Editor's PiCK

From next year, government subsidies to be paid with 'digital currency'...World's first experiment

Summary

- It was reported that from next year, some government subsidies will be paid as digital currency (deposit tokens).

- By introducing blockchain-based digital currency, it is expected to prevent the misuse of subsidies and reduce administrative and financial costs.

- In addition to government subsidies, there is potential for expansion to Onnuri Gift Certificates and local currencies, which could further increase policy effectiveness.

Ministry of Strategy and Finance and Bank of Korea to promote blockchain pilot project

Transfer via smartphone 'e-wallet'

Can prevent misuse of ₩112 trillion in subsidies

Strict restrictions on where recipients can spend funds

Save on fees and reduce payment time

Potential expansion to regional currencies

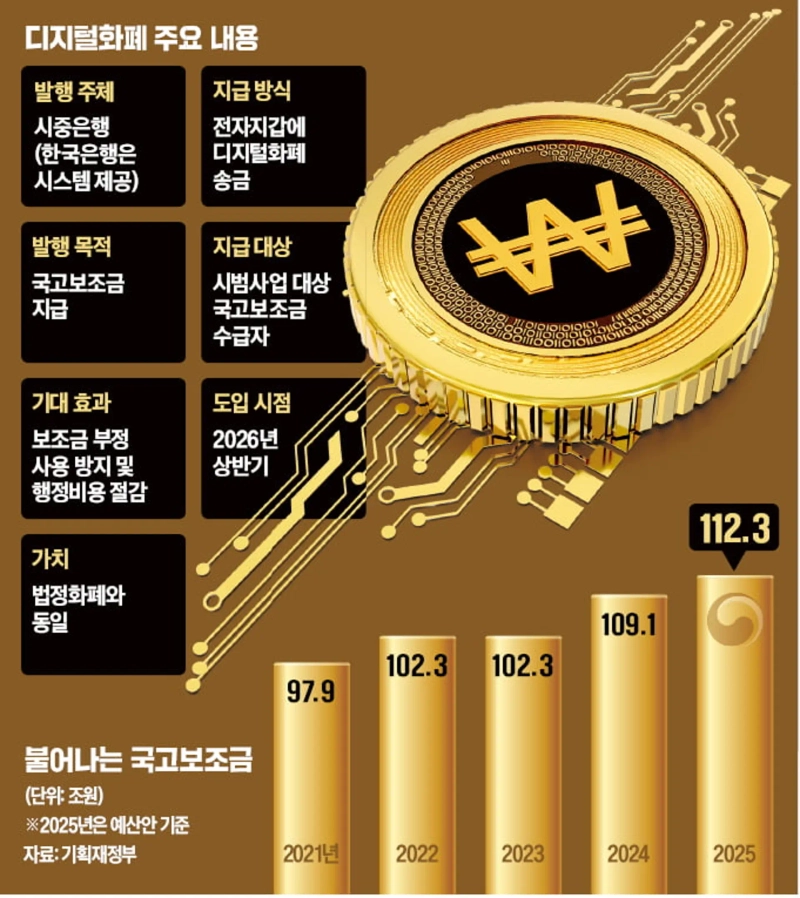

Starting next year, some government subsidies will be provided as digital currency (deposit tokens) instead of cash or vouchers. The purpose is to prevent subsidies from being used inappropriately and to reduce administrative and financial costs by utilizing blockchain-based digital currency. This is drawing attention as the world's first case of digital currency adoption in the public sector.

◇ World’s first introduction to the public sector

According to related ministries on the 22nd, the Ministry of Strategy and Finance is working with the Bank of Korea to implement a blockchain and digital currency pilot project in the first half of next year. The core of the project is to provide digital currency subsidies to certain recipients using the blockchain system built by the Bank of Korea. By the end of the year, they plan to select subsidy projects that will be paid through digital currency.

This digital currency will be issued by commercial banks, based on the Bank of Korea's central bank digital currency (CBDC) and blockchain system, and transferred to recipients' e-wallets (smartphone apps). The currency is pegged to the existing value and can be tracked and managed in real time via the Bank of Korea’s blockchain ledger. The main difference between this currency and the CBDC is that its usage is restricted. While CBDCs can be used anywhere like cash, the government's digital currency can only be transacted among subsidy recipients and associated businesses. For example, if you receive a digital currency subsidy for facility investment, you may only use it at designated business partners, such as construction or material suppliers.

Because digital currency can be tracked in real time, the government expects it will help prevent subsidy misuse. As government subsidies increased to a record ₩112.3 trillion this year, fraudulent claims are also on the rise. Last year, there were 630 cases of illicit subsidy usage, the highest since these records began. There are also many instances of R&D or prototype development grants being used for personal entertainment, contrary to their intended purposes.

The program is expected to deliver significant administrative cost savings as well. Previously, after subsidies were deposited into a bank account, another transfer had to be made to the supplier, incurring extra fees from banks, card companies, and payment gateway providers (PG). With digital currency, subsidy recipients can pay suppliers directly from their smart wallets, saving on fees and reducing payment times.

◇ Economic duo Koo Yun-cheol & Lee Chang-yong closely watching outcome

The government plans to expand digital currency use based on the pilot project's success. There is speculation that Onnuri Gift Certificates and local currencies could also be replaced with digital currency, which would enhance policy effectiveness. If designed so that digital currency can only be used at participating merchants in specific regions or industries, it could help revitalize local economies and support small businesses.

There is growing consensus that converting recently distributed consumer recovery coupons into digital currency could make policy measures more effective. Payment speed could be increased by allocating funds directly into individual e-wallets based on digital ID verification. Personal trading and fraudulent transactions at affiliated stores (card cashing) could be filtered, making it possible to track usage and more precisely analyze and adjust policy impact.

Vice Prime Minister and Minister of Strategy and Finance Koo Yun-cheol and Bank of Korea Governor Lee Chang-yong are also paying close attention to the project. Deputy Prime Minister Koo is said to have actively called for the initiative, emphasizing budget execution efficiency and policy effectiveness. Governor Lee is reportedly following the project as part of the CBDC initiative 'Project Han River.'

Kim Ik-hwan, reporter lovepen@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Market] Bitcoin falls below $71,000…Lowest level since October 2024](https://media.bloomingbit.io/PROD/news/0e5880b9-61dd-49d4-9d2e-c47a3fb33a93.webp?w=250)