Editor's PiCK

Ongoing U.S. employment shock…"Bitcoin, surpassing $114,000 is the key" [Kang Minseung's Trade Now]

Summary

- Experts said Bitcoin could gain rebound momentum if it breaks the $114,000 resistance, but if it falls below the $108,000 support, there is a risk of further declines.

- Despite the U.S. employment shock and expectations of rate cuts, Bitcoin is analyzed as remaining in a neutral but volatile box range in the short term.

- With strengthened SEC and CFTC cooperation on digital asset regulation, along with slowing ETF inflows and balanced buy/sell pressure, short-term momentum could be limited.

Bitcoin (BTC) saw a slight correction as expectations for rate cuts rose amid the U.S. employment shock. While the market is mindful of the employment shock, it is taking a cautious stance rather than immediately interpreting it as a recession signal.

Experts say that if Bitcoin breaks the $114,000 resistance, the rebound momentum could increase, but if it falls below $110,000 the decline could widen. In the market, short-term momentum trading with brief holding periods is prominent.

As of 8:50 PM on the 10th, on the Binance Tether (USDT) market, Bitcoin was trading down 0.25% from the previous day at $112,256 (Upbit basis ₩156,330,000). At the same time, the kimchi premium (the price difference between overseas exchanges and domestic exchanges) stood at 0.19%.

U.S. August employment shock, rate cut becomes visible…big cut possibility met with caution

When the U.S. labor market was revealed to be weaker than initially reported, hopes for rate cuts pushed New York stocks to record highs, but risk assets such as crypto instead underwent a slight correction.

On the 9th (local time), the U.S. Department of Labor said it revised annual employment statistics for March down by 911,000 from prior figures. This is the largest downward revision in 23 years. However, this figure was calculated based on tax records rather than the monthly employment report, so there are limits to simple comparisons. Previously released August nonfarm payrolls also increased by only 22,000, falling far short of market expectations and further raising concerns about the labor market.

However, views remain divided on a 'big cut.' A large cut while inflation is not contained could stimulate inflation and increase the risk of stagflation. Market participants are largely adopting a cautious mood, trying to gauge direction through the consumer price index (CPI) to be released at 9:30 PM on the 11th (Korea time).

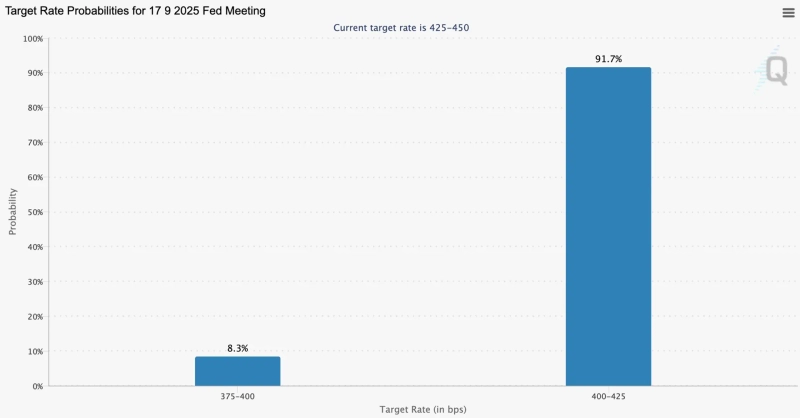

Meanwhile, as of 8:00 PM that day, the CME FedWatch reflected a 100% probability that the U.S. central bank, the Federal Reserve (Fed), will cut the policy rate this month. A 25bp (1bp=0.01% point) cut was favored with a 91.7% probability, while the chance of a big cut (50bp) stood at 8.3%.

Bitcoin: rebound expected amid September adjustment…mixed investor sentiment

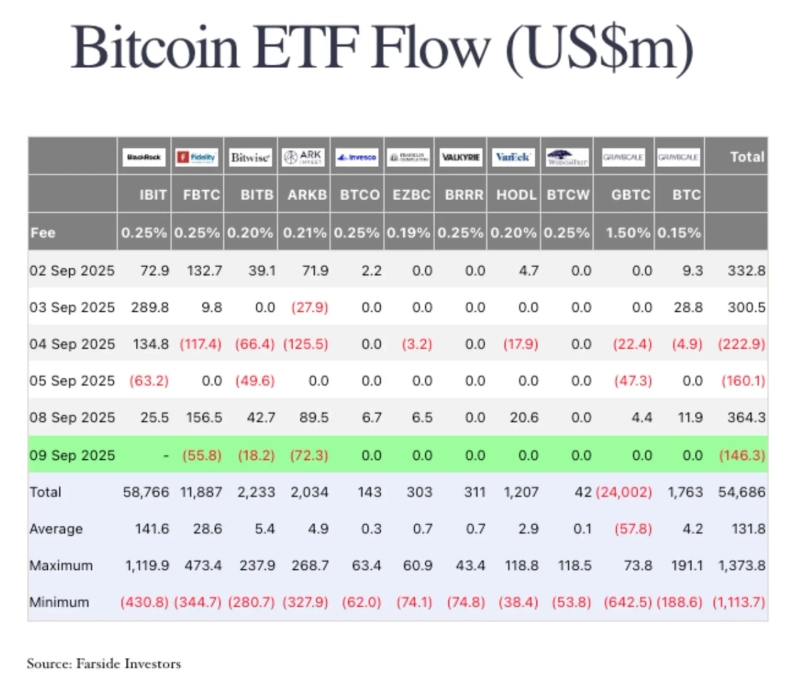

Spot Bitcoin ETFs saw somewhat reduced inflows, with a net inflow of $250.3 million last week (1–5). The joint announcement by the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to strengthen cooperation on digital asset regulation was seen as a sign that institutional framework adjustments are being phased in, boosting market expectations.

