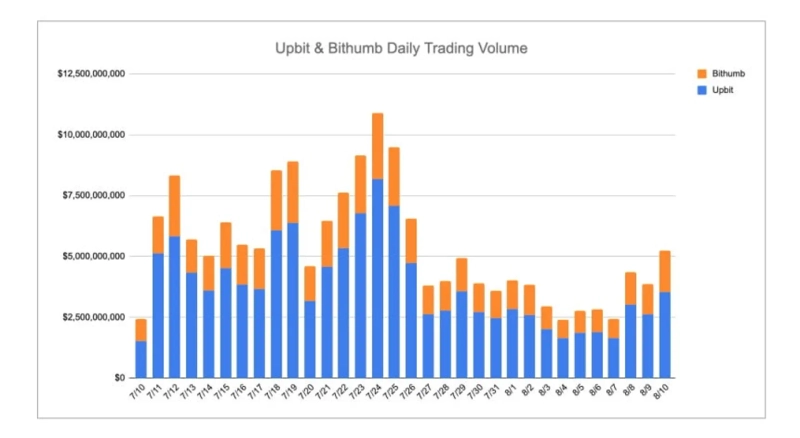

Last week, there were notable new listings across major Korean exchanges. Upbit listed Succinct (Succinct) and Story Protocol (Story Protocol), while Bithumb listed Succinct and Treehouse (Treehouse). Despite overlapping listings, Upbit maintained a commanding lead in trading volume, consistently surpassing $3 billion in daily trading, and even exceeded $8 billion on July 24. In contrast, Bithumb's highest daily trading volume during the same period was about $2.7 billion, demonstrating Upbit's firm grip on market share.

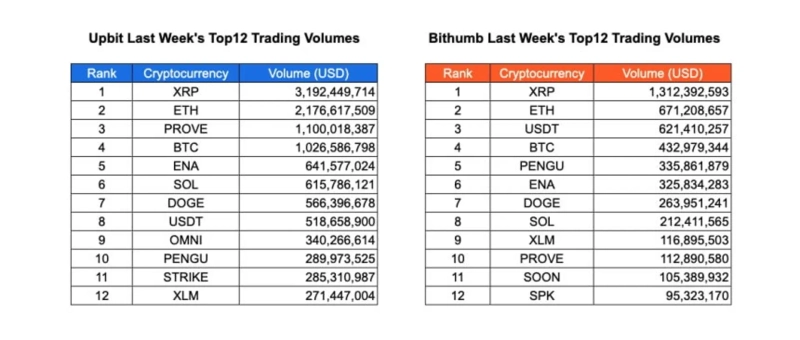

XRP dominated both exchanges, recording $3.19 billion on Upbit and $1.31 billion on Bithumb. ETH ranked second on both platforms, posting $2.17 billion on Upbit and $671 million on Bithumb. Newly listed PROVE on Upbit made an impressive debut with $1.1 billion, overtaking BTC ($1.02 billion) as well as other high-volume assets like ENA, SOL, DOGE, and OMNI. Meme token PENGU ranked among the top 10 on both platforms, remaining a popular cryptocurrency across exchanges. Bithumb’s top 5 included BTC and ENA, as well as USDT ($621 million) and PENGU ($335 million). Overall, Upbit not only kept its lead in total volume, but also highlighted broader trending assets, with new market entries such as PROVE making a strong early impact.

2. Exchanges

2-1. Newly Listed Coins

Last week saw several new listings on major Korean exchanges.

Succinct and Story Protocol were listed on Upbit.

Succinct and Treehouse were listed on Bithumb.

Key Marketing Strategies and Highlights

Succinct (PROVE)

Succinct’s entry into the Korean market began with the community. When the testnet first launched, participation was limited to a few select users. This exclusivity attracted early adopters, and the word quickly spread, with several KOL channels accelerating the project’s recognition.

There tends to be a herd mentality in Korea, where people are likely to follow if they see others getting involved, and Succinct seems to have benefited from this effect.

Users who joined at this stage became a strong initial support base, actively sharing testnet guides and updates.

As the Korean crypto market has drawn more attention globally, the Succinct team also began focusing on Korea—visiting the country, holding offline events, and communicating directly with local community members to cement their presence.

Access to the Succinct testnet required invitation codes, which the team distributed to interested users and key community channels, alongside events to further expand participation.

