Summary

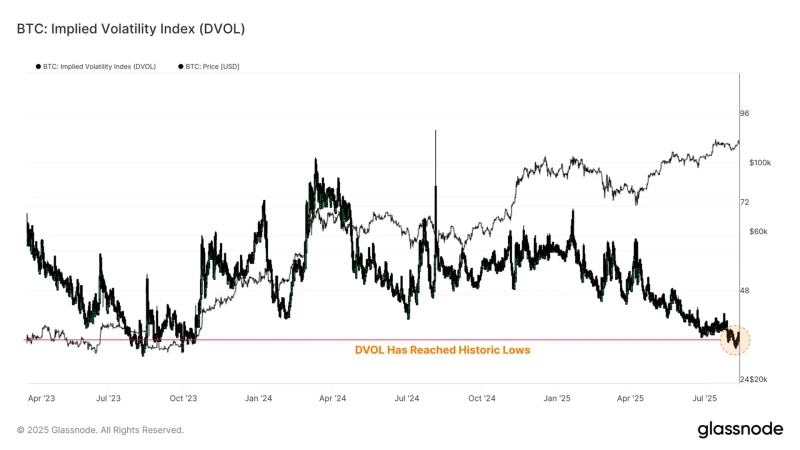

- Deribit's Bitcoin Options 30-Day Expected Volatility Index (DVOL) has reportedly neared a historical low.

- Glassnode explained that the decline of the DVOL index suggests there is almost no investor demand to hedge against downside risk.

- Glassnode added that this could lead to greater volatility.

Deribit, a cryptocurrency (crypto asset) options exchange, has reported that the 'Bitcoin Options 30-Day Expected Volatility Index (DVOL)' is nearing a historical low.

On the 15th (local time), Glassnode stated on X (formerly Twitter), "The Bitcoin DVOL index is approaching all-time lows," adding, "This indicates there is almost no demand from investors wanting to hedge against downside risk." They further noted, "As a result, volatility may increase."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)