Editor's PiCK

[Fed Watch] US cuts benchmark interest rate by 0.25 percentage points…Powell signals additional cuts, saying "labor market weakening"

Summary

- The U.S. central bank (Fed) decided to cut the benchmark interest rate by 0.25 percentage points.

- The Fed signaled the possibility of additional rate cuts by the end of the year and lowered its year-end benchmark rate forecast to 3.6%.

- Chair Powell emphasized the need for rate cuts, mentioning labor market weakening and a reduced inflation risk.

GDP growth rate revised up to 1.6% in 2025

PCE inflation kept at 3.0% this year in line with prior forecasts

The U.S. central bank (Fed) on the 17th (local time) held the September Federal Open Market Committee (FOMC) meeting and decided to lower rates by 0.25% percentage points.

Included in the vote was Steven Myron, a newly appointed Fed board member (also chair of the National Economic Advisory Council), whom President Trump appointed and who took office the previous day. He voted against the decision, arguing for a 0.50%P cut ('big cut'). Meanwhile, 11 members including Board Member Christopher Waller and Board Member Michelle Bowman, who had previously argued for larger rate cuts, supported the 0.25% percentage point cut. A total of 19 members attended the FOMC, of whom 12 had voting rights.

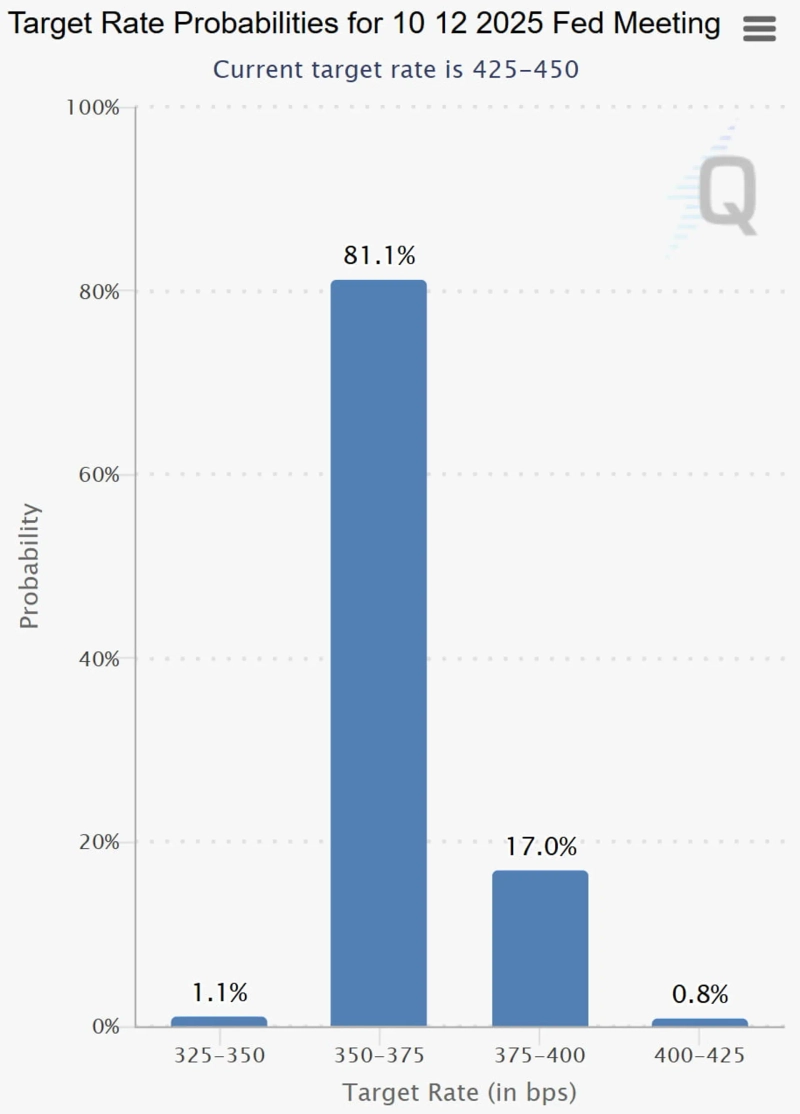

However, the Fed hinted that it would lower rates two more times (0.5% percentage points) by the end of this year. In the economic projections (SEP) released that day, it lowered its year-end policy rate forecast from 3.9% to 3.6%. Prices in interest rate futures traded on the Chicago Mercantile Exchange most heavily reflect (81.1%) the possibility that the policy rate will be around 3.5–3.75% after the December FOMC.

In the statement released after the meeting, the Fed said, "Uncertainty about the economic outlook remains high," but also assessed that "downside risks to employment have increased." It judged that a weakening labor market is a bigger concern than the risk of rising prices. The statement did not include an assessment that the U.S. labor market is 'solid.' It also contained language emphasizing that there may be a need for rate cuts.

Chair Powell made clear at the press conference that "the labor market has weakened" and that "the likelihood of persistent inflation has diminished." This continued the stance he showed in his August Jackson Hole speech. He noted that employment had fallen sharply even as the unemployment rate remained low.

Washington = Lee Sang-eun, correspondent

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)