Gu Yun-cheol "U.S. will continue rate-cutting stance…Uncertainty also confirmed"

Summary

- The Fed's policy rate cut decision was evaluated as an expected result.

- The Fed signaled an additional rate-cutting stance, but also noted uncertainty in the economic and rate path.

- The domestic financial market showed a stable trend, reporting positive effects such as a rise in the KOSPI index and a decline in the won·dollar exchange rate.

Review of economic and financial effects following U.S. Fed policy rate cut

The U.S. Federal Open Market Committee (FOMC) cut its policy rate for the first time in nine months, and the Expanded Macroeconomic and Financial Meeting (F4 meeting) was held for the first time since the inauguration of the Lee Jae-myung administration. Attendees viewed the Fed's rate cut decision as an "expected result," but also said they "could confirm uncertainty."

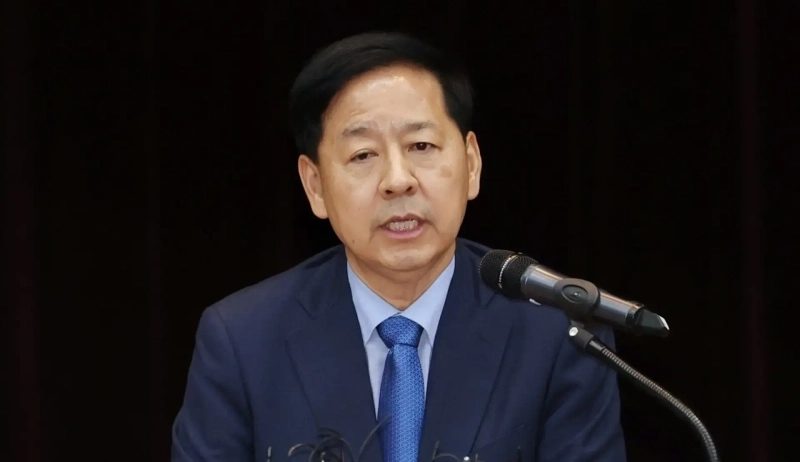

Deputy Prime Minister and Minister of Economy and Finance Gu Yun-cheol held the Expanded Macroeconomic and Financial Meeting at the Federation of Korean Banks building on the morning of the 18th to review the impact of the Fed's rate cut decision. In the early hours of the day, the U.S. Fed decided at the FOMC to lower the policy rate by 25bp. It was the Fed's first rate cut in nine months since last December. As a result, the upper bound of the rate was lowered from 4.5% to 4.25%. The Fed also indicated two additional cuts within the year.

The meeting was attended by Bank of Korea Governor Lee Chang-yong (joined via video), Financial Services Commission Chairman Lee Eok-won, and Financial Supervisory Service Governor Lee Chan-jin. Participants responded that the Fed's rate cut decision was an expected outcome. They said, "The U.S. Fed is expected to continue the rate-cutting stance going forward," and assessed that "the impact on the domestic economy is limited." Relevant agencies agreed to manage the macroeconomy and financial markets with a focus on progress in tariff negotiations with the U.S., household debt, real estate market trends, and strengthening competitiveness in key industries such as petrochemicals.

In his opening remarks, Deputy Prime Minister Gu said, "The Fed raised its inflation outlook in its economic projection, but presented an improved outlook for growth and employment compared to before," and added, "Fed officials' views were widely dispersed, so uncertainty over the economy and the rate path could also be confirmed." The Fed lowered next year's inflation forecast from 2.4% to 2.6% and lowered the unemployment rate forecast from 4.5% to 4.4%. Next year's growth rate was raised by 0.2 percentage points from 1.6% to 1.8%.

Deputy Prime Minister Gu assessed that "the domestic financial market is maintaining a stable trend," saying, "Since September, the KOSPI index hit record highs due to net buying by foreigners, the won·dollar exchange rate fell somewhat due to increased foreign investment in the stock market, and financing conditions such as corporate bond issuance are also smooth."

Reporter Lee Gwang-sik bumeran@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)