'Unstoppable' KOSPI…"Further gains depend on the staying power of leading stocks"

Summary

- The KOSPI surpassed 3400 for the first time, driven by foreign buying and strength in semiconductor and securities stocks.

- Existing leading stocks such as 'shipbuilding, defense, and nuclear' showed weakness as profit-taking orders emerged.

- Experts said that whether there is further upside depends on the resilience of existing leading stocks, and warned of possible overshooting and corrections above 3500.

Fourth consecutive day of 'record highs'

Semiconductors and securities stocks lead the rally

Riding industry improvement and shareholder-friendly policies

Foreign buying pushes past 3400 for the first time

Shipbuilding, defense, and nuclear stocks that drove record highs

Turned 'weak' as profit-taking orders piled up

The key is how long they can hold up in a correction

Experts: "If KOSPI passes 3500,

it could face an overshooting risk and undergo a correction"

"In the short term, whether existing leading stocks can withstand a correction will determine if there is further upside." (Lee Jin-woo, Head of Research Center, Meritz Securities)

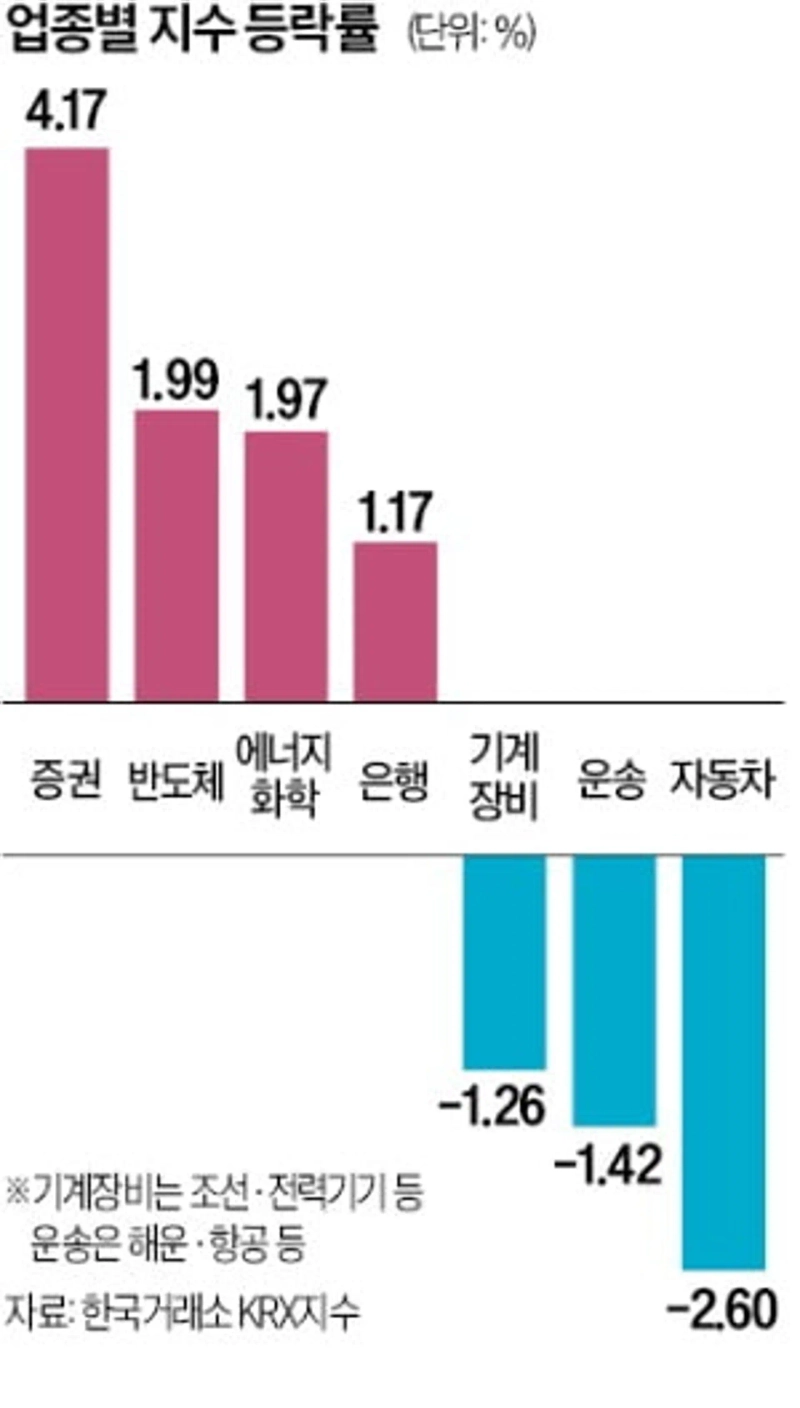

The KOSPI surged relentlessly and passed 3400 for the first time. Buying that had been concentrated in shipbuilding, defense and nuclear-related stocks shifted to semiconductors and securities/financial sectors, driving four consecutive days of record-highs. Experts expect a period in which profit-taking and additional buying demand battle it out.

◇Uptrend for 10 trading days

On the 15th, according to the Korea Exchange, the KOSPI closed at 3407.31, up 0.35%. It has risen without pause for 10 trading days, breaking its all-time high for the fourth straight session. On the Stock Market, foreign investors led the rise by net buying 266.9 billion won worth of stocks. Individual and institutional investors were net sellers of 137.2 billion won and 137.9 billion won worth, respectively.

When the government announced it would keep the 'major shareholder threshold for stock capital gains tax' at the current '5 billion won per stock', the market quickly pushed past the 3400 level at the open. The government had stirred market adjustments by proposing at the end of July a tax reform that would strengthen the threshold to 1 billion won.

The bellwether Samsung Electronics closed at 76,500 won, up 1.46%, marking a 52-week high. SK Hynix rose 0.75% to 331,000 won, rewriting its record high. Lee said, "Recent changes in semiconductor industry outlook have been a big help to the market," adding, "Through earnings outlooks from U.S. firms like Oracle and Broadcom, it was confirmed that front-end demand for artificial intelligence (AI) remains strong."

Securities stocks led gains on expectations that restored trust in government market support measures will boost trading activity. Kiwoom Securities jumped 7.21%, NH Investment & Securities rose 5.35%, and Mirae Asset Securities climbed 4.01%.

Expectations that market-friendly policies such as 'adjusting the top tax rate for separate taxation of dividend income' will follow also attracted funds to high-dividend holding companies and financial stocks. Hanwha rose 8.39%, Samsung C&T 7.05%, SK 4.72%, and Woori Financial Group 3.12%.

Robotics stocks also rose together. After the Blue House announced it would hold a 'Core Regulation Rationalization Strategy Meeting' and said it plans to revise regulations that hinder the growth of new industries such as robotics, Zenix Robotics(17.52%), Robostar(15.08%), and Rainbow Robotics(1.53%) rose significantly.

◇Leading sectors 'shipbuilding, defense, nuclear' see profit-taking

Profit-taking selling hit shipbuilding, defense and nuclear sectors that had fueled the KOSPI's record-high rally. Among shipbuilders, Hanwha Ocean fell 3.27%. HD Hyundai Heavy Industries dropped 2.25% and Samsung Heavy Industries fell 1.82%. Defense leader Hanwha Aerospace declined 1.6%, and nuclear stock Doosan Enerbility slid 3.61%.

Park Seong-chul, a researcher at Eunta Securities, explained, "Leading stocks that drove the KOSPI's record rally showed overall weakness due to profit-taking orders." With no progress in Korea-U.S. tariff talks, auto stocks also saw heavy selling. Hyundai Motor fell 3.8% to 215,000 won, and Kia dropped 3.97%.

Lee added, "While government policy has partially restored market confidence, there are still many hurdles to overcome," and analyzed, "In a rotation market, how well existing leading stocks hold up is a major concern."

There are also views warning against excessive expectations for a U.S. Federal Reserve rate cut. Han Ji-young, a researcher at Kiwoom Securities, said, "Because rate-cut expectations have already been used as a driver for the stock rise, a 0.25 percentage point cut has limited ability to secure additional momentum," and predicted, "Around the 3400 level, additional buying and profit-taking demand will battle it out." Lee Kyung-min of Daishin Securities also said, "If it goes above 3500, overshooting issues may arise," adding, "KOSPI could undergo a short- to mid-term correction."

Reporter Lee Tae-ho thlee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)