Although this restricted access, the team gradually opened participation to genuinely interested users, preventing the community from stagnating and providing momentum right up to the successful TGE.

Treehouse (TREE)

Treehouse’s Korean marketing took the form of a short-term, intensive campaign. Given that DeFi projects can feel unfamiliar to many in the Korean community, the campaign emphasized Treehouse’s fixed income-market strengths and increasing brand awareness. To achieve this, the Treehouse team worked with several KOLs, prioritizing clear and broad messaging.

Through Telegram channels run by KOLs, the team communicated what Treehouse is, its products and services, and how people can participate. They also amplified their messaging by tying it to key global exchange TGE announcements such as those from Binance and Bybit, raising expectations for Korean exchange listings.

2-2. Trading Volume

Upbit maintained its overwhelming dominance in the Korean crypto market last week, consistently outpacing Bithumb in daily trading volume. Upbit often exceeded $3 billion in volume, breaking the $8 billion mark on July 24. In contrast, Bithumb’s daily peak approached $2.7 billion over the same period. The gap between the platforms has widened, and Upbit sustained a majority market share throughout the week.

On Upbit, XRP once again topped the charts with $3.19 billion, followed by ETH ($2.17 billion), and newly-listed PROVE ($1.1 billion) showing strong momentum at #3. BTC took fourth place with $1.02 billion, with ENA ($641 million), SOL ($615 million), DOGE ($566 million), and OMNI ($340 million) among other leading cryptocurrencies. Meme token PENGU maintained a top-10 ranking with a trading volume of $289 million.

On Bithumb, top positions were held by XRP ($1.31 billion) and ETH ($671 million). USDT secured third with $621 million, while BTC ($432 million) and PENGU ($335 million) rounded out the top 5. Other important tokens included ENA, DOGE, and SOL, with PROVE entering at #10 on Bithumb.

In summary, although both exchanges are led by similar blue chips such as XRP and ETH, Upbit remains the unmistakable market leader in both overall trading volume and asset diversity. Notably, newly listed coins such as PROVE have made a substantial early impact on the charts.

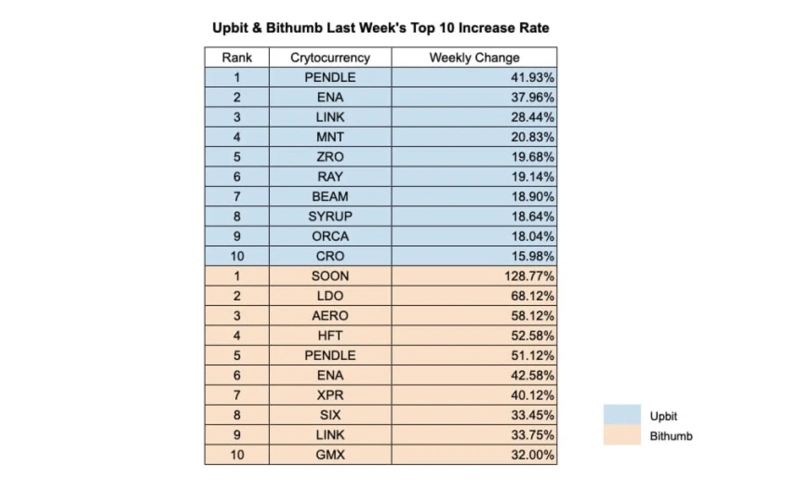

2-3. Top 10 Gainers

Last week, Upbit showed strong momentum among mid-cap tokens. PENDLE led the rally with a 41.93% surge, closely followed by ENA (37.96%) and LINK (28.44%), all posting robust gains. This remarkable growth points to renewed interest in decentralized finance and oracle-related projects amid general market stability.

Speculative activity was even more pronounced on Bithumb, where SOON soared 128.77%, far outpacing other gainers. LDO also saw a massive rally (+68.12%), while AERO delivered solid gains (+58.12%). The strength of these small-cap altcoins signals active demand and fund flows into high-risk assets on this exchange.

Overall, the largest gainers on Upbit and Bithumb indicate clear demand for specific DeFi and Layer 2 tokens. Bithumb’s exceptionally high risers contrast with Upbit’s more balanced momentum, reflecting a more aggressive speculative positioning.

3-1. Korea Delays Crypto Tax Again?

