U.S. Fed's hidden 'money injection'… Why parents of international students are hopeful [Global Money X-File]

Summary

- The U.S. central bank (Fed) is using an 'ultra-slow quantitative tightening (QT)' and a stance of cutting the policy rate to ease liquidity in the market, a policy referred to as 'stealth easing.'

- This policy is leading to a weakening of the dollar, stabilization of global financial markets, and revived investor sentiment toward safe-haven assets like gold.

- For emerging markets such as Korea, it is expected to lower the cost of dollar funding and improve capital flows, but there is also concern that a stronger won could hurt exports.

The U.S. central bank (Fed) has decided to keep the speed at which it withdraws money from the market at a slow level. This approach is sometimes called a 'hidden money injection', or 'stealth easing'. It is expected to affect global capital flows and the prices of investment assets.

Will the 'cash choke' ease?

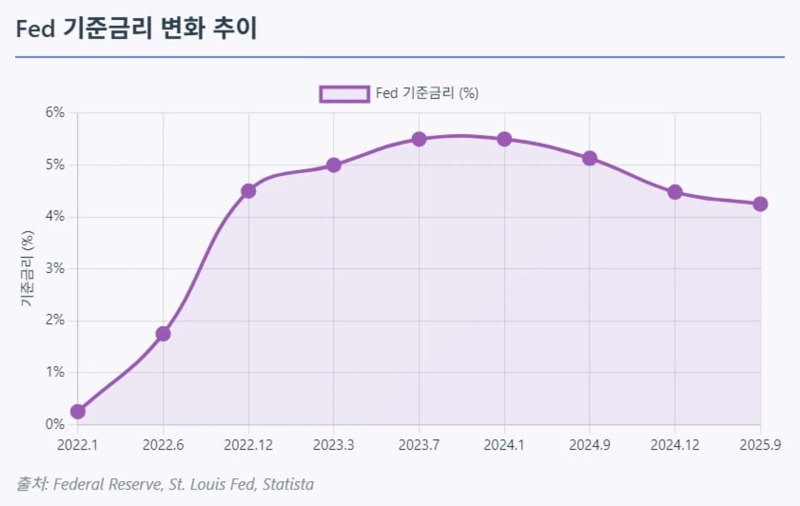

According to Reuters on the 19th, the U.S. central bank (Fed) on the 17th lowered the benchmark interest rate by 0.25% percentage point to adjust the policy rate to 4.00–4.25%. The Fed explained, "Recent economic growth appears to have slowed in the first half of the year, and the labor situation faces increasing risk of deterioration."

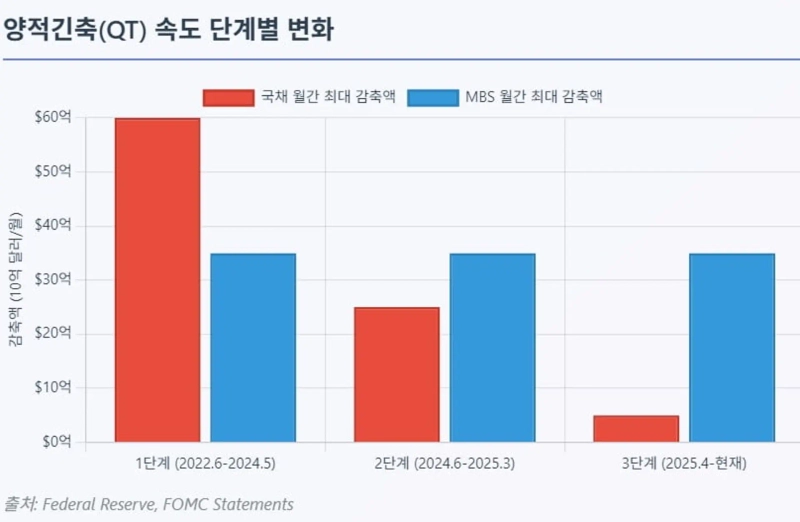

In its announcement that day, the Fed said it would keep the amount of Treasuries it reduces from the market each month at up to $5 billion. Mortgage-backed securities (MBS) will also be kept at up to $35 billion per month. This continues the 'ultra-slow quantitative tightening (QT)' that began in April. At one time the Fed had been reducing Treasuries by up to $60 billion per month, so the current $5 billion per month is a very low level.

Quantitative tightening (QT) is the opposite concept of quantitative easing (QE), which injects money into the market during an economic crisis. During the COVID-19 crisis, the Fed injected money into the market to revive the economy (QE). But now it is withdrawing money from the market to return the economy to normal (QT).

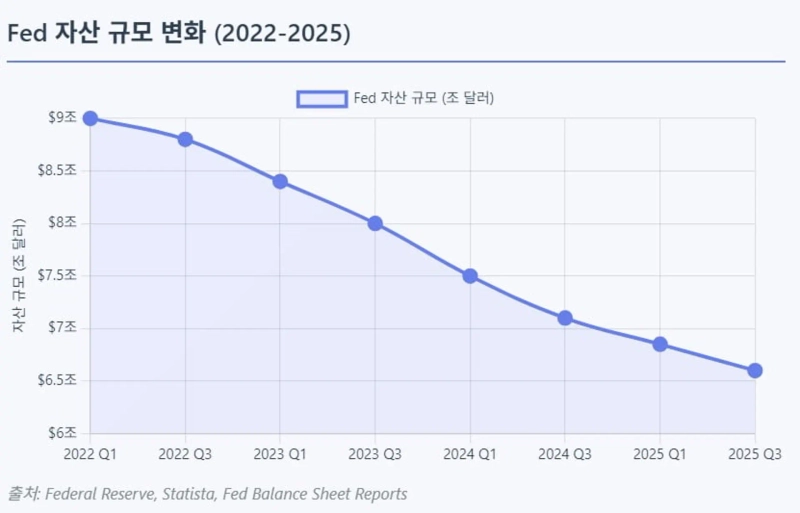

The Fed's QT works like this. When the Treasuries the Fed holds mature, it does not reinvest them and leaves them to run off, naturally withdrawing money from the market. Through this process, the Fed's total assets fell from about $9 trillion in 2022 to about $6.6 trillion currently. About $2.4 trillion of funds have already been withdrawn.

QT is not simply the reversal of QE. It is also a process in which banks' excess funds held at the Fed (reserves) are directly reduced. Markets are sensitive to how quickly this amount of funds decreases (the speed of QT).

The reason the Fed is calibrating QT slowly is due to past experience. During the first QT that began in 2017, the Fed misestimated the minimum reserves banks needed, causing a sudden shortage of money in the market. Ultimately, in September 2019, the repo market experienced a 'repo market seizure' in which the overnight rate spiked from about 2% to as high as 10% when financial institutions borrowed short-term funds.

To avoid such incidents, the Fed is proceeding very cautiously in three stages during this QT process. