Stunning Twist of the Coca-Cola Empire…Did the Sugar Tax Actually Save It? [Global Money X-file]

Summary

- Reported that the global expansion of the sugar tax and WHO's active recommendations are shifting beverage industry portfolios toward low- and no-sugar products.

- Major global companies such as Coca-Cola and Pepsi have focused on Zero Sugar and high-growth core brands, achieving both profitability and revenue growth.

- Investment and supply chain changes in sweeteners and synthetic biology have accelerated, drawing market attention to core material companies.

The introduction of sugar taxes in countries around the world is changing the landscape of the global beverage business. Global food companies such as Coca-Cola have rushed to introduce 'Zero Sugar' products. Demand for sweeteners to replace sugar has also surged, significantly altering related raw material supply chains. Global speculative capital has increased investment in related companies such as those in microbiology and enzyme engineering.

Sugar tax in regions covering half the world's population

According to the World Bank on the 3rd, 117 countries and territories had introduced a Sugar-Sweetened Beverage Tax (SSB Tax) as of this year. This covers regions with more than 50% of the world's population. Brazil also plans to partially introduce a sugar tax in 2027. The sugar tax is usually paid by producers or companies of sugar-containing products.

The background for countries adopting sugar taxes is the strong recommendation from the World Health Organization (WHO). Since 2016, WHO has recommended member states introduce sugar taxes, emphasizing them as a key tool to prevent noncommunicable diseases such as obesity and type 2 diabetes. Recently WHO announced the '3 by 35 Initiative.' The goal is for member states to raise the real price of tobacco, alcohol, and sugar-sweetened beverages by at least 50% by 2035.

WHO estimated that this policy could prevent 50 million premature deaths over the next 50 years. Countries could also secure an additional $1 trillion in revenue. WHO Assistant Director-General Jeremy Farrar emphasized, "These health taxes are among the most efficient tools we have," adding, "They can reduce consumption of harmful products and generate revenue that governments can reinvest in health care, education, and social protection."

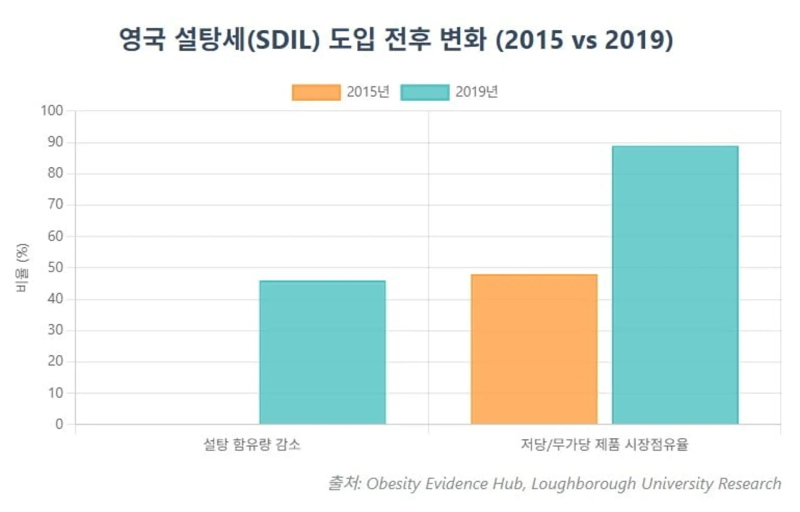

40% reduction in sugar content in the UK

The effects of the sugar tax have appeared. The UK's Soft Drinks Industry Levy (SDIL) is a representative example. SDIL has been praised as a 'smart tax' that encouraged the entire related industry to redesign product portfolios beyond simple tax collection. Introduced in 2018, the system applied two tiered rates based on sugar content. If sugar content exceeded 5g per 100ml, 18 pence per liter was charged; if it exceeded 8g per 100ml, 24 pence per liter was charged.

This tax structure presented companies with a clear choice: pay the tax and raise prices to pass the burden to consumers, or reduce sugar content to 5g per 100ml or below to avoid the tax. Most chose the latter. After implementation, total sugar content in taxed beverage categories fell by 46%. Market share of low- and no-sugar products soared to 89% between 2015 and 2019.

