Editor's PiCK

Powell "Employment slowdown materializes"… Probabilities of rate cuts in October and December exceed 80%

Summary

- Powell acknowledged the U.S.'s labor market slowdown as a reality and carried out a policy rate cut.

- Markets say the probabilities of policy rate cuts in October and December each exceed 80% and investors' attention is focused.

- The Fed emphasized that this measure is risk management rather than an economic slowdown, and raised its economic growth forecast from 1.4% to 1.6%.

Fed, 0.25%P rate cut

Last month's employment increase at 'shock' levels

Labor market slowdown due to anti-immigration policies

Price increases of some goods due to tariffs

Concerns it could lead to inflationary pressure

Draws a line against interpreting it as entry into an economic slowdown

This year's U.S. growth forecast 1.4 → 1.6%

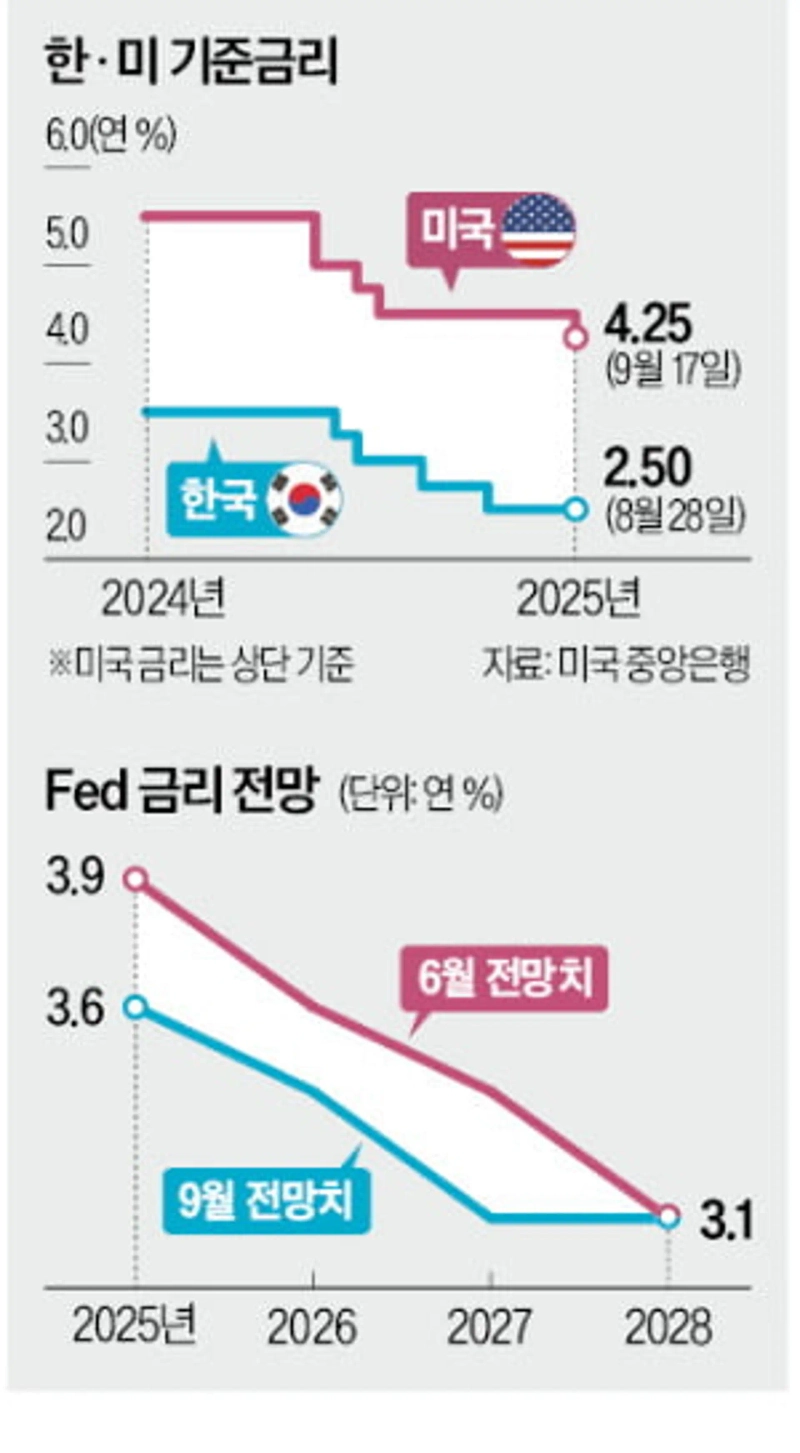

Jerome Powell, chair of the U.S. central bank (Fed), on the 17th (local time) cited "a cooling labor market" as the reason for the policy rate cut. Previously the employment slowdown had been seen as a potential risk, but this time it was acknowledged as a reality facing the U.S. economy. Since the COVID-19 outbreak, the Fed had described the labor market as "resilient" in statements after Federal Open Market Committee (FOMC) meetings, but that phrasing was omitted this time. Markets see the probability of policy rate cuts at the October and December monetary policy meetings this year as each over 80%.

"Both labor supply and demand are declining"

At a press conference after the rate cut, Powell said the background for FOMC members deciding to cut rates for the first time in nine months was "because labor market risks have become clear." He said, in particular, "Until July we described the labor market as resilient based on monthly job gains of 150,000, but the new data show that the downside risk has materialized." Because the labor market had been resilient, rates had been held, but it has become difficult to maintain that policy any longer.

The U.S. Department of Labor's August nonfarm payrolls released on the 5th were at 'employment shock' levels. They increased by 22,000 month-on-month, which was far lower than Dow Jones's estimate (75,000). Job gains for June–July were revised down by 21,000 from previous releases.