Korea’s cryptocurrency taxation, currently set for January 2027, may face yet another delay. Originally planned for 2022, the crypto tax has already been postponed three times due to investor backlash, with the most recent extension announced last year. Lim I-ja, chairperson of the National Assembly’s Planning and Finance Committee, recently noted that even if the OECD’s Crypto Asset Reporting Framework (CARF) is launched next year, further delays may occur due to design issues and administrative costs for the tax framework. She also pointed out that about 47% of Korea’s 7 million crypto traders are under 30, hinting that political considerations—especially with local elections set for 2026—could make policymakers hesitant to push forward.

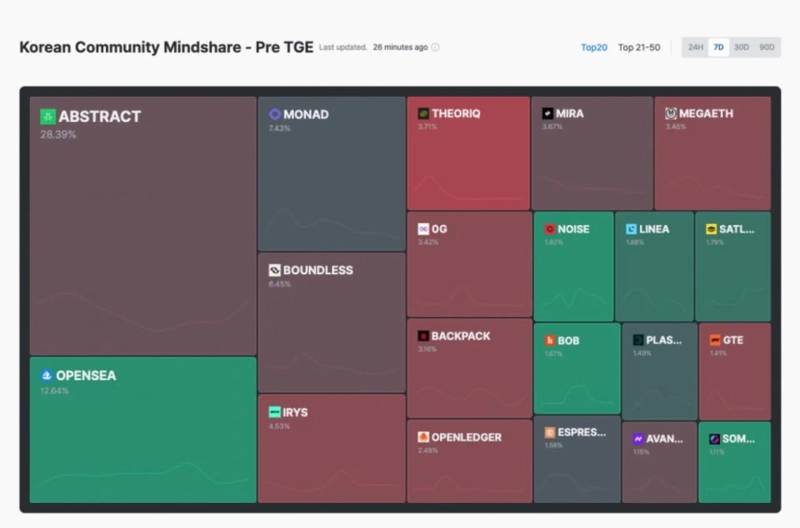

3-2. Telegram Mindshare Soars After Meetup

According to DeSpread's Telegram Mindshare Dashboard, IRYS climbed to #2 last week, just behind long-time leader ABSTRACT. One KOL commented: “IRYS jumped to 2nd place after the meetup. It clearly made a big impact in terms of mindshare.” The IRYS meetup on August 1 spurred a flood of summary content on Twitter and Telegram, demonstrating strong community engagement.

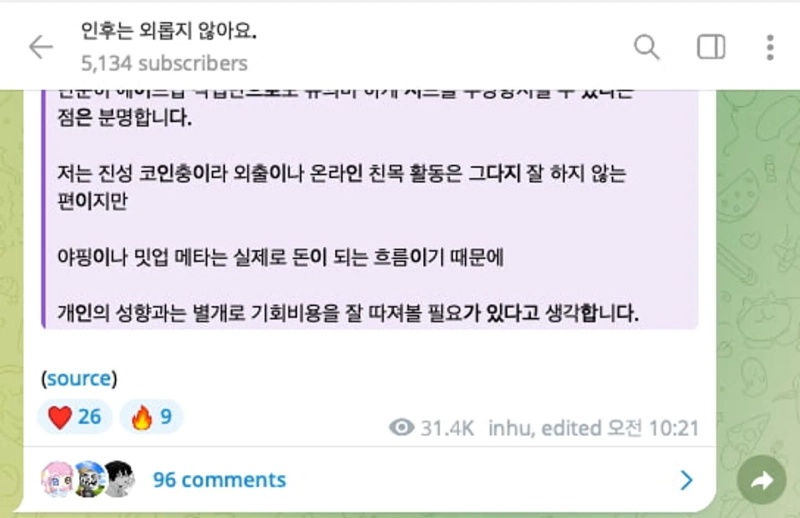

3-3. 150 Million Won in Airdrops After 8 Months?

Recently, a KOL shared a list of projects and verification posts for airdrop participation in 2025, causing a stir in the community. The post, which began with, “Could you make this much money if you just kept at it in 2025?”, was viewed over 30,000 times and drew nearly 100 comments among KOL circles. They remarked, “Just doing airdrop tasks can meaningfully grow your initial capital. I’m not really interested in social activities or attending events, but the ‘chatting’ and meetup meta offer practical profit opportunities, so regardless of personal preference, it’s worth considering the opportunity cost.” Community members responded with praise, saying, “Truly admirable,” “Incredible persistence,” and “With steady effort, anything is possible.”

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)