Summary

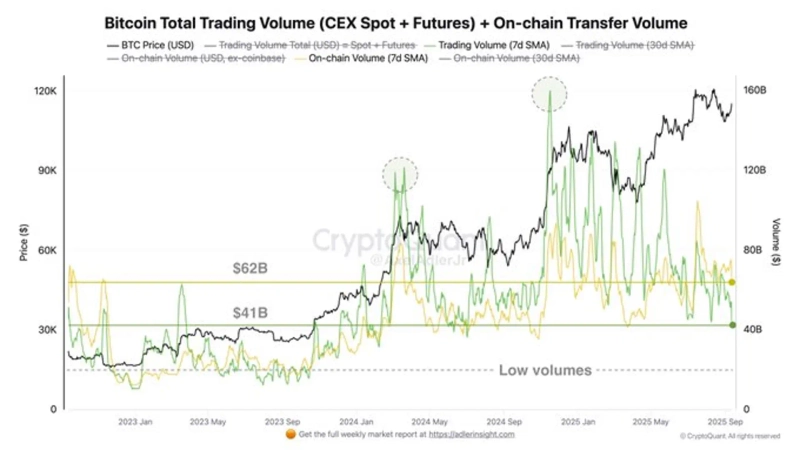

- Bitcoin's on-chain volume was $62 billion, surpassing centralized exchange (CEX) volume.

- A negative divergence has formed where price is rising while volume is decreasing.

- This indicates thin liquidity and is analyzed to suggest the possibility of increased volatility for Bitcoin.

Bitcoin (BTC) has shown a rare phenomenon where, after reaching an all-time high (ATH) this year, on-chain volume has surpassed the combined spot and futures volume of centralized exchanges (CEX).

On the 12th (local time), crypto analyst Axel Adler Jr. said via X (formerly Twitter), "Bitcoin's recent on-chain volume reached $62 billion, while CEX spot and futures combined volume was around $41 billion." He emphasized, "This kind of trend rarely occurs in the market."

He added, "Currently, according to the volume flow, price is rising but volume is decreasing, forming a negative divergence," and pointed out, "This means thin liquidity(thin liquidity)." He analyzed that as Bitcoin's liquidity decreases, it suggests a phase of increased volatility in which sharp ups and downs may repeat for the time being.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)