Summary

- The global stablecoin market capitalization is expected to approach $250 billion in 2025, and the demand and role of digital asset wallets are expanding from simple storage to practical asset management and market responsiveness.

- Following the risks of centralized exchanges, users are focusing on self-custody and hardware wallets, and execution UX that supports actual on-chain activity and investment behavior is becoming the core of market competitiveness.

- Wallets such as D'Cent are enhancing features for asset management, on-chain insights, and real-time trend analysis to support investment decision-making, signaling that the hardware wallet market is being reorganized from mere storage to platforms for judgment and execution.

As stablecoins emerge as the fastest-growing segment in the global digital asset market, the role of 'crypto wallets' is expanding beyond mere storage to include practical asset management and market responsiveness.

The Rise of Stablecoins

Immediately after the Trump administration returned to office, the development of a central bank digital currency (CBDC) at the federal level was halted, and stablecoins were adopted as a private-sector solution for the digital dollar strategy.

President Trump appointed David Sacks, also known as the 'Crypto Czar,' to take the lead in fostering a market-driven digital asset ecosystem.

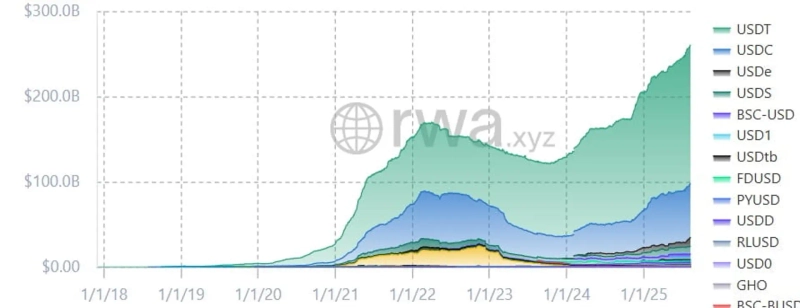

The shift in policy direction is evident in the numbers. According to the market analysis platform RWAxyz, as of August 2025, the stablecoin market capitalization was around $249.9 billion, up approximately 52.5% from the same month the previous year.

Tether (USDT) dominated with a 65.04% market share, followed by USDC at 25.18%. By network, Ethereum circulated $142.2 billion, Tron $80.7 billion, and Solana $10.3 billion worth of stablecoins. This is the result of a mix of risk-aversion sentiment, the practicality of using stablecoins as a remittance tool, and fiat-backed price stability.

The Evolution of Crypto Storage

The stablecoin market's growth is not just about increased trading volume. Stablecoins are now held in over 100 million digital wallets, with monthly active users reaching around 25 million. Users who previously stayed with exchanges or web3 wallets are increasingly switching to self-custody, creating their own wallets and managing their assets directly.

In the US, the cumulative downloads for top crypto wallet apps (Coinbase Wallet, Trust Wallet, MetaMask, etc.) surpassed 6.5 million in Q1 2025, with all major apps showing double-digit year-over-year growth rates.

The wallet market itself is booming. According to Straits Research, the global crypto wallet market size was about $12.6 billion at the end of 2024 and is forecast to grow to $19 billion by 2025. This is not just a result of rising coin prices, but of increased demand for self-custody and the expansion of infrastructure to support it.

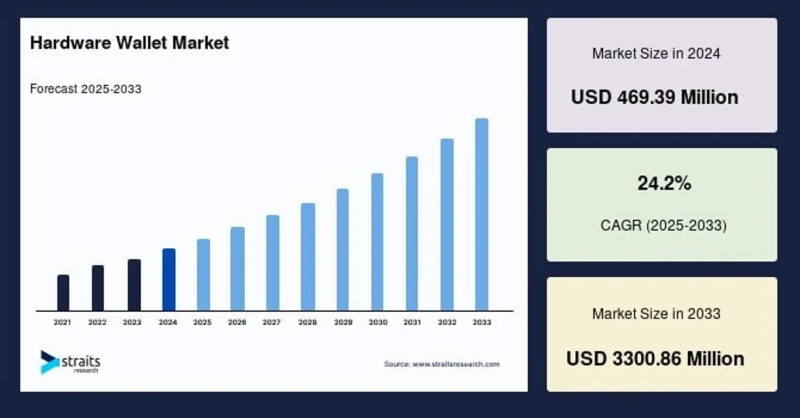

The trend is also clear in the hardware wallet market. The global hardware wallet market, valued at $460 million in 2024, is expected to grow by more than 25% annually and reach over $2 billion by 2030.

This reflects not just a demand for security, but a shift where users are seeking a foundation that allows them to make decisions and act on their own, rather than leaving assets in the hands of others.

Ultimately, the emergence of stablecoins raises not only the question of how to store assets, but also who holds control over them. Hardware wallets are no longer just storage devices. They're becoming new user interfaces, where decision-making and execution begin.

