Editor's PiCK

Expectations for a 'big cut' dashed by US PPI...Virtual asset market turns downward

Summary

- The US Producer Price Index (PPI) for July greatly exceeded market expectations and sharply dampened hopes for an interest rate cut.

- As a result, the virtual asset market saw major assets, including Bitcoin (BTC, down 4.70%) and Ethereum (ETH, down 4.17%), collectively decline.

- In particular, it was reported that investor sentiment was further weakened after the US Treasury Secretary announced the suspension of additional Bitcoin purchases.

The virtual asset (cryptocurrency) market has collectively shifted into a downward trend. The United States' Producer Price Index (PPI) for July surpassed market expectations by a large margin, rapidly quashing hopes for an interest rate cut. Additionally, US Treasury Secretary Scott Bessent’s announcement of halting further Bitcoin purchases led to a marked decline in investor sentiment.

According to the US Department of Labor on the 13th (local time), the July PPI rose by 0.9% from the previous month. This is the highest figure since June 2022, greatly exceeding the market forecast of 0.2%. The core PPI, which excludes food and energy, also increased by 0.9%, surpassing the expectation of 0.2%. Year-over-year, the overall PPI rose by 3.3%, and the core PPI by 3.7%.

Due to a sharper increase in prices than expected, expectations for a 50bp cut in the federal funds rate, the so-called ‘big cut’, by the US central bank (Fed) in September have essentially vanished. There is growing concern in the market that "rising prices at the producer level are highly likely to be passed on to consumers."

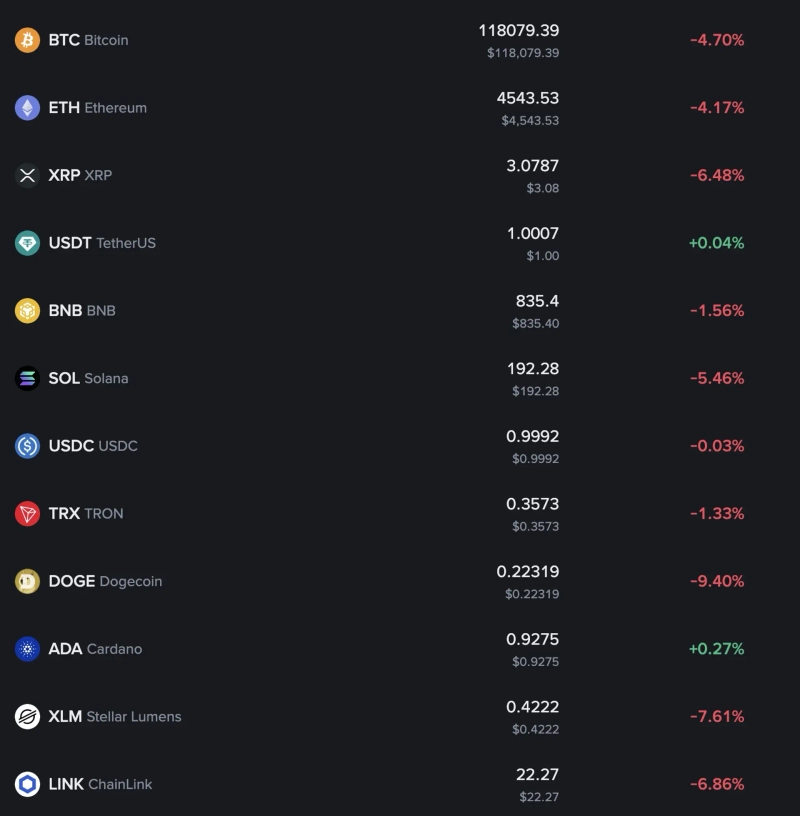

The virtual asset market reacted immediately. On the 14th (local time), based on the Binance Tether (USDT) market, Bitcoin (BTC) was down 4.70% from the previous day, trading in the $118,000 range. Ethereum (ETH) fell by 4.17% to around $4,540. Other major altcoins, such as XRP (-6.48%), Solana (SOL, -5.46%), Stellar Lumens (XLM, -7.61%), and Chainlink (LINK, -6.86%), also experienced significant declines. Notably, Dogecoin (DOGE) plunged by 9.40%, marking the largest drop.

Another news release that day added to the downward pressure. US Treasury Secretary Scott Bessent stated he would halt additional Bitcoin purchases and look for ways to utilize the government's existing holdings. Analysts say that with the disappearance of expectations for government-level buying, disappointment among investors has grown.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)