Editor's PiCK

U.S. Ethereum spot ETFs see net outflows for four consecutive days…price also down 4%

Summary

- It reported that Ethereum spot ETFs traded in the United States showed net outflows for four consecutive trading days.

- During this period, the Ethereum price also fell about 4% to the $4,300 range.

- Large-scale fund outflows from major ETFs such as Fidelity's FETH are occurring, affecting investor sentiment.

Ethereum (ETH) spot exchange-traded funds (ETFs) failed to switch to net inflows.

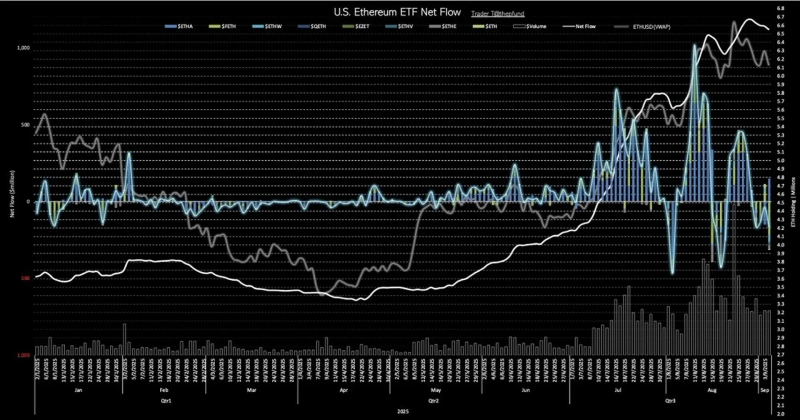

On the 4th (local time), according to Trader T's data, $166,380,000 flowed out of Ethereum spot ETFs traded in the United States. This marked four consecutive trading days of net outflows for Ethereum ETFs. During that period the price also fell by about 4%, sliding into the $4,300 range.

By product, BlackRock's ETHA saw net inflows of $149,810,000. However, Fidelity's FETH saw $216,680,000 flow out, dragging down the overall trend. Bitwise's ETHW also recorded net outflows of $45,660,000.

In addition, major products such as Grayscale's ETHE ($26,440,000), VanEck's ETHV ($17,220,000), Invesco's QETH ($2,130,000), and Franklin's EZET ($1,620,000) also saw funds flow out one after another.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)