Powell pointed to immigration policy as a cause of the labor market slowdown. He diagnosed, "It is rare for both labor supply and demand to slow, and the labor market's dynamism has declined and is somewhat weakened."

He did not expect this rate cut to have a visible effect on the economy. He explained, "I do not see a single action (a 0.25% percentage point cut) as able to change the economy," and "We acted because we could not ignore signals of weakness in the labor market."

Tariff-driven inflation is temporary

Although the Fed cut rates, the inflation risk cannot be ignored. U.S. prices have slowed significantly since the mid-2022 peak but still exceed the Fed's long-term target of 2%. Year-to-date through August, the personal consumption expenditures (PCE) index rose 2.7% year-on-year, and core PCE, which excludes volatile food and energy, rose 2.9%.

This is higher than at the start of the year and reflects rising goods prices. Inflation is easing in the services sector. Powell said, "Short-term inflation expectations have generally risen this year, and this appears to reflect mainly tariff news, as confirmed in both market- and survey-based indicators."

Powell said, however, that the Trump administration's tariff policy "has begun to push up prices for some goods," and "the baseline scenario is that this effect is likely to be temporary and one-off, but there is a risk it could feed through into inflationary pressure."

Markets are also betting on two cuts this year

According to the September dot plot (FOMC members' economic projections) released by the Fed, the median forecast for the policy rate at the end of 2025 is 3.6% per annum, 0.3% percentage points lower than the June projection (3.9%). This implies the possibility of two 0.25% percentage-point rate cuts this year.

According to the Chicago Mercantile Exchange (CME) FedWatch tool, federal funds rate futures reflect probabilities of about 87% and 81%, respectively, that the Fed will cut the policy rate by 0.25% percentage points in October and December.

Powell rejected interpretations that this rate cut reflected entry into an economic slowdown. He said, "(It) can be seen as risk management regarding economic slowdown," and "the U.S. economic growth forecast was slightly raised and there is no large change in inflation and unemployment projections."

The Fed raised this year's U.S. economic growth forecast from 1.4% to 1.6%.

New York=Park Shin-young correspondent nyusos@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)