Summary

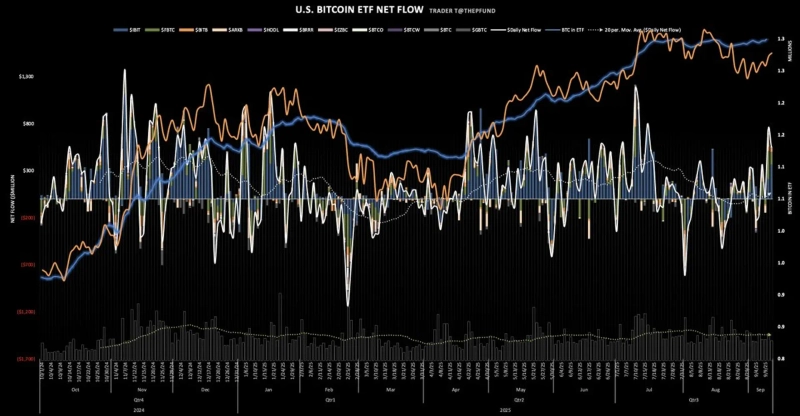

- It reported that Bitcoin spot ETFs traded in the U.S. recorded total net inflows of USD 553,220,000.

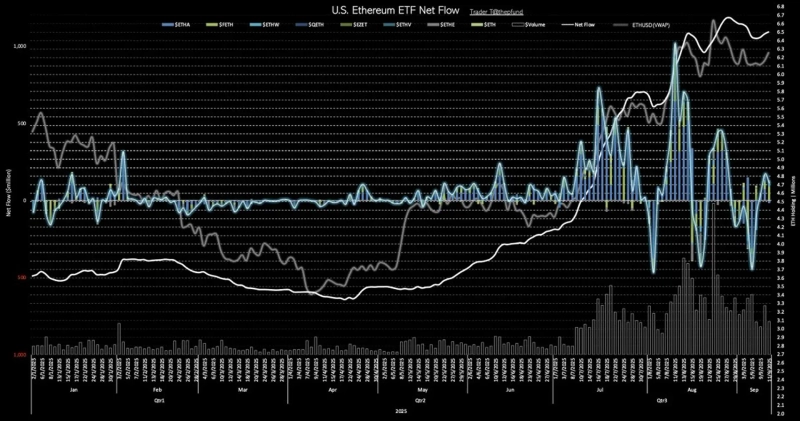

- Ethereum spot ETFs also posted daily net inflows of USD 113,080,000.

- It said that asset managers such as BlackRock, Fidelity, and Bitwise particularly led the inflows.

Capital is flowing into U.S.-traded Bitcoin (BTC) and Ethereum (ETH) spot ETFs, and institutional demand continues.

According to TraderT data on the 11th (local time), total net inflows into U.S. Bitcoin spot ETFs amounted to USD 553,220,000.

BlackRock's IBIT attracted USD 366,630,000, accounting for the largest share. Fidelity's FBTC recorded net inflows of USD 134,710,000, and Bitwise's BITB recorded USD 40,430,000 in net inflows. Invesco's BTCO, Franklin's EZBC, and VanEck's HODL also saw small inflows.

Ethereum spot ETFs also had daily net inflows of USD 113,080,000. Fidelity's FETH attracted the most capital at USD 88,340,000, followed by Bitwise's ETHW (USD 19,650,000), Grayscale's ETHE (USD 14,580,000), Franklin's EZET (USD 3,360,000), and Grayscale Mini ETH (USD 4,580,000). By contrast, BlackRock's ETHA recorded net outflows of USD 17,430,000.

On that day, some products such as ARK Invest, Valkyrie, WisdomTree, 21Shares, and Invesco had no inflows in either the Bitcoin or Ethereum ETFs.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)