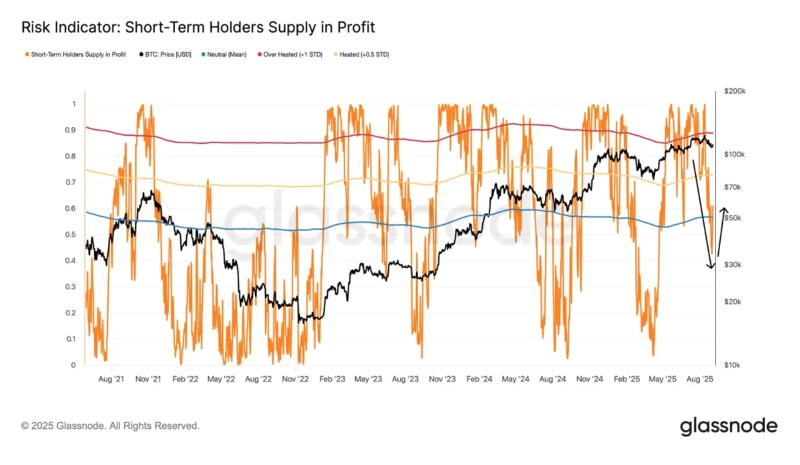

The market remains in a phase of balanced buying and selling pressure. Crypto data analytics firm Santiment recently said on a YouTube broadcast, "On on-chain indicators, short-term investors are nearly back to breakeven at -0.5% loss over the past 30 days," and analyzed that "both short- and long-term investors are in a neutral state, neither a clear opportunity nor a clear risk." It added that "volume showed a temporary spike earlier this month but remains weak compared to July," and "the futures market is also witnessing investors taking a wait-and-see stance without deciding on direction."

On-chain analytics platform Glassnode, in its weekly research report, also noted that "short-term holders were shaken by sudden profit-and-loss swings and selling pressure, but many have returned to profit, helping the market regain balance." It added that "ETF inflows that previously drove the rally have recently slowed significantly, reducing spot-based demand, so short-term momentum could be limited."

On the other hand, there is growing optimism that funds could soon move from safe-haven assets to risk assets. Crypto service provider Matrixport analyzed on the 9th that "recent weakness in the 10-year U.S. Treasury yield and the dollar reflects expectations of policy easing, suggesting investors may first allocate to gold and later move to risk assets like Bitcoin."

Some analysts also see Bitcoin's recent decoupling from equities as a potential upside factor. Santiment noted, "In the past 2–3 weeks, the S&P 500 rose 0.4% and gold rose 5.5%, while Bitcoin fell 6%," adding that "over the past four years, when the S&P leads, Bitcoin has tended to follow, and this signal could be interpreted as a potential upside indicator."

Meanwhile, the market also raised the possibility of September's typical seasonal weakness. Global crypto exchange Bitfinex, in an August 8 research report, forecast that "statistically, Bitcoin has tended to form lows in September, so a short-term correction is likely." It added that "October and November have historically shown large average gains," and "if the Fed confirms a September rate cut, falling real rates and a weaker dollar could amplify Bitcoin's seasonal rise."

"Bitcoin needs to break the $114,000 zone to gain upward momentum"

Bitcoin is currently exploring direction within a neutral box range. Analysts said Bitcoin could see stronger rebound momentum if it breaks the $114,000 resistance, while if the $108,000 support fails, the risk of further declines increases.

Ayushi Jindal, a researcher at NewsBTC, diagnosed that "Bitcoin pulled back from the prior $113,200 level and has struggled to recover above $112,000." She said, "If the short-term rebound continues and breaks $111,700–$112,300, a retest of $113,200 could follow. It could open up to $114,200–$115,000," but warned that "if the breakout fails, it could test $110,000 and then slide to $108,800, and ultimately $107,500."

Rakesh Upadhyay, a researcher at Cointelegraph, said, "Buying pressure is trying to keep Bitcoin above $112,500, but unless whale selling eases and corporate demand increases, a large rally could be limited for now." He analyzed that "if Bitcoin breaks the $114,920 resistance, it could trade within a 'wide box range' between $107,000 and $124,474." However, he added that if $107,000 breaks, it could fall further to $100,000.

On-chain analytics firm Glassnode also said, "Bitcoin is undergoing a correction between $104,000 and $116,000," adding that "the market is neutral but still vulnerable; momentum can reignite only after reclaiming $114,000–$116,000. Conversely, if $104,100 breaks, the risk of further decline increases." It added that "the $108,000–$116,000 range can be used as a buying opportunity, but medium-term retracement risk remains high."

Alex Kupchykievich, senior market analyst at FXPro, stated that "total crypto market capitalization rose 2.5% over seven days but remains below short-term support, so the bear market persists," and diagnosed that "Bitcoin also drifted around $111,000 over the past week." He added that "while dovish Fed expectations lifted equities, recession fears are dampening retail investors' risk appetite."

Kang Minseung, BloomingBit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)