Summary

- It said that most of the volatility in the virtual asset market occurs on Binance.

- It said that price direction is often determined by changes in Binance's momentum.

- It said that if ETF momentum rises in the future, an institution-led bull market could resume.

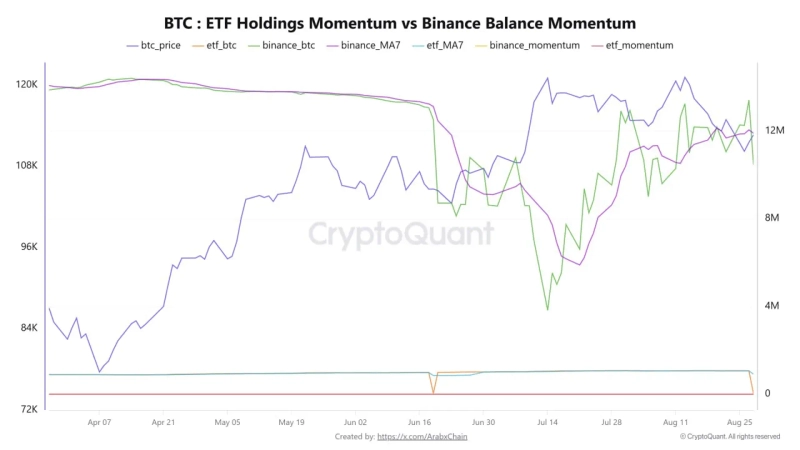

A claim has emerged that most of the volatility in the virtual asset (cryptocurrency) market is generated by Binance.

On the 1st (local time), a contributor to ArabChain CryptoQuant said in a report, "Most of the volatility in the virtual asset market comes from Binance," adding, "Price direction was often determined by increases or decreases in Binance's momentum." He went on to say, "Surges in Binance momentum sometimes appear before market rises."

He also predicted a new bull market. The analyst said, "The current upside momentum from exchange-traded funds (ETFs) is not having a major impact on the market," and, "If ETF momentum rises, an institution-led bull market will begin again."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)

![[Market] Bitcoin slips below $77,000…Ethereum also breaks below $2,300](https://media.bloomingbit.io/PROD/news/f368fdee-cfea-4682-a5a1-926caa66b807.webp?w=250)