Summary

- Samsung Electronics and Coupang have joined the U.S. stablecoin payment ecosystem, and are taking preemptive steps to respond to changes in the global payments market centered on stablecoins.

- Samsung invested in Rain, and Coupang joined the Tempo partnership, with potential for payment efficiency improvements and cost savings of up to 300 billion won annually.

- With global stablecoin supply rapidly increasing, the moves by the two companies are seen as strategic decisions to prepare for a new digital financial order.

The Onslaught of Stablecoins

(14) Korean Companies Seeking Opportunities in the U.S.

Samsung Invests in 'Rain' with Visa

Stablecoin Payments at Merchants in Various Countries

Embedded in Phones, Pay, etc... Strategic Move

Coupang Also Joins as an Initial 'Tempo' Partner

Expected Annual Cost Savings of 300 Billion Won

"In the U.S., a Private-Led Ecosystem Is Rapidly Growing"

Samsung Electronics and Coupang have entered the stablecoin ecosystem in the United States. The country's top manufacturing and distribution companies have each moved to respond to stablecoins. As the global payments market is rapidly changing around stablecoins, this is interpreted as a preemptive move to avoid falling behind.

◇ Samsung Begins Venture Investment

According to the cryptocurrency industry on the 16th, Samsung Next, the venture investment arm under Samsung Electronics, participated in the Series B funding round of U.S. stablecoin payment infrastructure startup Rain. The total was about $58 million, and individual investment amounts were not disclosed.

Rain, founded in New York in 2021, works with global payments company Visa to provide card issuance and payment services based on USD Coin (USDC). In addition to card infrastructure, it is pursuing new businesses such as tokenization of credit card receivables and settlement automation using smart contracts (self-executing contracts on the blockchain).

Industry observers suggested that Samsung Electronics, which has its own payment infrastructure such as Samsung Pay and Samsung Wallet, may be considering the possibility of using stablecoins. A person familiar with Samsung Electronics' payment business said, "If stablecoins are connected to the Samsung Pay payment network, it could secure new competitiveness," adding, "I understand that various internal reviews are being conducted." There is also analysis that if Samsung Electronics uses stablecoins as an internal remittance method among affiliates, branches, and corporations, it could reduce costs by more than $100 million annually.

◇ Coupang Shows Interest in Payment Blockchain

Coupang recently joined as an initial partner of 'Tempo,' a blockchain jointly developed by U.S. fintech firms such as Stripe. Tempo is a blockchain specialized for stablecoin payments. The partner list also includes global financial companies such as Visa, Deutsche Bank, and Standard Chartered. It is interpreted that Coupang, which faces large transaction costs for payments and settlements, is aiming to improve payment efficiency and reduce costs by using stablecoins.

Coupang, which recorded sales of 41 trillion won last year, is estimated to be able to save nearly 300 billion won in fixed annual costs if it uses stablecoins for payments, settlements, or international remittances. Coupang pays payment fees to card companies and payment gateway (PG) firms.

Considering remittances to its U.S. headquarters, exchange costs are also substantial. Stablecoins have payment fees that are less than half of existing fees. International remittance costs are also at about $1, and transfers are made in real time. Even accounting for stablecoin infrastructure operating costs, the industry estimates that annual savings could be at least 230 billion won and up to more than 300 billion won. Kim Min-seung, head of the Kobit Research Center, said, "Stablecoins have the potential to drastically reduce transaction costs," and evaluated, "Samsung's and Coupang's moves are strategic decisions to prepare for a new digital financial order."

◇ "Global Adoption Will Accelerate"

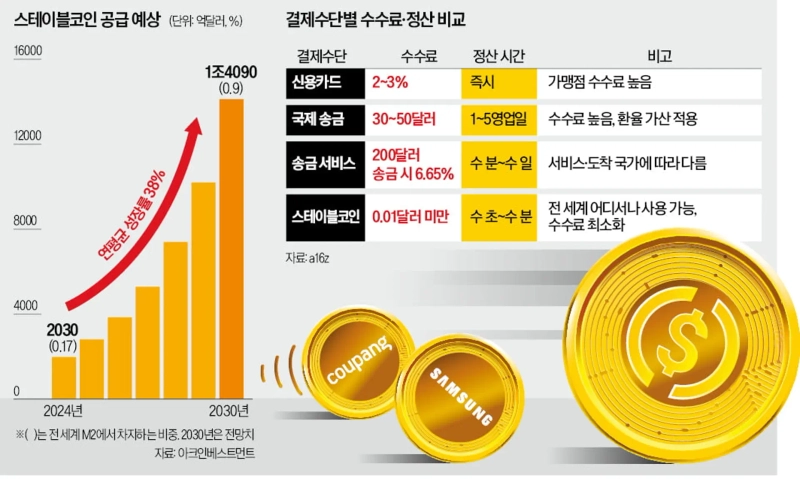

The spread of stablecoins is accelerating worldwide. According to Ark Invest, global stablecoin supply is increasing at an average annual rate of 38% and is expected to reach about $1.409 trillion (approximately 2,000 trillion won) by around 2030. This is seven times last year's supply ($203 billion).

The share of stablecoins in broad money (M2) was 0.17% last year but is expected to expand to 0.9% in five years. That means the scale at which stablecoins are used like actual money in the market will grow. Ark Invest projects that at this pace, stablecoins could emerge as a liquidity size comparable to the world's 13th-largest national currency. Kang Hyeong-gu, a Hanyang University professor who served as an adviser to the State Advisory Planning Committee, said, "From a corporate standpoint, it is natural to consider introducing stablecoins for cost efficiency," adding, "It is regrettable that major conglomerates are turning to dollar stablecoins before a won-denominated stablecoin ecosystem is established."

Jo Mi-hyeon/Kim Chae-yeon/Ha Heon-hyeong reporters mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)