Dr. Natalie Pearson, a behavioral epidemiology and public health expert at Loughborough University, said, "SDIL has shown it can effectively reduce sugar consumption among children in low-income households," adding, "Modelling studies also predict long-term improvements in childhood overweight and obesity prevalence, and expanding the levy could build on this success." Several UK studies have demonstrated reductions in childhood obesity rates and improvements in dental health following SDIL's introduction.

Mexico also saw effects from its sugar tax. Mexico became the first country to introduce a nationwide sugar tax in 2014. Two years after the tax was introduced, sugar-sweetened beverage sales fell by an average of 7.6%, with larger declines among low-income households. Purchases of no-sugar beverages increased. Consumers reduced sugary drinks and chose water instead.

A related study published last year in the Journal of the American Medical Association (JAMA) found that in five U.S. cities, prices of sugar-sweetened beverages rose by an average of 33.1% and sales fell by 32.8% two years after taxes were imposed. In a 2023 report, WHO noted that "many countries are not yet fully using this policy," urging governments to expand taxation of sugar-sweetened beverages alongside alcohol.

In some regions, the policy's scope is expanding to foods in general. In June, Barbados, a Caribbean island nation, began imposing a 20% consumption tax on high-sodium snack foods (potato chips, popcorn, pretzels, etc.). Colombia has been gradually raising taxes on processed foods since 2023 and increased the rate to 20% this year. Taxed items include a wide range of products such as sugar-added dairy products, sausages, snacks, and cereals.

Sugar tax couldn't topple the 'Coca-Cola empire'

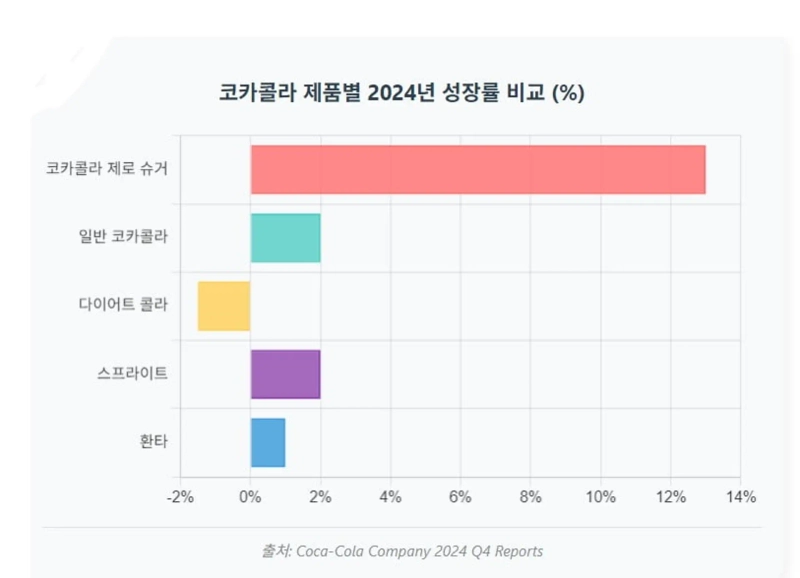

Some predicted the spread of sugar taxes would lead to the collapse of the Coca-Cola empire. But those predictions were completely off. Coca-Cola used the external shock of regulation as a catalyst to accelerate portfolio shifts. It is instead judged to have successfully transformed into a healthier and more profitable company. In the second quarter, Coca-Cola recorded 5% organic revenue growth. Comparable operating margin was 34.7%.

The core driver of this growth is the 'Coca-Cola Zero Sugar' product. Global sales of Coca-Cola Zero Sugar rose 14% year-on-year in the second quarter. Coca-Cola CEO James Quincey stressed during the Q2 earnings call, "We are on track to deliver both our topline and updated bottom-line guidance for the first half of the year."

Coca-Cola's success did not rely solely on one Zero Sugar product. It was the result of years of meticulous portfolio restructuring. Its 'zombie brand' pruning strategy is a representative example. Coca-Cola found that roughly 200 of its 400 total brands—small local brands—accounted for just 2% of total sales. The company boldly discontinued these 'zombie brands' and concentrated the resources and capabilities freed up on core brands with high growth potential like Zero Sugar, which is credited as effective.

