Editor's PiCK

"Bitcoin whales realized about 5.5 trillion won in profit-taking the previous day…largest since February"

Summary

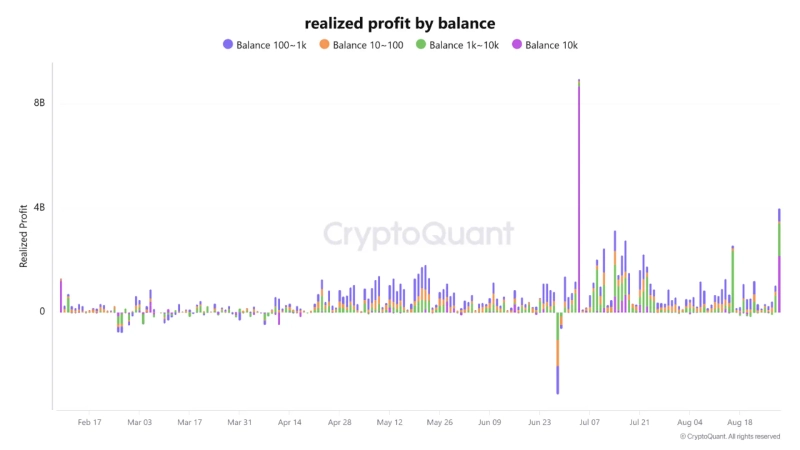

- It reported that about KRW 5.566 trillion in profit-taking occurred in the Bitcoin market the previous day.

- They said this phenomenon was the result of large whales realizing profits by taking advantage of the price rise, and that there is a high possibility of market adjustment in the short term.

- The analyst said short-term investors need to be cautious and emphasized closely watching whales' movements.

An observation emerged that profit-taking amounting to $4 billion (about 5.566 trillion won) occurred in the Bitcoin (BTC) market the previous day.

On the 30th, a CryptoOnChain analyst said in CryptoQuant's QuickTake report, "This decline is the result of large whales realizing profits by taking advantage of the recent price rise, which is generally a phenomenon that occurs at price peaks, and there is a high possibility of short-term adjustment going forward."

Looking at the breakdown of profit-taking, 'mega whales' (10,000 BTC or more) accounted for the largest share at $2.17 billion, 'large whales' (1,000–10,000 BTC) realized $1.25 billion, and 'mid-size whales' (100–1,000 BTC) realized $495 million in profits.

The analyst pointed out, "The surge in profit-taking can be seen as a transfer of Bitcoin from 'strong hands' to 'weak hands,'" adding, "As large holders realize profits and hand assets over to smaller investors, it can be a factor that increases market fragility."

He added, "This profit-taking may signal short-term price adjustment or consolidation, but it does not mean the start of a long-term downtrend," while also saying, "Short-term investors need to be cautious, and it will be important to closely monitor the whales' subsequent moves."

Meanwhile, analysts also say that although the U.S. July personal consumption expenditures (PCE) price index released the previous day matched market expectations, it hit the highest level since February, which rekindled inflation concerns and led to weakness across risk assets.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)