Editor's PiCK

[Analysis] "New Bitcoin investors withstand selling pressure, holding the average price at $112,000"

Summary

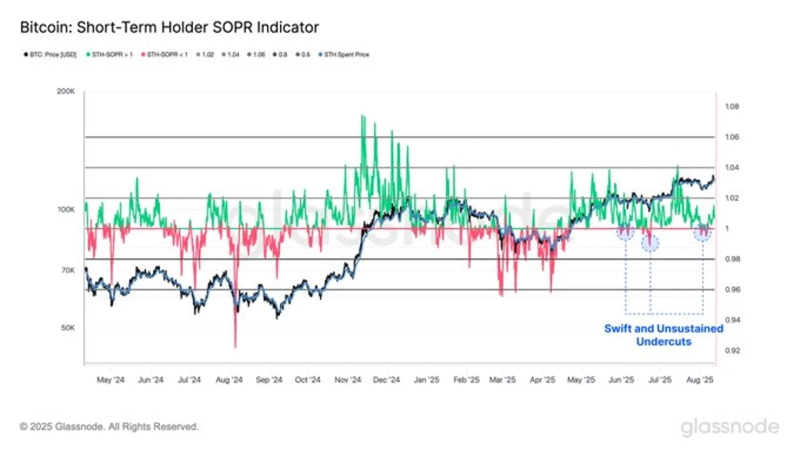

- The on-chain analytics platform Glassnode reported that short-term holders are defending selling pressure near the average purchase price of Bitcoin.

- It was revealed that the short-term holders' SOPR indicator dipped below the neutral line (1.0) and then quickly recovered.

- Glassnode explained that new investors are showing determination to maintain the breakeven point at around $112,000.

Signals have emerged that short-term holders of Bitcoin (BTC) are defending against selling pressure near their average purchase price.

According to on-chain analytics platform Glassnode on the 14th, the SOPR (Spent Output Profit Ratio) for short-term holders briefly dipped below the neutral line (1.0) but quickly rebounded. Glassnode explained, "This (indicator) rebound demonstrates that realized losses are limited, and new investors are showing determination to maintain their breakeven point at around $112,000."

Meanwhile, the short-term holder SOPR indicator shows whether current investors holding coins for more than 1 hour and less than 155 days are in profit or loss. When this indicator is above 1, it means the proportion of investors who realized profits through short-term trading is high; below 1, the proportion of investors who incurred losses is higher.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)