The market reshuffling triggered by the sugar tax is not unique to Coca-Cola. Pepsi also posted solid results, exceeding market expectations with $22.73 billion in revenue in Q2. Pepsi marked the 50th anniversary of the 'Pepsi Challenge' this year with a 'Pepsi Zero Sugar vs Coke Zero blind test' campaign, going all-in on no-sugar line marketing. Both major soda companies have made it clear that lower- or no-sugar products are central to future growth.

The Zero Sugar strategy has become essential for improving brand image and responding to consumer trends. Millennials and Gen Z increasingly avoid sugar. Beverage companies are releasing low- or no-sugar new products not only in sodas but also in juices, iced teas, and energy drinks. Coca-Cola has expanded related lineups such as 'Vitaminwater Zero' and 'Powerade Zero.'

Sweetener market dominated by a few companies

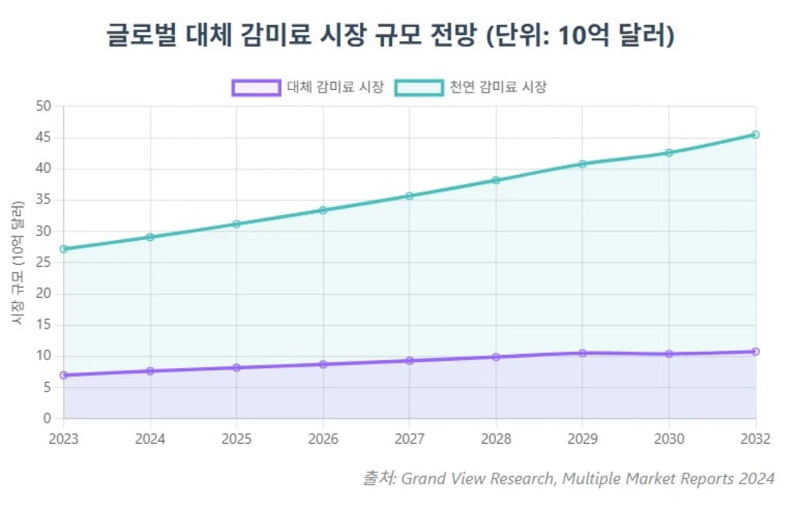

The market for sweeteners to replace sugar has also rapidly grown. Representative alternative sweeteners include stevia, monk fruit, allulose, tagatose, and brazzein. According to global market researcher Fortune Business Insights, the global natural sweetener market is expected to grow from $27.2 billion this year to $42.6 billion by 2032.

The benefits of this huge market have concentrated in a few firms through mergers and acquisitions. The stevia market, synonymous with natural sweeteners, is a case in point. Global ingredient giant Ingredion acquired PureCircle, the world's largest stevia producer. Competitor Tate & Lyle acquired 'Sweet Green Fields,' creating a duopoly structure in that market. These companies not only secured production capacity but also controlled key patents related to steviol glycoside extraction and purification and bitterness-masking blending technologies.

Ingredion posted record adjusted operating profit in the second quarter. Notably, operating profit in its 'Texture and Health Solutions' segment surged 29%, driven by growth in sugar-reduction portfolios. Tate & Lyle also reported 4% EBITDA growth for fiscal 2025. Sales of high-intensity sweetener sucralose increased 16%.

Some other natural sweeteners like monk fruit have supply chains concentrated in specific regions, posing geopolitical risks. Most monk fruit production comes from China, making the supply chain vulnerable to instabilities such as tariffs from U.S.-China trade tensions. In 2018, when the U.S. imposed high tariffs on Chinese sweeteners, import prices of monk fruit surged and the U.S. food industry faced an emergency.

Allulose is another game-changer called a 'rare sugar.' Allulose is a monosaccharide that occurs in small amounts in nature. It has about 70% of sugar's sweetness while approaching zero calories. Because its physicochemical properties are similar to sugar, it is praised for excellent baking and cooking characteristics when used as a sugar substitute.

After commercialisation in Japan in the early 2010s, U.S. FDA excluded allulose from added sugars in 2019, drawing attention. Currently, allulose can be freely used in food in the U.S., Japan, and Korea. In contrast, approval in the European Union (EU) remains pending. Allulose supply is also concentrated in a few companies, such as Samyang in Korea and Matsutani in Japan.

