Summary

- The U.S. August nonfarm payroll increase was 22,000, making the slowdown in the employment market clear.

- As a result of this employment deterioration, the U.S. central bank (Fed) is widely expected to cut rates this month.

- The market said that not only a September rate cut but also additional cuts within the year have become more likely.

Nonfarm jobs up 22,000, below expectations

Lowest figure since October last year

Unemployment rate rose to 4.3% … employment deterioration

The U.S. August job increase fell far short of market expectations, making the slowdown in the labor market clear. With growing concerns that the labor market could worsen further, the market is treating a rate cut by the U.S. central bank (Fed) this month as a foregone conclusion.

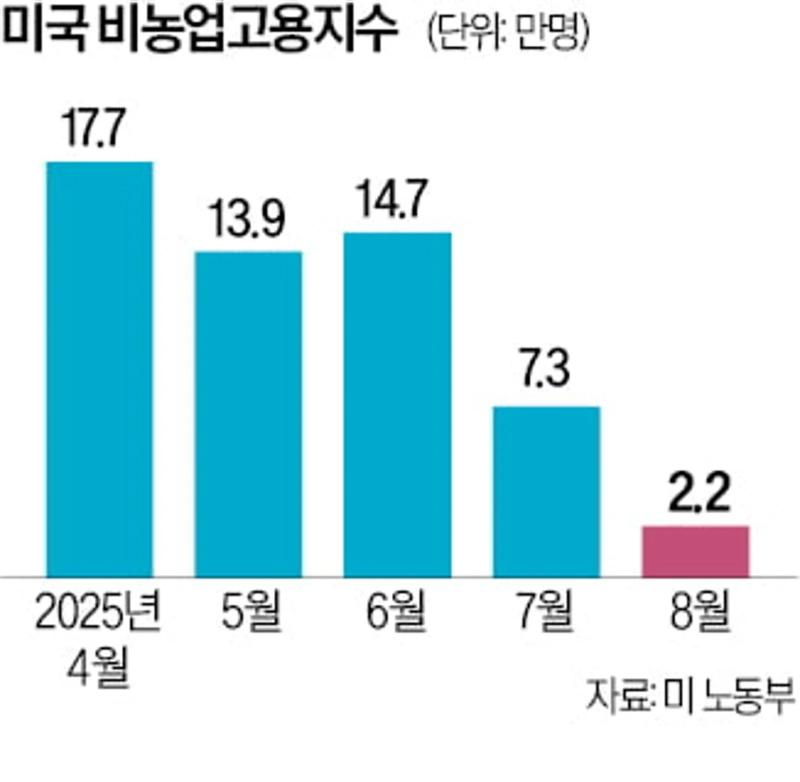

The U.S. Department of Labor announced that nonfarm payrolls increased by only 22,000 in August from the previous month. This figure is far below the expert forecast of 75,000 compiled by Dow Jones. It is the lowest figure since October last year and only about a quarter of the 79,000 increase in July. In July, the 79,000 increase was about half the June increase (144,000). This is analyzed as indicating that the labor market is contracting at a rapid pace.

According to the employment report, private nonfarm payroll change was 38,000 in August, also well below the market forecast of 75,000. It is almost half of the 77,000 job increase in July. The unemployment rate rose from 4.2% in July to 4.3% in August. However, the August unemployment rate matched expert expectations.

Detailing sectors, health care and leisure and hospitality showed job gains, but information, financial activities, manufacturing, the federal government, and business services showed large declines. The Department of Labor said that healthcare job gains were offset by job losses in the federal government, mining, and oil and gas extraction.

The U.S. labor market has been slowing since July. Job gains have slowed significantly, job postings have decreased, and wage growth has eased, analysts say. Economists pointed to President Donald Trump’s large import tariffs and immigration enforcement reducing labor supply as major causes.

According to the Chicago Mercantile Exchange (CME) that day, the probability of a Fed rate cut rose from 96.4% the previous day to 99% that day. As the labor market came out worse than expected, the likelihood increased not only for a September rate cut but also for additional cuts within the year. Gregory Paraniello, head of strategy at Amerivest Securities, said, "The labor market has weakened, and lower rates are needed to shift job growth from the public to the private sector. The Fed will start cutting rates this month, and additional cuts are expected to follow during that process."

Reporter Sangmi Ahn saramin@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)

![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)