Editor's PiCK

Circle up 5x after IPO: Investment strategy amid overvaluation controversy [Jeon Ye-jin's Market Insight]

Summary

- Circle (CRCL) has garnered investor attention as it continues to face share price corrections and persistent losses despite a significant increase in USDC circulation and revenue growth after its IPO.

- The market views Circle as both a potential beneficiary of regulation and a high-growth company, but differing opinions remain over its high valuation and worsening profitability.

- Experts recommend defensive strategies such as split buying and selling until profitability improves, highlighting the importance of risk management amid intensifying regulatory and competitive pressures.

Circulating supply of USDC surges 90%, Q2 revenue up 53% to $660 million

Share price correction phase post-IPO due to large-scale rights offering… Expected to benefit from regulatory tailwinds

Circle Internet Group (CRCL), the issuer of the stablecoin 'USDC', is attracting attention from domestic investors ahead of a visit to Korea by President Heath Tarbert. Circle is one of the most notable companies in the U.S. stock market in the first half of this year. Since its listing on the New York Stock Exchange (NYSE) in June, its share price has nearly soared tenfold compared to the IPO price ($31), approaching $300. Although the price has recently entered a correction phase, investor interest remains high amid expectations of regulatory benefits.

◆ Revenue soars as coin circulation increases

Circle is a fintech company headquartered in Boston, USA. It issues and manages USDC, a digital asset pegged 1:1 with the U.S. dollar. For each unit of USDC issued, an equivalent amount of U.S. dollars or U.S. Treasury bonds must be held in reserve. The company emphasizes transparency by disclosing reserve details through monthly audits by an accounting firm.

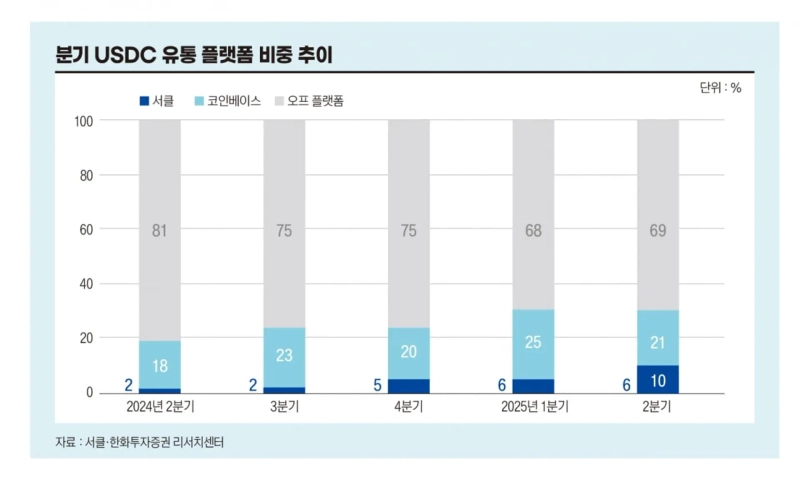

Most of Circle’s revenue comes from interest earned on reserves. In the second quarter, the company generated $658.1 million (approx. ₩920 billion) in revenue, of which reserve interest income amounted to $630 million (approx. ₩880 billion). USDC reserve interest revenue grew 49.9% year-over-year, driving overall sales. The steady increase in USDC circulation has been a growth driver. As of the end of June, the circulating supply of USDC reached $61.3 billion (approx. ₩85.7 trillion), up 90.2% from a year earlier. As of August 10, circulation rose 6.4% from the end of Q2 to $65.2 billion (approx. ₩92 trillion). Circle also operates payment infrastructure connecting traditional and crypto finance using blockchain technology. It supports global payments, remittances, and settlements based on USDC through API services for enterprise clients, addressing demand for real-time cross-border transactions. It supplies a variety of USDC-based financial tools and infrastructure for DeFi, NFTs, blockchain gaming, and fintech companies.

As blockchain network partnerships expand, usage fees and transaction fees for infrastructure are also increasing. With additional revenue from Circle Payment Network (CPN) and USDY (MMF token) usage fees, other Q2 revenue surged 251.8% to $23.8 million.

◆ "Expecting 40% annual growth from network effects"