Speculative capital is betting on synthetic biology

The sugar tax and low-sugar trend have also changed the flow of global investment capital, driven by increasing demand for healthy foods and technological advances. Investment in startups in synthetic biology and food tech has grown. Venture capital and related corporate interest have increased in areas such as sweetener production via precision fermentation, low-cost production technologies for rare sugars, and development of new high-intensity natural sweetener materials. Global investment in synthetic biology startups reached $6.9 billion in 2023. While somewhat lower than the investment boom in 2021–2022, it was higher than in 2019.

Wall Street investment banks have shown interest as well. Morgan Stanley named the low-sugar and alternative sweetener sector "one of the most promising food investment themes over the next five years" in a report last year. Goldman Sachs is reportedly examining IPO prospects for related companies. The securities market also took note. After the alternative meat craze cooled in 2022 and related stocks fell, investors turned their attention to sweetener ingredient companies with actual revenue potential. Ingredion's stock rose significantly after acquiring PureCircle but has recently plateaued.

Korea has not adopted a sugar tax, but

Despite these global trends, Korea is among the countries that have not adopted a sugar tax. Concerns about obesity and sugar intake are high, but the government has not implemented related tax policies. A sugar tax bill was proposed in 2021 but discussion was halted due to opposition from the food industry.

In a survey conducted in June at the request of the Seoul National University Health Culture Project Group, 58.9% of respondents said they supported the introduction of a 'sugar tax' on high-sugar foods. In the same survey, 64.1% believed a sugar tax would be effective in improving public health, and 58% expected it would reduce production of high-sugar products by industry. Awareness of sugar's risks was high, with 82% agreeing that "sugar should carry warning labels like tobacco."

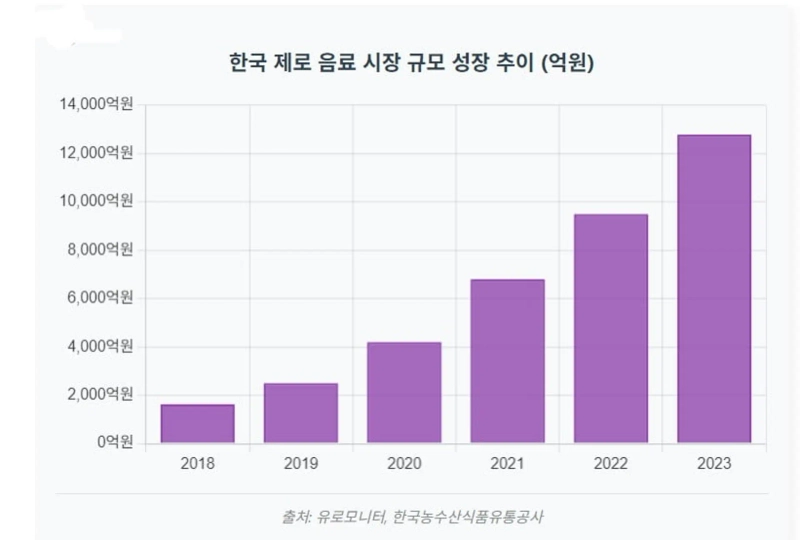

Nevertheless, Korea's food industry has proactively developed low-sugar products and invested in raw materials. Various zero sodas, zero snacks, and low-sugar ice creams have become popular domestically. Chilsung Cider Zero, released in 2021, exceeded cumulative sales of 100 million cans within a year. HiteJinro added allulose to its beer Terra in 2022 to reduce sugar and launched 'Terra Zero.'

There has been aggressive action in sweetener raw material production as well. Samyang opened Korea's largest allulose plant in Ulsan last year, with an annual production capacity of 13,000 tons. Samyang aims to use this as a springboard to become the global leader in the rare sugar market. Daesang Group also started mass production in 2022 at its Gunsan plant with allulose-dedicated facilities through its subsidiary Miwon Presstek.

[Global Money X-file examines important but little-known flows of global money. If you want to conveniently read necessary global economic news, please subscribe to the reporter page]

Reporter Kim Joo-wan kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)