US and Europe emerge as major gold investors, overtaking China... sweep up $5.5 billion in ETFs

Summary

- It reports that gold ETF investment demand has exploded in the United States and Europe this year.

- According to the World Gold Council, $22.1 billion flowed into gold ETFs in North America alone, and investment demand for gold surged 78%.

- While the outlook for gold prices is generally positive, it also notes the possibility of a short-term correction due to overheating.

As a stagflation hedge… gold prices hit record highs day after day

Investor preference for safe assets expands

Overlapping interest rate cuts and dollar weakness

'Gold rush' as confidence in US Treasuries wavers

$22.1 billion flowed into ETFs in North America this year

Gold futures up 26% so far this year

Twice the rise of Nasdaq, S&P and Bitcoin

Some warn of short-term overheating and a possible correction

Gold prices are on a high. In recent years emerging market central banks and Asian investors drove demand for gold, but this year demand has exploded focused on gold ETFs in the United States and the European Union (EU). Analysts say tensions between U.S. President Donald Trump and the U.S. central bank (Fed) and concerns about stagflation (economic slowdown + rising prices) are stimulating gold demand in developed countries.

◇Shifted gold demand

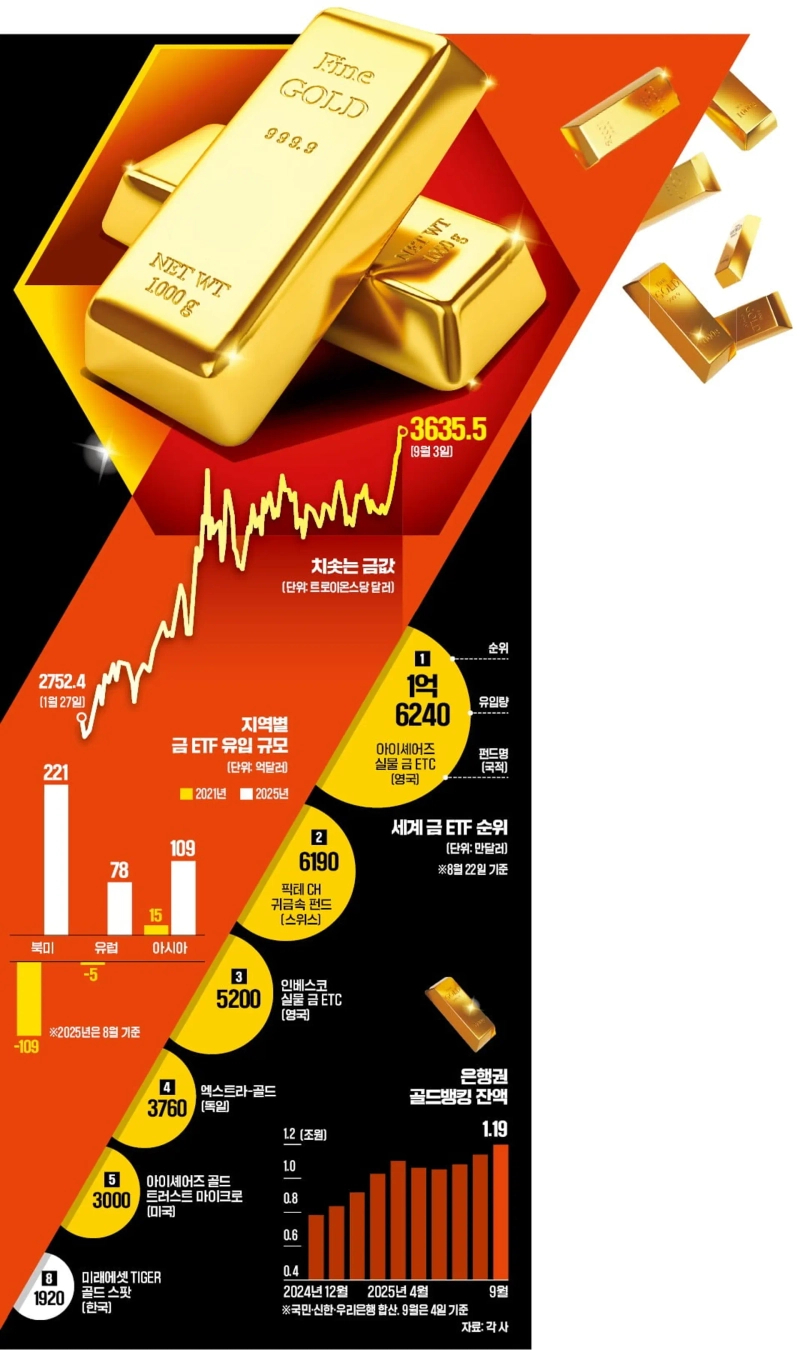

According to the New York Mercantile Exchange on the 5th, gold futures have risen 26.2% so far this year. Although this lags the KOSPI year-to-date gain (33.5%), it far outstrips the rises of the Nasdaq (12.6%) and the S&P 500 (10.8%) as well as Bitcoin (12.6%).

Gold surged nearly 30% last year as well. That was because emerging market central banks and Asian investors overwhelmingly bought gold. Back then, central banks around the world rushed to buy gold to reduce dependence on dollar assets and diversify foreign exchange reserves. In particular, central banks of countries whose relations with the U.S. deteriorated or that are geopolitically unstable—such as China, Türkiye, Poland and Russia—increased gold investment aggressively. Retail investor demand was also notable in Asian markets. For example, in China sales of gold bars and coins exploded as a property market downturn and concerns about yuan weakness overlapped.

This year gold prices are being driven up by developed countries such as the U.S. and the EU. Among investors in developed countries, preference for safe assets has grown, causing a sharp increase in gold investment demand. The Fed is expected to cut the policy rate and the dollar is weak. Typically, rate cuts and a weak dollar stimulate gold demand.

On top of this, tensions between President Trump and the Fed have poured fuel on gold prices. President Trump has openly pressured the Fed's interest rate decisions. As the Fed's independence appeared at risk, global investors began to question the credibility of the dollar and U.S. Treasuries, analysts say. Jeffrey Currie, head of commodity research at Goldman Sachs, said, "As political risk rises, individuals are buying more gold aggressively."

◇Positive outlook but possible correction

So far this year, inflows into gold ETFs have exploded, centered on North America and Europe. According to the World Gold Council (WGC), $22.1 billion flowed into gold ETFs in North America this year alone. Considering that $10.9 billion flowed out in 2021, a massive amount of funds has poured into gold ETFs. Europe also turned from a $500 million outflow to a $7.8 billion inflow over the same period.

Overall, gold demand in the precious metals market is shifting toward the investment market. Gold demand in the precious metals market was 417.2t in Q2 last year but fell to 356.7t in Q2 this year, a 14.5% decrease. Central bank gold demand also fell 21.3% over the same period to 166.5t. By contrast, investment demand for gold surged 78% from 268t to 477.2t.

The outlook for gold prices is generally positive. If Fed rate cuts accelerate and geopolitical risks persist, the rise in gold prices could become steeper. Goldman Sachs expects gold to surpass $4,000 per troy ounce by mid-next year. Some forecasts say that if just 1% of global investors' U.S. Treasury holdings moved to gold, prices could approach $5,000.

On the other hand, there are many concerns about short-term overheating due to the sharp price rise. Given the rapid rise in gold prices in a short period, there is a possibility of a temporary correction depending on future Fed monetary policy or major economic data releases.

Mi-hyun Cho, reporter mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)

![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)