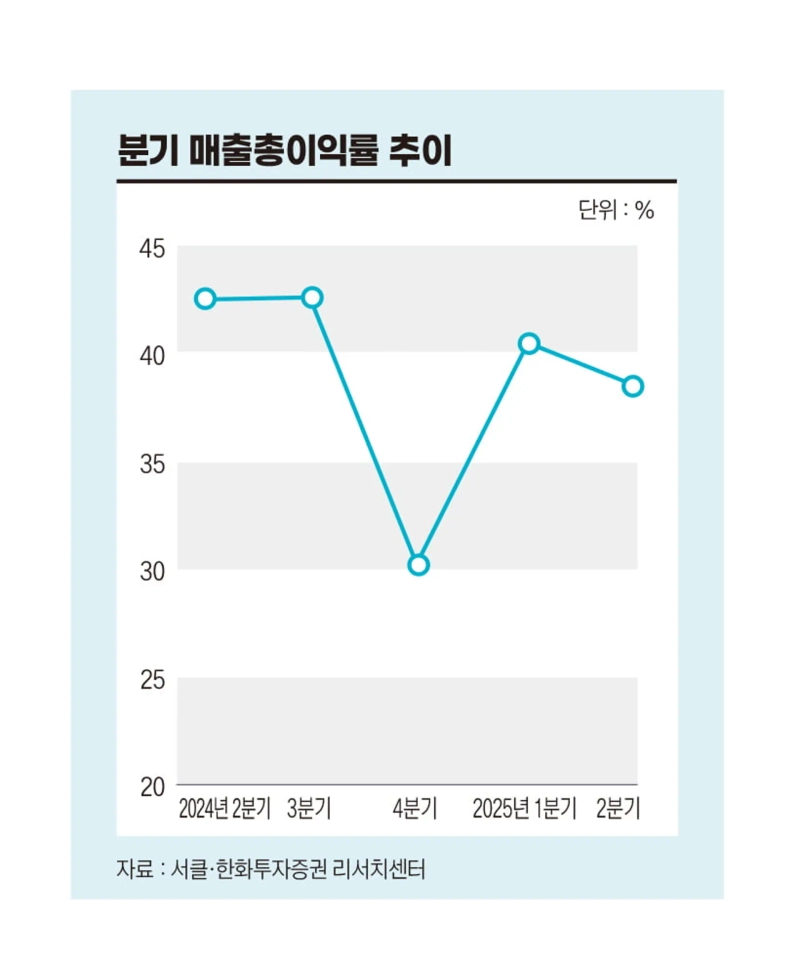

The crypto industry rates the growth potential of USDC highly. Compared to another stablecoin, Tether (USDT), USDC is considered more regulatory-friendly and better tailored for institutional demand. Its strong linkage with payment infrastructure is also a strength. Circle is leveraging these USDC advantages by increasing partnerships with major exchanges such as Binance and OKX. It is also expanding as a major payment method for Visa, Mastercard, and others. The company expects, due to network effects inherent to stablecoins, that USDC’s circulating supply will grow more than 40% annually on average. However, there are lingering concerns about the revenue structure. While Circle's total Q2 revenue rose 53% year-over-year, net losses reached $482.1 million for the period. The company remains in deficit. Losses were particularly high in Q2 due to $591 million in IPO-related expenses.

The profit-sharing structure with its key distribution partner Coinbase is also a burden. Interest income from USDC held in Coinbase user accounts accrues to Coinbase. Yumin Kim, an analyst at Hanwha Investment & Securities, noted, "Circle’s Q2 distribution and transaction costs rose 63.8% YoY to $400 million as USDC balances held by Coinbase increased," and added, "As distribution channels diversify, dependence is expected to decrease."

◆ 'Regulatory beneficiary' vs 'Overvalued stock'

Even though Circle made a spectacular debut in the IPO market, its high valuation (stock price versus earnings) and concerns about declining profitability have led to mixed evaluations among investors. Share price, after surging to $299 immediately after listing, recently dropped to the $130 range, more than 50% below its peak.

News of the rights offering raised concerns about lower earnings per share (EPS) and dragged the share price down. Circle recently announced a rights offering of 10 million Class A common shares at $130 each. Of these, 2 million are new shares, resulting in a dilution effect of about 53.3%. Wall Street analysts stated, "Circle’s 12-month forward P/E ratio is 200.5 times, and its EV/EBITDA is 65.6 times," and analyzed that "while results were solid, the stock price is too high and a period of adjustment is inevitable due to profit-taking."

Securities firms are also divided in their evaluations. J.P. Morgan and Mizuho set target prices for Circle at $89 and $84, respectively. J.P. Morgan raised its target price for Circle from $80 to $89 on August 19, but maintained an "Underweight" rating. The firm warned, "If interest income drops and USDC growth slows, the current share price could fall to less than half."

However, there are several institutions expecting target prices above $100. The average target price among 17 brokerage firms that presented investment opinions on Circle over the last three months is $178.61, representing a 16.6% upside from the current share price. The highest target price is $358.

Some analysts say that the U.S. Congress’ "GENIUS Act," a bill currently being promoted to regulate stablecoins, could be favorable for regulated companies like Circle. Clarified regulation may boost USDC’s usage in payments and foreign exchange, leading to further revenue growth. However, the heavy burden of fixed and operational costs remains a hurdle. The potential intensification of market share competition for stablecoins, including Tether (USDT), also poses a risk. Experts commented, "If Circle does not fully capitalize on regulatory benefits, bubbles reflected in the share price could quickly burst," and emphasized, "Defensive strategies with short-term momentum and mid- to long-term risk management are needed."

Experts agree that until profitability improves, a defensive strategy involving dollar-cost averaging on both buys and sells is advisable. One industry source commented, "Circle could become the first case of a stablecoin issuer being incorporated into the regulated financial sector, but for now, it is still a transitional phase where growth and risk coexist," and added, "Investors must maintain balance between rosy expectations and rigorous risk management."

Jeon Ye-jin, Korea Economic Daily ace@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.