Summary

- Bitcoin prices have been experiencing sharp fluctuations recently due to changes in the outlook for the U.S. key interest rate and large-scale Treasury issuance.

- J.P. Morgan said Bitcoin's price volatility has decreased, making it an attractive asset for institutional investors, and that it is undervalued compared with gold.

- The crypto industry expects that Bitcoin's price will likely continue to experience sharp fluctuations until the September FOMC and the release of major U.S. economic indicators.

Volatile back-and-forth market expected to continue for the time being

After hitting a record high on the 14th of last month

As hopes for a rate cut weakened

Dropped more than 8% in just over 10 days

High likelihood of sharp Bitcoin price swings until the Fed sets the key rate on the 17th of this month

Large-scale Treasury issuance also fuels the decline

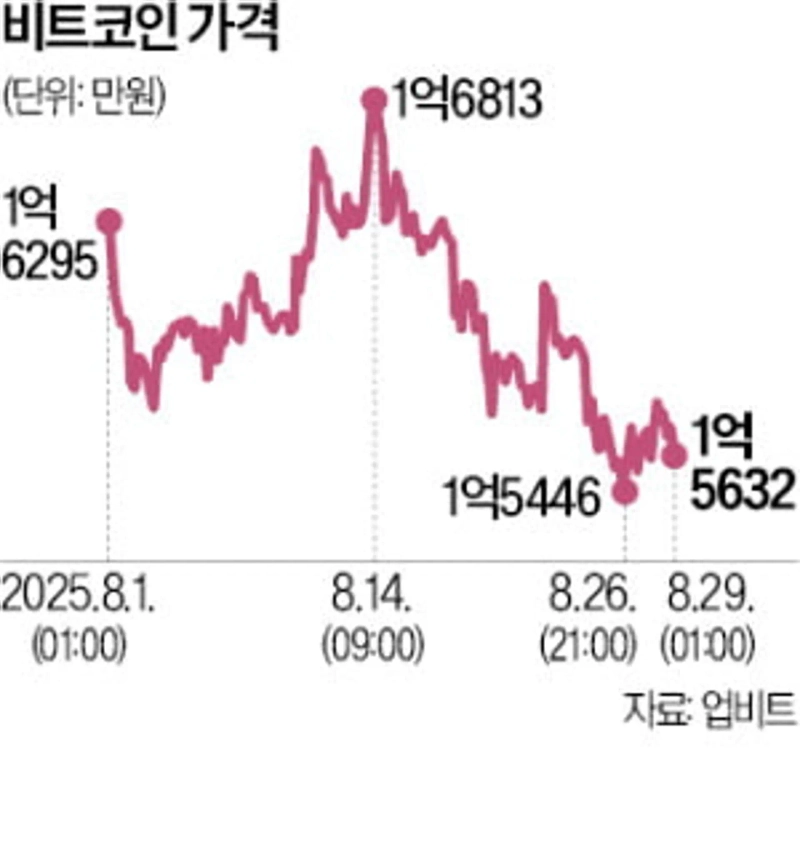

Bitcoin prices have been repeating sharp rises and falls. Until mid-last month, they surged to a record high, but when expectations for a U.S. interest rate cut weakened, they quickly fell. Last month, domestic Bitcoin prices fell by more than 8% from their peak. Each time major U.S. economic data are released, the outlook for the key interest rate shifts. The 'back-and-forth market' is expected to continue until the U.S. central bank (Fed) decides whether to cut rates on the 17th.

◇ Volatile market unfolded in August

On the 3rd, according to Upbit, the country's top cryptocurrency exchange, Bitcoin traded at 168,130,000 won on August 14, setting a record high. It jumped 7% in 11 days from August 3 (157,370,000 won). As expectations grew that the Fed would cut the key rate, demand for risky assets such as cryptocurrencies strengthened.

However, the mood changed on August 14 when the U.S. Department of Labor released the July producer price index (PPI) inflation rate. The PPI rise (3.3% year-on-year) far exceeded the experts' forecast of 2.5%, amplifying concerns that rates might not be cut. With investor sentiment weakening, domestic Bitcoin prices slid for a week, dropping to 157,170,000 won on August 20.

Thereafter, Bitcoin prices swung sharply depending on changes in the outlook for U.S. interest rates. On August 22 (local time) on Coinbase, the largest U.S. crypto exchange, Bitcoin was trading at $109,725 at 9:00 p.m. and six hours later, at 3:00 a.m. on the 23rd, it surged to $117,412. Over the same period, domestic prices jumped from the 150,000,000-won range to the 160,000,000-won range. This was after Fed Chair Jerome Powell hinted at a rate cut at the Jackson Hole meeting, expressing concern that employment indicators could deteriorate.

Powell said, "On the surface the labor market appears to be in balance, but it is an unusual kind of balance that has arisen as both demand and supply have notably slowed," adding, "Such an abnormal situation suggests increased downside risks to employment." He also said, "If these risks materialize, large-scale layoffs and a sharp rise in unemployment could occur." He emphasized, "A change in the baseline outlook and the balance of risks could justify our adjusting the stance of policy."

◇ "Bitcoin undervalued compared with gold"

The effect of Powell's remarks did not last long. In the domestic market, Bitcoin traded at 154,460,000 won on August 26, falling to a level lower than before Powell's comments. Compared with the record high on the 14th (168,130,000 won), it fell 8.1% in about two weeks.

The reason the Bitcoin surge around the Jackson Hole meeting reversed to weakness was renewed concerns about inflation. Observations that July U.S. personal consumption expenditures (PCE) could rise about 3% year-on-year strengthened the view that the Fed's tight monetary policy could be prolonged.

The crypto industry sees a high possibility that Bitcoin's sharp price swings will continue until the Fed holds the Federal Open Market Committee (FOMC) meeting on September 17 to set the key rate. In particular, the U.S. jobs report released on the 4th and the consumer price index (CPI) due on the 11th are expected to have a major impact on the market.

In this environment, J.P. Morgan drew attention by evaluating that Bitcoin is undervalued compared with gold. J.P. Morgan explained that Bitcoin's price volatility is generally three to six times that of gold, but recently has fallen to about twice that level. In a report on the 28th of last month, J.P. Morgan said, "Bitcoin's price volatility has fallen from 60% at the beginning of the year to about 30% now," adding, "Because this is at historically low levels, it is standing out as a more attractive asset to institutional investors." It also stated, "Compared with gold, it is undervalued and has upside potential." J.P. Morgan estimated that Bitcoin's market capitalization would need to increase by about 13% to be appropriate.

◇ Concerns about U.S. liquidity shortages

There is also a view that large-scale U.S. Treasury issuance is sucking up market liquidity and could keep Bitcoin prices weak until year-end. Crypto outlet CoinDesk analyzed, "Bitcoin prices fell at the end of August as U.S. Treasury General Account (TGA) balances surged, reducing market liquidity."

The TGA is the account the U.S. Treasury keeps at the Fed and is used to collect taxes and execute the budget. An increase in the TGA balance means the U.S. government has collected more taxes or issued more Treasury securities, thereby absorbing market liquidity.

CoinDesk noted, "The TGA balance, which was $320 billion at the end of July, has swelled to more than $500 billion," and forecasted, "For the TGA to remain at a healthy level going forward, the Treasury will likely need to issue about $500–600 billion in new bonds."

Jeong Ui-jin, reporter justjin@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)