Editor's PiCK

Jackson Hole Today, Market on Edge... Will Bitcoin's 'Final Defense Line' at $108,000 Be Tested? [Minseung Kang's TradeNow]

Summary

- Experts note that if Bitcoin (BTC) falls below the critical support at $111,500, it could decline further to the 'final defense line' of $108,000.

- Global investors are focusing on the Fed's Jackson Hole meeting and Powell's speech for signals regarding possible U.S. rate cuts.

- Institutional investors are accumulating, while retail investors are cutting losses. In the short term, caution is advised due to potential range-bound trading and heightened volatility.

Bitcoin (BTC) continues to weaken under the shock from U.S. inflation data and confusion over strategic reserve policies. The market is displaying caution ahead of the Jackson Hole meeting hosted by the U.S. central bank, the Fed.

Experts say that if Bitcoin breaks through the resistance at $115,000, it could rise to the $120,000 level. Conversely, if it falls below the support at $111,500, it could be pushed down further to $110,000 and the final defense line of $108,000. Since the market direction is unclear, it appears to be a period requiring caution and frequent reversals in the short term.

As of 13:53 on the 22nd, Bitcoin was trading at $112,795, down 0.89% from the previous day in the Binance USDT market (₩157,940,000 on Upbit). At the same time, the kimchi premium (the price difference between foreign and domestic exchanges) was at 0.17%.

"Bessent's Mixed Comments, Inflation Pressure... Heightened Tension Ahead of Powell's Speech"

The focus of the global stock and crypto asset (cryptocurrency) markets is on the Jackson Hole meeting being held on the 22nd (local time). Especially as Fed Chair Powell is scheduled to deliver a keynote speech at 11 PM (KST), all eyes are on his message. With sluggish employment, inflation concerns, and ongoing pressure from President Trump, speculation centers on whether Powell will hint at a rate cut or continue his cautious stance—an expected turning point for the market.

Previously, U.S. Treasury Secretary Bessent dampened expectations for a strategic Bitcoin reserve policy by stating, "The government's holding of Bitcoin is limited to seized assets." However, Bessent later attempted to clarify, saying, "Acquisition of Bitcoin in a budget-neutral manner is still under review." Ultimately, although the possibility of acquisition was kept open, inconsistent statements have only heightened uncertainty.

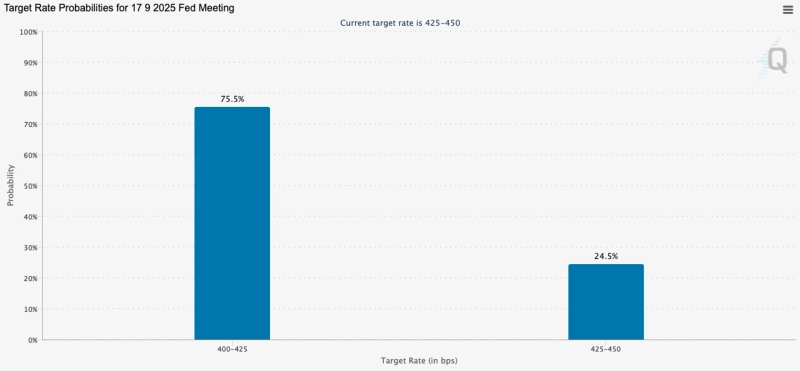

Meanwhile, according to the Chicago Mercantile Exchange (CME) FedWatch tool, as of 1 PM on this day, the probability of the Fed holding rates steady in September was estimated at 75.5%. As U.S. producer prices in July rose more than expected, hopes for a rate cut have eased slightly from the previous 90% levels.

"Whales Accumulate, Individuals Cut Losses... Diverging Investment Moves"

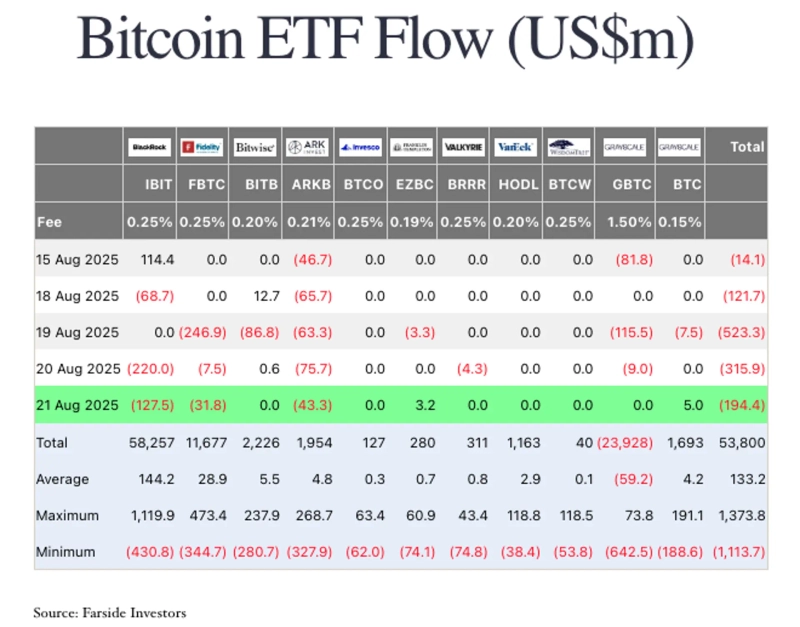

This week (18~20), a net outflow of $960.90 million was recorded from spot Bitcoin ETFs. Factors contributing to downward pressure include Treasury Secretary Bessent's statement that the government's Bitcoin holdings are 'limited to seized assets' and a slump in risk appetite after a shock in the U.S. Producer Price Index (PPI).

