September market, rebound limited…Prepare for possibility of large-scale decline [Real Stocks Part 2]

Summary

- Yang Tae-won said there is a limited rebound or a large-scale possibility of decline in the September market.

- He urged investors to be cautious, as there remains additional risk down to the 2,900 level.

- He emphasized that defensive responses and thorough risk management are needed now rather than optimistic expectations.

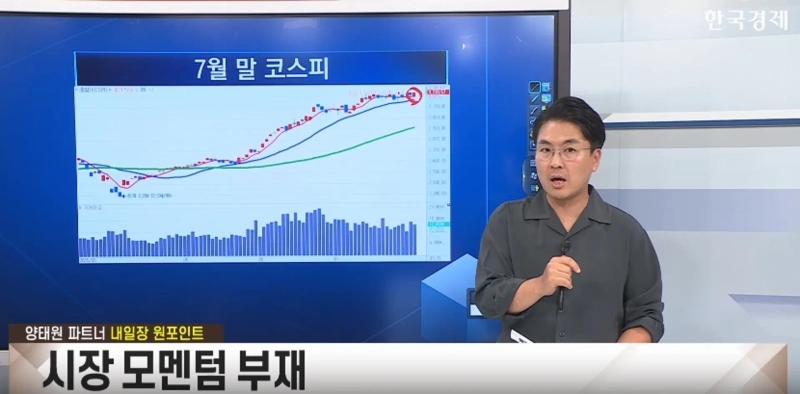

In the late July broadcast, warned of "August market risk"…All three declines materialized

"Warned in advance while the market was fine"…Emphasized investor preparedness strategies

September market: limited rebound at the level of 'geol' or possibility of a 'baekdo'-scale sharp crash

Yang Tae-won, an expert active at Korea Economic TV Wownet (CEO of Holy Investment), summarized the flow of the domestic market in August and presented a strategic perspective on the September market on the August 28 (Thursday) broadcast of 'Real Stocks Part 2'.

Yang said, "In the last broadcast in July I strongly warned that the August market would be the most dangerous period of the year," and stated, "In fact, in August we warned in advance of all the downward signals: ▲ the first downturn ▲ the second correction after a rebound ▲ the third sharp plunge."

He emphasized, "I do not speak retrospectively after the market has already fallen," and "Because I presented danger signals while the market was fine, investors who prepared could have largely avoided this August decline."

Regarding the September market, Yang described it as "in yut-nori terms, either 'geol' or 'baekdo'." He warned, "Even if it rises, strong increases like 'yut' or 'mo' will be difficult," adding, "It may be limited to a middling rebound, or, if things go wrong, a much larger correction could occur like a 'baekdo' that would make the prior decline seem insignificant."

Yang stressed that his warnings of a decline were not mere predictions. "Based on my master's degree in economics, I speak confidently only when the analysis probability reaches 80% or higher," he said, explaining, "All three declines in August were results based on high-probability analysis."

However, he urged investors to be cautious, saying, "It is not yet an 80% probability, but there remains a risk with about a 60% possibility of additional declines to the 2,900 level."

Finally, Yang advised, "Markets often only regret after an event occurs," and said, "Now is a time for defensive responses rather than optimistic expectations." He emphasized, "If risks are not thoroughly managed in this phase, it will be difficult to seize opportunities in the subsequent bull market."

Securities Editor Park Kwon-min reice@wowtv.co.kr

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.