Summary

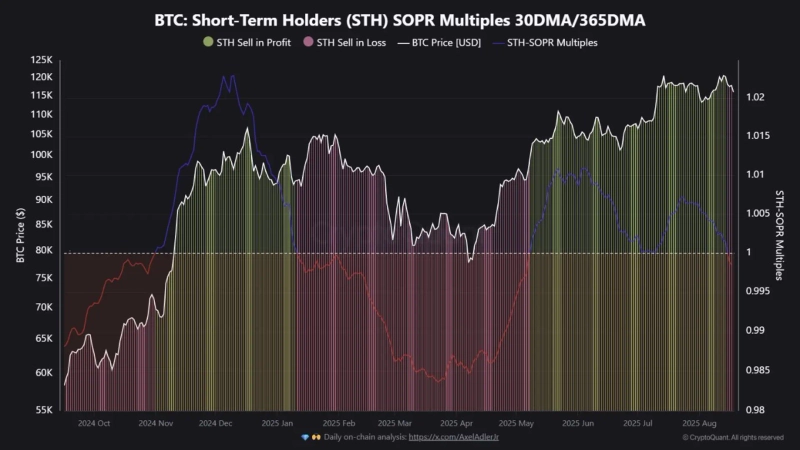

- It has been noted among investors that short-term Bitcoin holders are selling at a loss.

- Short-term loss selling by holders is said to be a key indicator for gauging the market's health.

- The outlook states that if loss-selling supply is quickly absorbed, a strong rebound is possible, but if not, the upward momentum may collapse.

As short-term holders of Bitcoin (BTC) have begun to cut their losses, an analysis suggests it is important to pay attention to upcoming market movements.

On the 19th (local time), Kripto Mevsimi, a CryptoQuant contributor, stated in a report, "Short-term holders selling at a loss is a key indicator confirming the market’s health," and "For the first time since the sharp decline last January, short-term holders are selling Bitcoin at a loss."

He further added, "If the supply sold at a loss is quickly absorbed, it could signal a powerful rebound through market resets. However, if not, the upward momentum could collapse." He continued, "We need to pay attention to the possibilities triggered by loss-cutting in the market."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)