Summary

- The U.S. Federal Reserve's 25bp cut to the benchmark interest rate is said to be beneficial to Bitcoin.

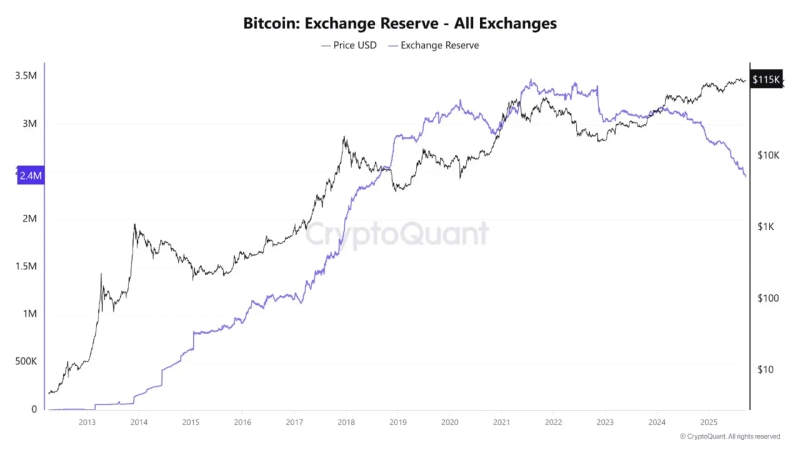

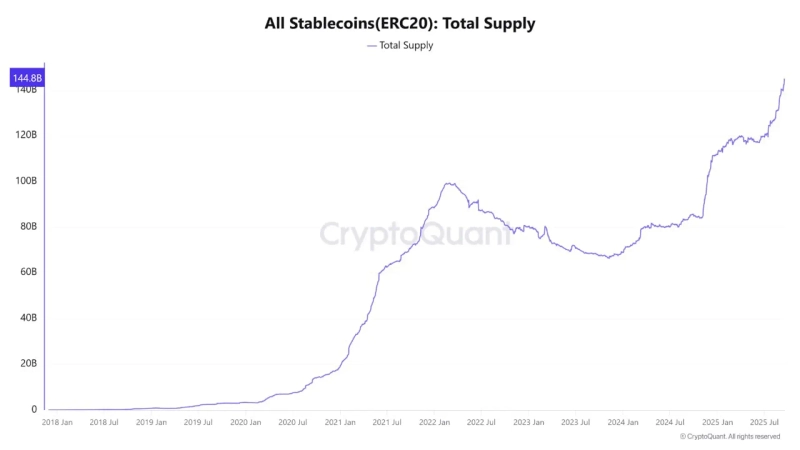

- It reported that centralized exchanges' Bitcoin holdings have declined to the lowest level and stablecoin issuance has reached an all-time high.

- It analyzed that Bitcoin futures open interest is increasing and on-chain indicators could positively affect investor sentiment recovery and liquidity expansion.

The U.S. Federal Reserve (Fed, the Fed) cut the benchmark interest rate by 25bp after nine months, and analysis suggests this will be beneficial to Bitcoin.

On the 18th (local time), CryptoQuant author XWIN Research Japan said, "The U.S. Fed lowered the interest rate range to 4.00~4.25%. On-chain data shows this decision is creating a favorable environment for Bitcoin (BTC)."

According to the author, ahead of the U.S. interest rate decision, Bitcoin holdings on centralized exchanges fell to the lowest level in years, easing selling pressure. This means investors are holding coins directly and holding them for the long term.

Also, ERC-20-based stablecoin issuance reached a record high of 144 billion dollars, greatly increasing liquidity that can be immediately converted into buying funds. Bitcoin futures open interest also exceeded 41 billion dollars, suggesting traders are using leverage to bet on a rise.

The author said, "Ultimately, the rate cut reduces the holding burden of interest-free assets like Bitcoin. Together with reduced exchange holdings, expanded stablecoin supply, and active positioning in the futures market, a foundation is being built to support Bitcoin demand," and analyzed, "On-chain indicators show that a dovish policy shift could act as a benefit to Bitcoin in terms of both liquidity and investor sentiment."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)