Summary

- China's industrial production, retail sales, and fixed-asset investment all fell short of market expectations, increasing concerns about an economic slowdown and deflationary pressure.

- Real estate development investment declined sharply, and economic indicators worsened in August following July, suggesting a possible economic downturn in the second half.

- Analysts say that without additional stimulus measures, it will be difficult for the Chinese government to achieve about 5%% economic growth this year.

August production, consumption, and investment fell short of expectations

Price declines continue amid economic slowdown

Last month, China's production, consumption, and investment all fell short of market expectations, marking a 'triple shock.' As concerns about an economic slowdown grow, there are forecasts that the government's target of around 5% growth this year is at risk.

According to the National Bureau of Statistics of China on the 15th, industrial production in August increased by only 5.2% year on year, missing the market expectation (5.7%). It is the lowest in a year since August last year (4.5%). The pace of industrial production growth has been slowing since March (7.7%).

Retail sales in August, seen as a gauge of domestic demand, rose 3.4% year on year, below market expectations (3.8%) and the previous month's increase (3.7%). It is the lowest since November last year (3%).

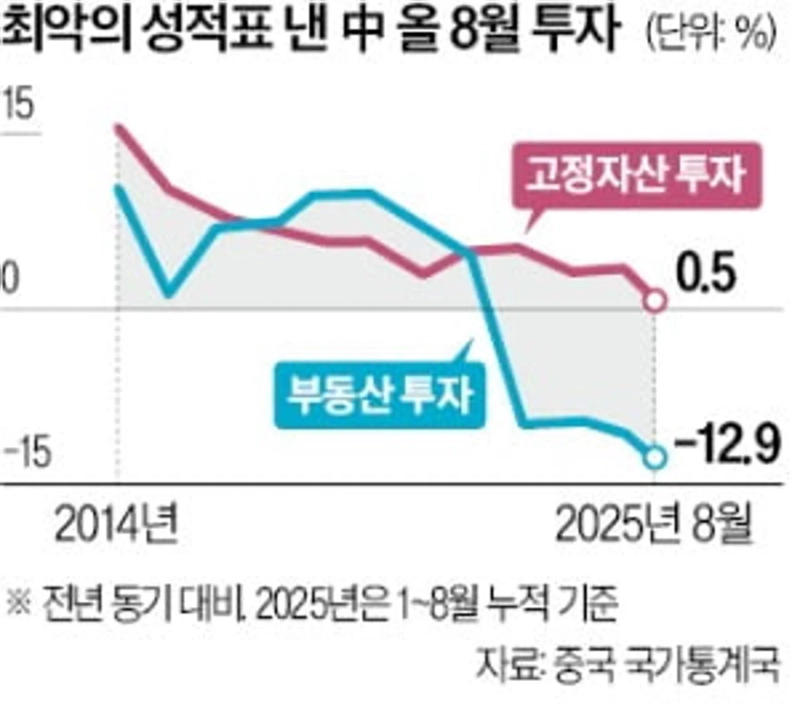

Fixed-asset investment for January–August this year increased 0.5% year on year, far below market expectations (1.5%) and the January–July increase (1.6%). Fixed-asset investment refers to investment in factories, roads, power grids, etc. Fixed-asset investment rapidly contracted from 4.2% in March to 3.7% in May, 2.8% in June, and 1.6% in July, and fell to the 0% range in August. Analysts say that fixed-asset investment was constrained as the government limited investment in part to address overcapacity.

Prices are on a downward trend. The consumer price inflation rate (year on year) recorded negatives from February to May this year, rose to 0.1% in June, but fell back to 0% in July and -0.4% in August. Deflationary pressure has increased as prices continue to fall amid an economic downturn.

Export slowdown, property slump… "China's roughly 5% growth this year is at risk"

Slowing industrial production and retail sales growth… fixed-asset investment in infrastructure also declined

Real estate investment, a barometer of China's economy, is already at depressed levels. Real estate development investment in January–August this year fell 12.9% year on year. It is the worst performance since the 2021 Evergrande crisis that triggered the property crisis after companies burdened by some 400 trillion won in debt were driven out of the market. The nationwide urban unemployment rate in August also stood at 5.3%, above market expectations of 5.2% and the previous month's 5.2%.

The National Bureau of Statistics of China said, "Overall, national economic operation is stable and new achievements have been made in high-quality development," but added, "the external environment is unstable and there are many uncertain factors, so economic operation still faces many risks and challenges."

However, the market views the economic situation as more serious than the government does. July's economic indicators were already the worst this year, and they deteriorated further rather than improving in August. Export value for August, released on the 8th of this month, rose only 4.4% year on year, below market expectations (5.0%) and July's export growth rate (7.2%). Bloomberg noted, "China's economy performed well in the first half due to an export boom, but has slowed more than expected in the last two months," and predicted, "with weak investment, the economy will show a downward trend in the second half."

The prolonged property slump since the Evergrande crisis has hampered China's economic recovery, and analyses say that shrinking consumption and deteriorating corporate profit outlooks are shaking the labor market.

The Chinese government is betting on reviving private investment. Premier Li Qiang, at a State Council meeting he chaired on the 12th, said the government would remove hidden barriers that hinder private investment and strengthen support and protection for private investment. But market observers already say that without additional stimulus measures, achieving roughly 5% economic growth this year will be difficult.

External uncertainty has increased due to weak domestic demand and tariff negotiations with the United States, putting exports in a precarious position. Additionally, intense low-price competition in key industries such as solar power and electric vehicles is a negative factor. It is becoming difficult to sustain high growth by increasing production as in the past. The manufacturing purchasing managers' index (PMI) has been in contraction for five consecutive months since April. Serena Zhou, Mizuho Securities' chief Asia economist, said, "There is a high likelihood that growth in the third quarter will slow noticeably," and warned, "if large-scale stimulus is not implemented, the government's target of 5% growth this year could be jeopardized."

Therefore, there are views that China could resort to stimulus measures including interest rate cuts and direct fiscal spending. The government has already focused on boosting sales by cutting consumer loan rates. If the United States cuts interest rates, China is likely to act quickly with measures such as lowering the loan prime rate (LPR). Ming Daoyu, a researcher at Donghai Securities, predicted, "If external shocks and domestic demand continue to weaken as now, the government could roll out successive stimulus policies toward the end of the third quarter and into the fourth quarter."

Lin Song, an economist at ING, said, "Thanks to a strong start to the year, this year's growth target is still within reach, but additional stimulus may be needed to finish the year strongly."

Beijing=Kim Eun-jung, correspondent kej@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)