Summary

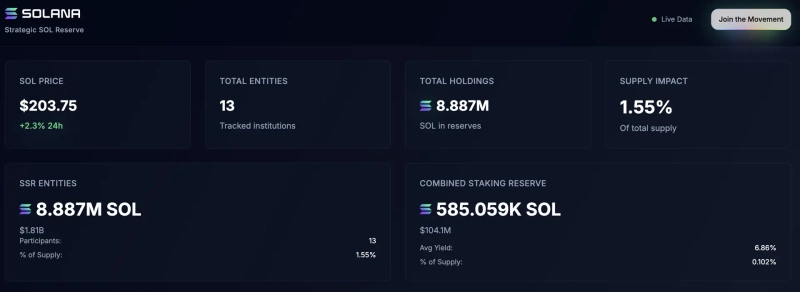

- 13 institutions said they hold 8.88 million Solana, accounting for 1.55% of the total Solana supply.

- Of these, 585,000 are staked, and the average staking yield is 6.86%.

- It noted that some institutions, such as DeFi Development and Upexi, show a rise in holdings.

Solana (SOL) financial reserves are rapidly expanding, centered on institutional investors.

On the 4th (local time), according to the tally by Strategic SOL Reserve, 13 institutions currently hold a total of 8,887,000 Solana, which corresponds to 1.55% of the total supply. Of these, about 585,000 Solana (about 100 million 41 billion dollars) are deposited (staked). The average staking yield is 6.86%, which is about 0.102% of the total supply.

Looking at holdings by institution, Sharps Technology holds 2,140,000 Solana (about 435 million dollars), ranking first. There was no change in holdings over the past 30 days.

DeFi Development Corp holds 2,028,000 Solana (about 412 million dollars), ranking second. Its holdings increased by 5.2% over the past month. Upexi ranked third with 2,000,000 Solana (about 406 million dollars), increasing by 15.3% over the same period.

Mercurity Fintech held 1,083,000 Solana (about 220.4 million dollars), with no change. iSpecimen was fifth with 1,000,000 Solana (about 215.1 million dollars). SOL Strategies holds 403,000 Solana (about 82 million dollars), increasing 12.4% over the past 30 days.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)