Summary

- "The U.S. July PCE index rose 2.6% year-on-year, matching market expectations.

- "This PCE result increased prospects that a rate cut at the September Federal Open Market Committee (FOMC) is more likely.

- "According to CME FedWatch, the probability of a September rate cut rose to 87.2%.

Personal consumption expenditures, in line with expectations

Core inflation up 2.9% year-on-year ↑

"Probability of Fed rate cut 87%"

The personal consumption expenditures (PCE) price index, a key indicator the U.S. central bank (Fed) considers when deciding monetary policy, rose slightly in July in line with market expectations.

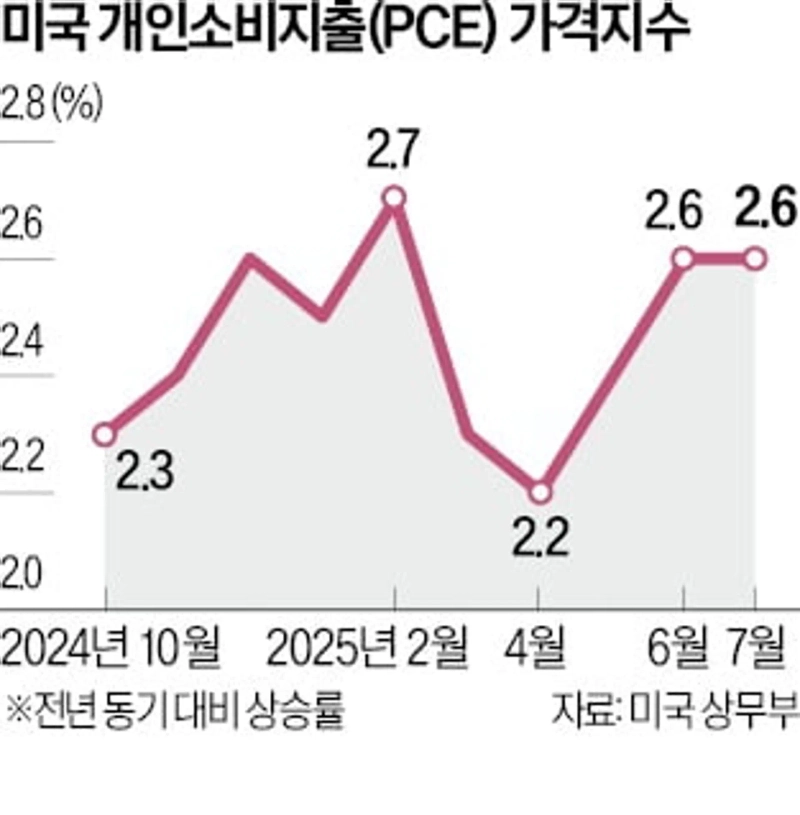

The U.S. Department of Commerce said on the 29th that the July PCE index rose 2.6% from the same period a year earlier. That level matches the consensus forecast compiled by Dow Jones. It was 2.6% in June as well. Compared with the previous month, it rose 0.2%. That is 0.1% percentage point lower than June (0.3%).

The core PCE price index, which excludes volatile items such as energy and food, rose 2.9% year-on-year. This also matched market expectations. It is the highest level since March (3.0%). Compared with the previous month, it rose 0.3%. The increase is the same as in June.

The PCE price index is an inflation measure that captures the prices U.S. residents pay when purchasing goods and services. The Fed uses the PCE price index, rather than the relatively better-known consumer price index (CPI), as the benchmark when judging whether it has achieved its monetary policy goal of a '2% inflation rate'.

Because this indicator is a price data point the Fed pays attention to ahead of the Federal Open Market Committee (FOMC) meeting scheduled for the 16th–17th of next month, it was cited as a key variable that could determine a rate cut. With data coming in line with market expectations, forecasts have emerged that the possibility of a rate cut has increased.

According to the Chicago Mercantile Exchange (CME) FedWatch, in the interest-rate futures market that day the probability that the Fed would cut the policy rate by 0.25% percentage point at the September meeting rose from 83.2% to 87.2%. Earlier, Fed Governor Christopher Waller, who is seen as 'pro-Trump,' suggested he could support a 'big cut'—lowering the policy rate by 0.5% percentage point at the September FOMC—if a clear weakening in the labor market is confirmed. Waller is a governor appointed by U.S. President Donald Trump.

Reporter Kim Ju-wan kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.