Leverage 'big player' James Wynn, Ethereum long position liquidated six times in a row

Summary

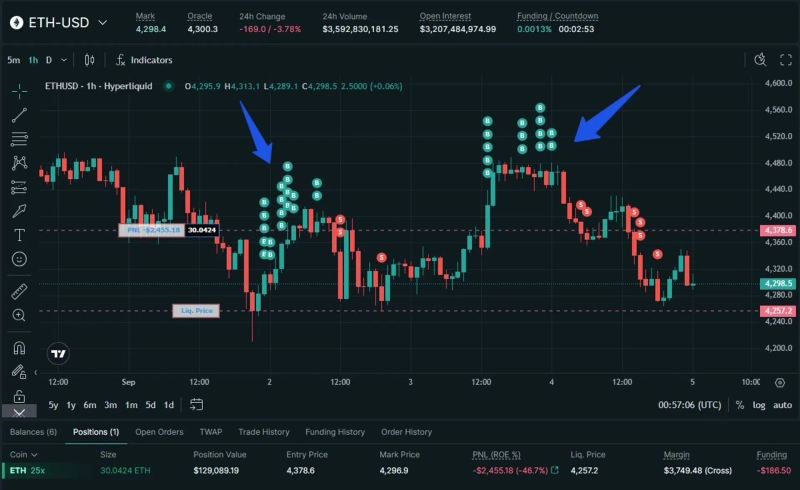

- 'Big player' trader James Wynn was reported to have been forcibly liquidated six times in a row from a 25x leverage Ethereum (ETH) long position.

- James Wynn's current ETH long position has an average entry price of $4,378.62, a liquidation price of $4,257.29, and a size of about $130,000.

- Some in the market interpret the consecutive liquidations as an 'top signal' for Ethereum.

A 'big player' trader on Hyperliquid, the crypto derivatives exchange, James Wynn was reportedly forcibly liquidated six times in a row from a 25x leveraged Ethereum (ETH) long position. Some in the market regard this as a 'top signal'.

According to crypto-focused media BlockBeats on the 5th, on-chain data analyst OnChainLens said, "Wynn was liquidated six times recently," and "the ETH long position he currently holds has an average entry price of $4,378.62 and a liquidation price of $4,257.29, with a size of only about $130,000."

Earlier, Wynn opened a full long position when ETH surpassed $4,400 on the 2nd, but it was liquidated the next day as the $4,280 level collapsed. Then on the evening of the 3rd he added another long near $4,440, but as ETH slipped into the $4,370s he was partially liquidated again. At that time the liquidation price of that position was $4,339, and the remaining size was about $320,000.

On that day OnChainLens said on X (formerly Twitter), "James Wynn was liquidated six times in a row," and "trading against him always seems to be 'Wynn Wynn'."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)