"In the end, what was going to burst has burst"…'Crisis-hit France' plummets to the bottom

Summary

- International credit rating agency Fitch said it downgraded France's sovereign credit rating to a historic low of 'A+'.

- It reported that France's chronic 'fiscal deficits' and political division are acting as obstacles to restoring fiscal soundness.

- It said there are concerns that rising borrowing costs due to higher government bond yields and the possibility of further downgrades could arise.

France Addicted to Fiscal Imbalances

Shock of Sovereign Credit Rating Downgrade

Fitch Downgrades from 'AA-' to 'A+'

Historic Low Amid Government No-Confidence

International credit rating agency Fitch downgraded France's sovereign credit rating. It lowered the rating to a historic low on the grounds that the government's ability to restore fiscal soundness has weakened amid a sharp rise in national debt burdens and repeated government collapses.

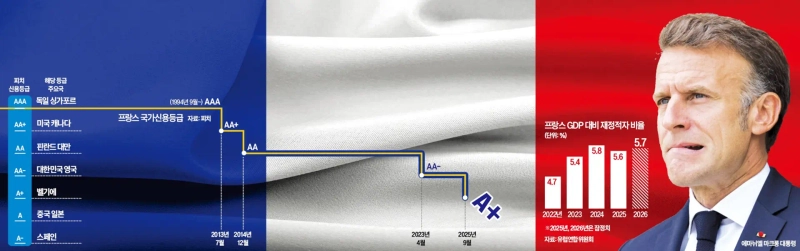

Fitch announced on the 12th that it had downgraded France's sovereign credit rating one notch from 'AA-' to 'A+'. In the report released that day, Fitch explained the reason for the downgrade by saying, "The government's defeat in a confidence vote shows deepening political division and polarization," and that it "raises questions about the government's ability to reduce fiscal deficits." France's credit rating fell two years after it was lowered from 'AA' to 'AA-'. The current A+ rating is one notch below the UK and South Korea and is on par with Belgium.

The rating action came one week after the French parliament voted no confidence in Prime Minister François Bayrou. Former Prime Minister Bayrou had proposed an austerity budget in July to tackle the fiscal deficit, which met with strong public and opposition backlash. On the 10th of this month, 'national paralysis' protests against austerity policies occurred across France. Some argue this is an example showing how once a country becomes 'addicted to fiscal spending,' it is that much harder to escape.

Since Emmanuel Macron's re-election in 2022, France has replaced its prime minister five times. Although chronic fiscal deficits persist due to increased spending during the COVID-19 pandemic, the ruling and opposition parties have been unable to close ranks on austerity policies. Last year France's fiscal deficit was 5.8% of gross domestic product (GDP). It is projected to be 5.6% and 5.7% of GDP this year and next year, respectively. Fitch said it is unlikely the government will achieve its goal of reducing the fiscal deficit to 3% of GDP by 2029. France's national debt exceeds 113% of GDP, making it the third-highest in the eurozone after Greece and Italy.

Blind 'fiscal addiction'…severe political division…ultimately a warning

Sinking into national debt…Fitch downgrades France after 2 years and 5 months

France's sovereign credit rating was downgraded to a historic low because it failed to overcome concerns about deteriorating fiscal soundness. Other rating agencies such as Moody's and Standard & Poor's (S&P) are also increasingly likely to lower their ratings. Markets expect the French government to agree on an austerity budget with the ruling party, making it even harder to achieve deficit reduction targets.

France trapped in fiscal addiction

Credit rating agency Fitch projects that France's fiscal deficit will remain above 5% of GDP in 2026–2027. This far exceeds the eurozone average of about 3.1%. National debt exceeds 113% of GDP, the third-highest in the eurozone after Greece and Italy. Fitch believes that internal political divisions in France make it unlikely that fiscal soundness will be secured before the 2027 presidential election. Fitch warned, "Political gridlock is likely to persist even after the election."

France's fiscal crisis stems from spending on business and household support during the COVID-19 period and energy issues triggered by the Russia–Ukraine war. In particular, social welfare burdens are considered large. France's social welfare spending accounts for 32% of GDP, exceeding the European Union (EU) average of 26%. Recent EU policies to increase defense spending are also cited as a fiscal burden. President Emmanuel Macron pledged to increase France's defense budget by 6.5 billion euros over the next two years, saying that U.S. President Donald Trump urged NATO member states to raise military spending.

As concerns about fiscal deficits grew, international rating agencies have recently been downgrading France's credit ratings one after another. When the French government announced its 2025 budget at the end of last year, Fitch gave France a 'negative' sovereign outlook. Less than a year after issuing a negative outlook, Fitch made the downgrade decision. Earlier last year, S&P also lowered France's rating to 'AA-'. S&P warned it could lower the rating again in its November review if the French government fails to reduce the fiscal deficit.

Markets warn that France's sovereign credit downgrade could trigger a vicious cycle in which borrowing costs rise, exacerbating fiscal deterioration. French government bond yields have approached the highest levels since the eurozone debt crisis about 15 years ago. The yield on France's 10-year government bond rose to an annual 3.5% as of the 12th. Just before Prime Minister François Bayrou's resignation, it had surged to about 3.6%. France's bond yields have become similar to those of Greece and Italy, which are considered high-risk countries in the eurozone.

Political instability likely to continue

The fall in the sovereign credit rating is analyzed as increasing the burden on newly appointed Prime Minister Sébastien Lecornu. He must address fiscal deterioration, but strong opposition from the opposition and public makes it difficult to push through Bayrou's proposed 44 billion-euro spending cuts. With a minority government in the legislature, passing the budget is difficult. Fitch said, "We expect the new prime minister to present a fiscal consolidation package softer than the previous government's budget in upcoming budget negotiations," and warned, "If the budget is not passed before the end of the year, previous-year spending will continue under parliamentary budget procedures." The budget is to be submitted to parliament by the 7th of next month.

In practice, Prime Minister Lecornu has shown signs of stepping back from the previous government's austerity stance to consider public opinion. In an interview with French regional media on the 13th, he said he would withdraw the previous government's proposal to eliminate public holidays. The previous government had proposed canceling two public holidays to boost productivity. Instead of abolishing public holidays, he added that he would "seek other sources of revenue." Reorganization of state bodies, including agency mergers, is expected. Reuters reported, "To gain parliamentary support, Prime Minister Lecornu is likely to concede policies including increased taxes on the wealthy and a softened pension reform," but warned, "If he concedes too much, he risks backlash from members of the ruling party."

Reporter Han Myung-hyun wise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)