Summary

- It was announced that the US Bitcoin spot ETF market recorded a net inflow of $230.55 million.

- BlackRock’s IBIT led the capital inflow with a net inflow of $523.34 million, while ETFs from major asset managers such as Fidelity and ARK Invest experienced significant net outflows.

- Some ETFs, such as those from Invesco, Franklin Templeton, Valkyrie, WisdomTree, and Grayscale, saw no net inflow or outflow.

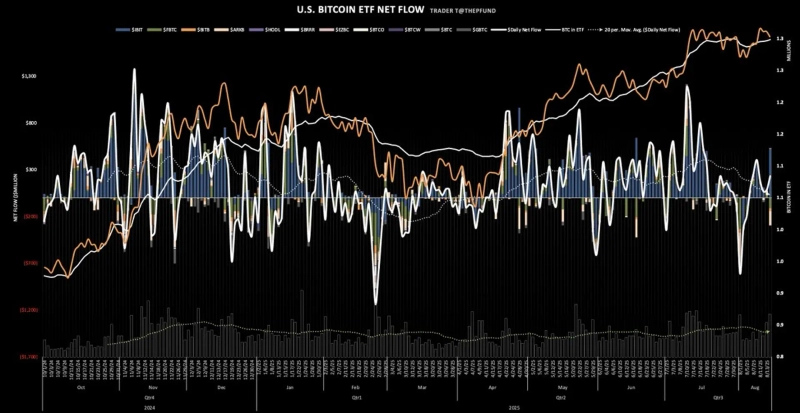

On the 14th (local time), the US Bitcoin spot ETF market recorded a total net inflow of $230.55 million (about ₩230.5 billion). While BlackRock led the inflow trend, major asset managers such as Fidelity and ARK Invest showed large net outflows, reflecting a mixed movement.

According to TraderT’s data, the product leading the inflows was BlackRock’s ‘IBIT’ with a net inflow of $523.34 million. Grayscale’s ‘BTC’ also saw an inflow of $7.32 million. On the other hand, Fidelity’s ‘FBTC’ recorded a net outflow of $113.47 million, ARK Invest’s ‘ARKB’ had a net outflow of $149.92 million, and Bitwise’s ‘BITB’ showed a net outflow of $30.87 million. VanEck’s ‘HODL’ also saw an outflow of $5.85 million.

Invesco ‘BTCO’, Franklin Templeton ‘EZBC’, Valkyrie ‘BRRR’, WisdomTree ‘BTCW’, and Grayscale ‘GBTC’ had no net inflow or outflow.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)