Editor's PiCK

U.S. spot Bitcoin ETFs see net outflows of $222.94 million… Only BlackRock with net inflows

Summary

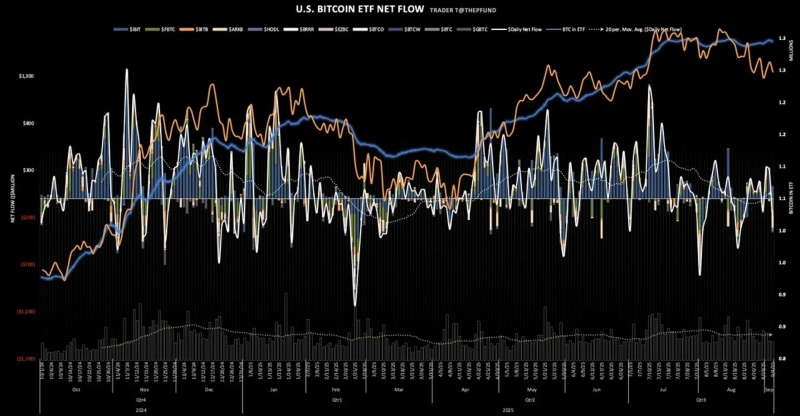

- Reported that U.S. spot Bitcoin ETFs experienced $222.94 million in net outflows.

- Among major ETFs, only BlackRock's IBIT recorded $134.71 million in net inflows.

- Major ETFs such as ARK, Fidelity, and Grayscale continued to see ongoing net outflows.

More than $200 million in net outflows occurred from spot Bitcoin (BTC) exchange-traded funds (ETFs).

According to data from TraderT on the 4th (local time), U.S.-traded spot Bitcoin ETFs saw total net outflows of $222.94 million that day. By individual products, only BlackRock's IBIT recorded net inflows of $134.71 million.

Meanwhile, other major ETFs continued to see net outflows. ARK Invest's ARKB recorded net outflows of $125.49 million, and Fidelity's FBTC recorded net outflows of $117.45 million. Bitwise's BITB and Grayscale's GBTC also experienced net outflows of $66.37 million and $22.42 million, respectively.

In addition, VanEck's HODL saw $17.88 million withdrawn, and Franklin Templeton's EZBC saw $3.18 million withdrawn. Meanwhile, Invesco, Valkyrie, and WisdomTree's Bitcoin ETFs saw no net flows.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)