Global crypto exchange Bitfinex stated in its weekly report, "The crypto market is highly sensitive to U.S. inflation data," and predicted, "The market is likely to remain range-bound until a strong catalyst such as dovish Fed signals or resumed ETF inflows emerges."

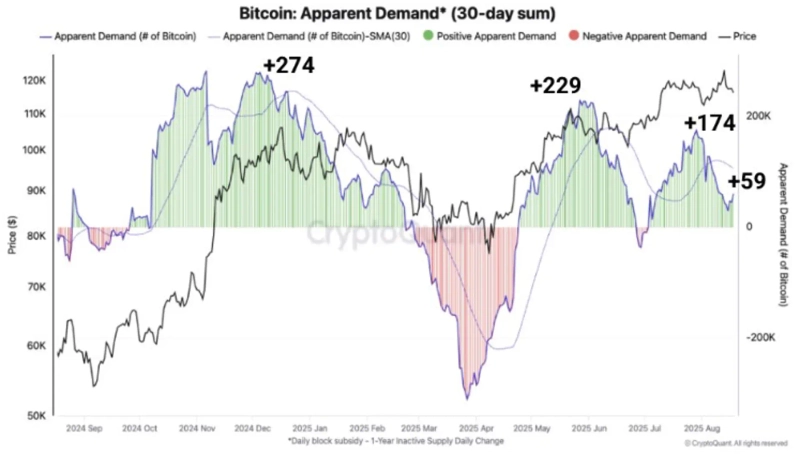

Individual investors appear to be engaging in stop-loss selling. On-chain analytics platform CryptoQuant analyzed, "Bitcoin demand has sharply dropped from 174,000 BTC last month to 59,000 BTC now," adding, "In particular, demand from individual investors has decreased by 5.7%, and short-term investors are selling at a loss." The firm continued, "If individual stop-loss sales are quickly absorbed, this may be a sign of a rebound, but if not, it could lead to a further weakening of momentum." In fact, according to CoinMarketCap, the Fear & Greed Index for crypto assets plunged to 46 from 75 just one week ago.

Meanwhile, major whale wallets continue to accumulate. On-chain analytics firm Santiment reported, "While Bitcoin is undergoing a correction after reaching an all-time high of $123,677 on the 13th, wallets holding between 10 and 10,000 BTC have recently added 20,061 BTC." The report also noted, "Since March, these wallets have increased holdings by over 220,000 BTC. Their holdings have shown a clear correlation with price trends."

The market remains wary of volatility driven by leverage. On-chain analytics firm Glassnode, in its weekly report on the 20th, noted, "With selling pressures accumulating in the crypto market, the derivatives market in particular is leading heightened volatility." The report added, "Bitcoin futures open interest remains high at $6.7 billion, and in such a structure, even small price movements can trigger amplified market responses."

"Bitcoin Facing Tests at 115K Resistance and 108K Support"

Bitcoin has recently slipped to the $113,000 range, shifting the market's focus to whether it can defend the crucial support level of $108,000.

Aayush Jindal, a researcher at NewsBTC, said, "There’s strong resistance around $115,000 for Bitcoin. In the short term, it needs to break through the $115,000~$115,500 range for further upside. In that case, targets of $118,400, $120,000, and possibly $121,500 would come into play." However, he also pointed out, "There are multiple challenges on the way to $120,000, with major resistance lines acting as significant hurdles."

He continued, "If Bitcoin fails to break resistance, additional declines toward $113,500, $111,500, and possibly even the $110,000 support can follow. In such a scenario, $108,000 would become the final defense line."

Some analysts expect Bitcoin to continue range-bound movement for now. Rakesh Upadhyay, a researcher at Cointelegraph, analyzed, "Even if Bitcoin breaks above $116,687 going forward, intensifying selling pressure during rallies could keep it trading in a range between $110,530 and $124,474 for the time being." Upadhyay added, "However, if it breaks below the lower bound of the range, further declines to $105,000, or the psychological support at $100,000, could follow."

Coupling with the traditional financial market is also noteworthy. Alex Kuptsikevich, chief market analyst at FXPro, analyzed, "The market's attention is on the $108,000 level. Failing to hold this could result in a sharp decline to $100,000." He added, "The latest rebound from the low ($112,500) is not yet a meaningful recovery. Continued weakness in U.S. tech stocks is also putting pressure on crypto assets."

Christopher Lewis, an analyst at FXPro, also noted, "Bitcoin's correlation with the stock market has recently increased, and its sentiment is highly affected by equities. The upward trend isn't necessarily over, but the market is hesitating. Investors are advised to wait until a clear rebound signal emerges."

Minseung Kang, Bloomingbit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Market] Bitcoin steadies after 'wash shock'…reclaims the $79,000 level](https://media.bloomingbit.io/PROD/news/2d67445a-aa24-46b9-a72d-5d98b73b6aec.webp?w=250)