Summary

- The Bank of Korea said policy rate cuts affected the rise in Seoul metropolitan area housing prices and the expansion of household debt.

- They said 26%% of the increase in Seoul apartment prices was due to policy rate cuts, and apartments priced over 1.5 billion won continue to trade at record highs.

- They explained that with accommodative financial conditions in place overall, the decision on additional policy rate cuts will depend on U.S. rate cut expectations and foreign exchange market volatility.

Bank of Korea sends hawkish signal

Apartments over 1.5 billion won continue to record new highs

26% of Seoul house price rise in the first half of the year

Effect of 1%P cut in BOK policy rate

6·27 measures dampened overheating, but

Risks remain, such as expectations of price increases

U.S. policy rate cut expectations grow

If FX market volatility eases

Possible to focus monetary policy on domestic conditions

The Bank of Korea named Seoul metropolitan area housing prices as a variable for a policy rate cut ahead of the Monetary Policy Committee meeting on the 23rd of next month. While the government's real estate measures have somewhat calmed the overheating trend, it expressed concern that a rate cut could re-stimulate the housing market. With markets placing a high probability on a rate cut next month, there is an interpretation that the BOK sent a hawkish message to curb excessive expectations.

Deciding monetary policy while watching housing prices

The Bank of Korea said this in its Monetary and Credit Policy Report published on the 11th. This report is prepared twice a year, in March and September, to explain the background and future direction of the BOK's monetary policy decisions.

Lee Su-hyung, a member of the Monetary Policy Committee who oversaw writing the report, emphasized, "When deciding the timing and magnitude of a rate cut, the stability of the housing market and the household debt situation, along with growth trends, are important considerations," and added, "Given that the upward trend in housing prices in the Seoul area and expectations of further increases remain high, it is necessary to review the effects of housing supply measures and the impact of accommodative financial conditions on housing price expectations while determining the timing of additional rate cuts."

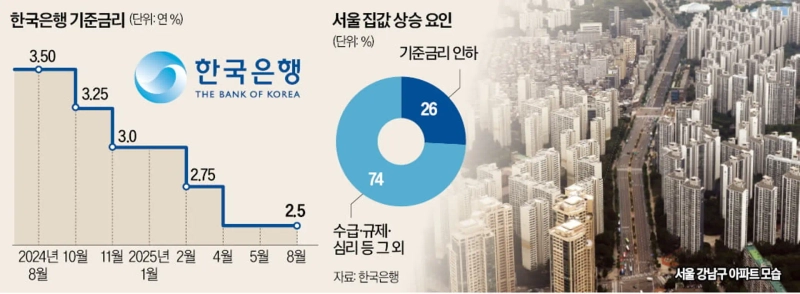

The Bank of Korea said, "Policy rate cuts affected the rise in Seoul metropolitan area housing prices and the expansion of household debt in the first half of the year," and stated, "26% of the increase in Seoul apartment prices in the first half of this year was due to policy rate cuts." The BOK lowered the policy rate four times since October last year from an annual 3.50% to an annual 2.50%, meaning these rate cuts significantly contributed to the rise in housing prices. The remaining 74%, the BOK analyzed, was influenced by a shortage of new housing supply, relaxed regulatory levels, and expectation-driven sentiment.

The BOK judged that the 6·27 real estate measures have calmed the overheating, but still sees risk factors. The BOK explained, "The upward trend in housing prices in the Seoul area remains high, and apartments priced over 1.5 billion won continue to trade at record highs," adding, "Expectations of further price increases and potential purchase demand remain firm."

Financial conditions "accommodative"

It was analyzed that policy rate cuts have not yet had an impact on growth and inflation. The BOK said in the report, "The effect of policy rate cuts on growth has not appeared," and explained, "Economic agents are postponing consumption and investment because this is a period of high uncertainty." The BOK expects that the growth effects delayed by uncertainty will appear from the second half of the year.

They assessed that the current interest rate level is close to the "neutral rate." Park Jong-woo, BOK deputy governor, said, "Korea lowered the rate from an annual 3.5% by 1% point, bringing the policy rate to around the midpoint of the neutral rate," and explained, "There are views that rates should be lowered faster to stimulate the economy, but we are moderating this considering financial stability risks."

Overall financial conditions were assessed to already be accommodative. Choi Chang-ho, director general of the BOK's Monetary Policy Department, explained, "Looking at indicators such as liquidity conditions, interest rate spreads, and risk asset prices, overall financial conditions are at an accommodative level." This was interpreted to mean there is less need to rush rate cuts because conditions to support growth are already in place.

However, growing expectations of a U.S. policy rate cut are a factor that increases the likelihood of a policy rate cut in Korea. The deputy governor Park said, "It is true that U.S. employment indicators are weak and the Producer Price Index (PPI) has undershot expectations, which fuels expectations of a U.S. policy rate cut," and explained, "If volatility in the foreign exchange market eases, there will be greater room to focus monetary policy on domestic conditions."

Kang Jin-gyu reporter josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)