Korean retail investors who followed Warren Buffett 'beaming smiles'... Also actively betting on Circle·Bitmain

Summary

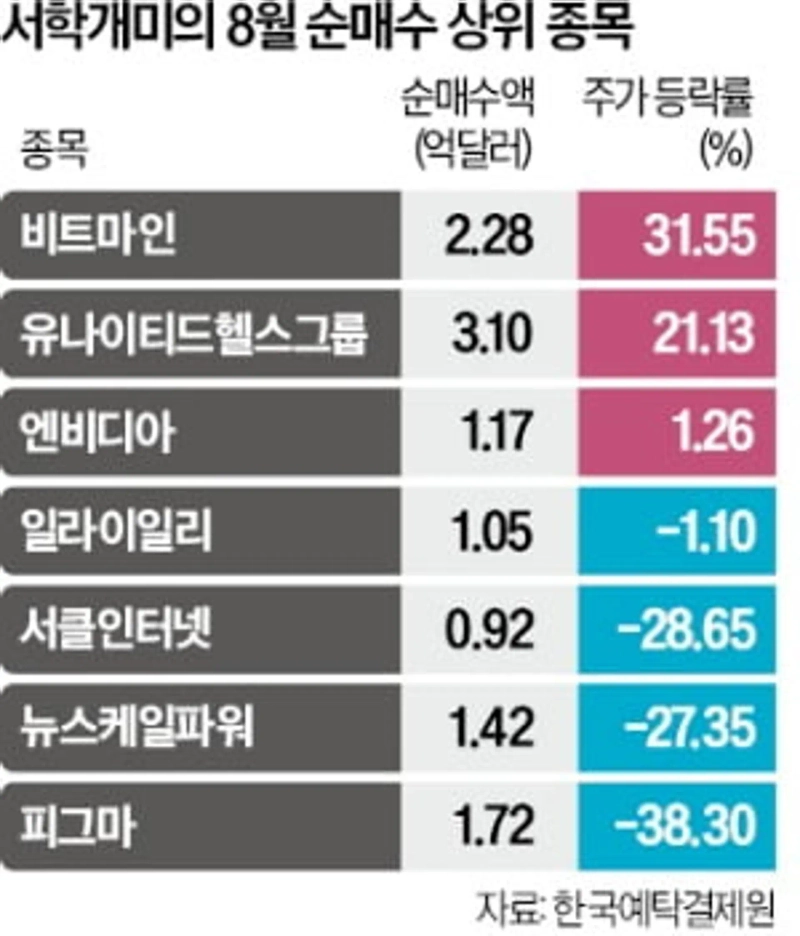

- UnitedHealth Group's stock rose 21% this month, far outpacing the S&P500 index's gain.

- Domestic investors' Bitmain net purchases were $228,490,000, and over the same period the newly listed stocks Figma and Circle fell 38.3% and 28.65%, respectively.

- An asset management company official said that investment in newly listed stocks that surged in the short term is highly volatile and carries the risk of buying at the peak, so a cautious approach is necessary.

UnitedHealth up 21% this month

Circle·Figma fell more than 30%

Investors targeting 'listing effect' suffer losses

Korean retail investors who bet on heavily beaten-down stocks posted favorable results. Meanwhile, investors who bought recently listed newcomer stocks saw losses.

On the 29th, according to the Korea Securities Depository, the foreign stock that domestic investors have net bought the most so far this month was UnitedHealth Group, the largest U.S. healthcare company. Net purchases amounted to $310,220,000 (about 502.5 billion won). Its share price rose 21.13% this month, far outpacing the S&P500 index's gain (2.56%) over the same period. The second most net-bought by domestic investors was Bitmain, a crypto-asset mining company that holds the most Ether in the world. Net purchases totaled $228,490,000.

UnitedHealth's stock plunged in April on news of a U.S. Department of Justice Medicare fraud probe and the CEO change. The stock, which had fallen to about half its level since the start of the year, has recently rebounded. Investor sentiment recovered after it became known that Berkshire Hathaway, led by investor Warren Buffett, purchased more than 5 million shares of UnitedHealth Group. Ann Hines, a strategist at Mizuho Securities, said, "The sharp drop in the share price increased the valuation attractiveness (price relative to performance)." However, reflecting weak second-quarter results, she lowered the target price from $350 to $300.

Korean retail investors who invested in newly listed stocks that surged in the short term saw losses. This month, investors bought $172,740,000 worth of design software company Figma and $92,030,000 worth of stablecoin issuer Circle, respectively, but their share prices fell 38.3% and 28.65% over that period. This was the result of profit-taking that followed the stocks more than doubling in a short period. Figma was listed on the 31st of last month, and Circle was listed on June 5 as newcomer stocks.

An official at an asset management company said, "As big tech stocks such as Tesla and Nvidia show sluggish movements, investors are flocking to newly listed stocks and heavily beaten-down stocks with high short-term price volatility," adding, "Because speculative capital has flowed in, if prices plunge, it is difficult to respond and investors may be stuck at the peak."

Reporter Maeng Jin-gyu maeng@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.