Summary

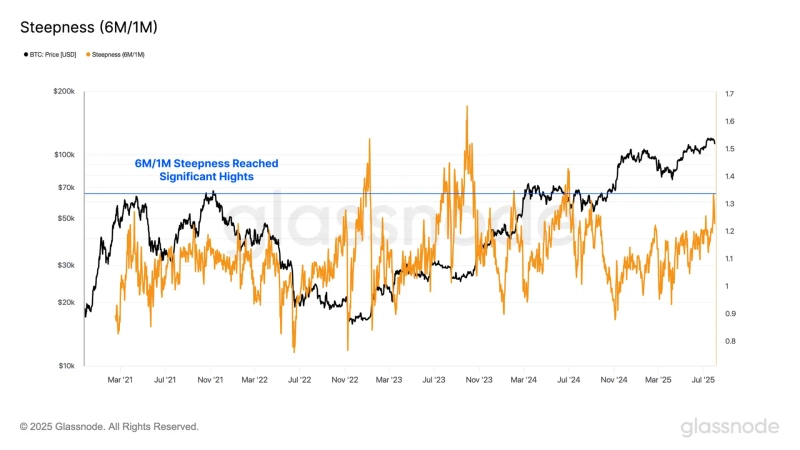

- Glassnode stated that Bitcoin's 1-month and 6-month implied volatility has increased significantly.

- It was reported that this indicates increasing investor concern about the macroeconomy going forward.

- Bitcoin is trading at $117,527, down 1.40% compared to 24 hours ago.

Glassnode reported a significant increase in Bitcoin (BTC) 1-month and 6-month implied volatility.

On the 15th (local time), Glassnode announced on X (formerly Twitter), "Bitcoin's 1-month and 6-month implied volatility has surged," and added, "This suggests growing investor concern about future macroeconomic conditions."

Previously, QCP Capital stated, "The U.S. Producer Price Index (PPI) rose 0.9% month-on-month yesterday, increasing the likelihood of a stronger dollar and higher interest rates," and diagnosed that "the virtual asset market has undergone a short-term correction due to the macro environment."

As of 11:50 PM, Bitcoin is trading at $117,527 on the Binance USDT market, down 1.40% compared to 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)