Crypto Wallets = The Starting Point for On-Chain Activity

The increase in wallet usage signals that users are actively engaging in on-chain activities. In the first half of 2025, global mobile crypto wallet users surpassed 35 million, with monthly active users (MAU) of top wallets such as Coinbase Wallet, MetaMask, and Trust Wallet hitting record highs. The average number of on-chain activities per user is also continually rising.

The most significant change is that wallets are now being used as 'the starting point of action' rather than mere 'storage boxes.' In the past, many users installed wallets but didn't participate on-chain; now, the majority actively execute transactions from the moment of installation. The range and frequency of activities have expanded to include not only transfers but also NFT minting, bridging, swapping, and DeFi participation.

Coinbase proclaimed a new slogan: "A New Day One for Coinbase Wallet," emphasizing that "the wallet is your new day one in crypto." This highlights that wallets have shifted from simply being a place to hold assets to the user's first point of engagement in the web3 space.

The numbers support this trend. According to Visa's on-chain data, total on-chain stablecoin transaction volume in the past 12 months reached $3.78 trillion (~₩5 quintillion), and even the adjusted volume came to $780 billion. Of 7.7 billion transactions, 1.7 billion were classified as genuine after filtering out spam and duplicates. Notably, small transactions accounted for 55.3% of all real transactions, highlighting the surge in everyday usage through wallets.

In the first half of 2025, Layer 2 networks saw an average of 500 million monthly transactions, 67% of which were related to stablecoin activities. This demonstrates that users are not just installing wallets, but actively transferring, utilizing, and deciding with stablecoins.

The criteria for choosing wallets are also changing. Rather than simply the number of supported coins, priority now lies in how easily, securely, and efficiently users can take meaningful actions. In this shift, 'storage' is no longer the end—true competitiveness lies in being an 'interface for decisions.'

The War for 'Execution UX' in Hardware Wallets Begins

Just a few years ago, self-custody was a strategy employed by only a small minority. Concerns about having to hold one's private keys—and the risk of losing everything with a single mistake—were the biggest barriers to entry.

Now, perceptions are changing rapidly. Triggered by the FTX bankruptcy in 2022, users began moving away from absolute trust in centralized exchanges (CEX). By 2025, this trend has only intensified, as large-scale fund outflows at exchanges such as KuCoin and Bybit reignited the self-custody movement under the banner of "protect your own assets."

The hardware wallet market is responding quickly to these changes. Ledger saw double-digit growth in shipments in Europe in Q1 2025 amid privacy regulation issues, while Trezor overhauled its wallet UX in six months to attract more users. While everyone is moving toward 'user-friendly hardware wallets,' many products are still focused on 'storage'-centric UX. There are frequent shortcomings in app connectivity, intuitive interfaces, and action-driven design, and often, users install wallets but never proceed to invested on-chain activity.

Today’s users expect more than just secure storage. Security is a given: what matters is what you can actually do inside the wallet. Beyond feature lists, the key criterion is how intuitively and easily integrated user experiences are designed.

D'Cent wallet is a prime example of responding swiftly to this evolution. Instead of simply listing features, it curates flows that guide users’ actual participation in web3.

For example, the wallet can lead users through real on-chain transactions by following specific conditions, or encourage repeated activities using a rewards-based structure. Even those unfamiliar with web3 can learn through action and eventually graduate toward investing.

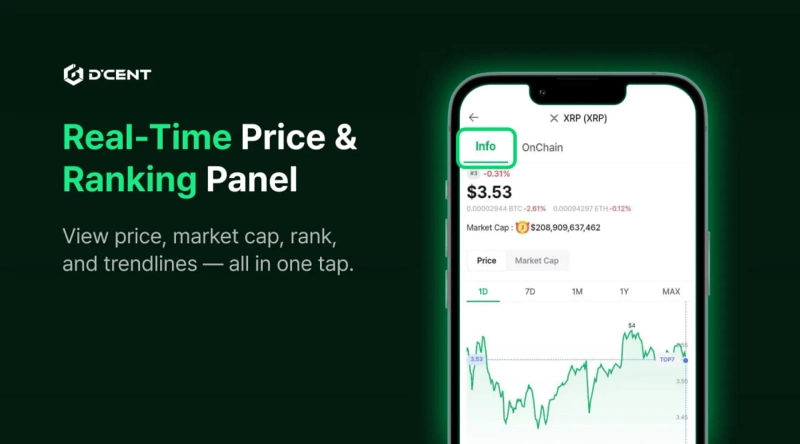

D'Cent is expanding from a storage and transaction tool to an assistant for investment decisions. It not only displays balances, but provides on-chain insights and tailored investment information and actionable indicators, turning the wallet into an 'auxiliary decision device.'

Consequently, the hardware wallet market is being reorganized—not by the number of supported coins, but by the power of the user experience. Now, users choose wallets based on what can be executed through them, and wallets are being redesigned not as mere storage, but as 'starting points for action.'

From Storage to Judgment: Expanding the Role of Wallets

To hold digital assets today is no longer just about storage. In the web3 environment, saturated with on-chain options, users face daily crossroads: 'Should I sell this asset now?', 'Should I join this project?', or 'Is now the right moment for action?'

Yet, most hardware wallets offer no answers to these questions. Many are still optimized solely for storage, with little functionality to guide or assist the user's next move.

D'Cent is setting itself apart at this juncture. Through recent updates, it has gone beyond simply adding features, attempting a structural UX transformation that supports user judgment and actions.

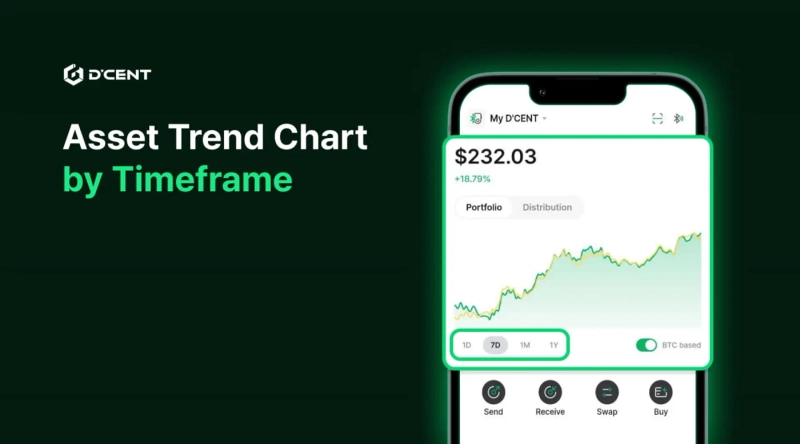

The newly designed D'Cent portfolio screen visually provides not just a list of holdings, but also real-time valuation, asset allocation ratios, and asset-specific trend flows. This enables practical management and response, helping users see patterns at a glance instead of just storing assets.

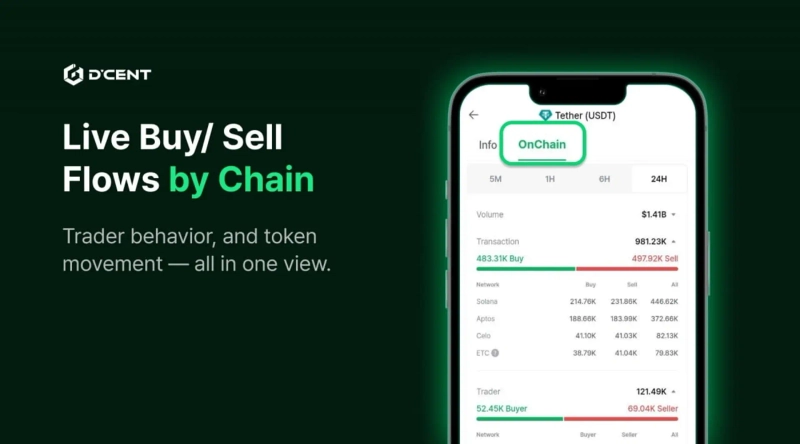

The on-chain insight feature integrates the activity of identical tokens scattered across various chains, displaying transaction flows in one view. Users can intuitively see which chains are experiencing trading concentration or where liquidity is flowing within the app—information that directly leads to judgment and action.

The trend analysis feature automatically detects when key tokens enter the 'Trend 7' zone based on real-time price data, notifying users accordingly. This functionality is highly useful for crucial moments such as short-term trading or taking futures positions, enabling users to react to market signals instantly within the wallet.

Ultimately, D'Cent is experimenting with the idea that wallets must become platforms for judgment and execution, not just tools for storing assets. These experiments are setting the new standards for hardware wallet UX.

The Time Has Come for Wallets to Move

The market is sending a clear message: assets are moving more frequently, in smaller amounts, and faster than ever before. In particular, stablecoins now account for the largest share of real-world-based transactions in a short period, sitting at the heart of payments, remittances, and swapping activities in web3. The traditional approach of simply storing assets is no longer valid.

If investor behavior has changed, so must wallets. They must evolve beyond simple repositories to platforms that intuitively connect information and flows, helping users quickly make and execute decisions. Hardware wallets, especially, need to evolve from isolated storage devices to real-time tools for the 'active investor.'

Ultimately, the hardware wallet market is no longer a battle of who can store the most coins. The competition is about which product can respond faster and more precisely within the flow of an active user base.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)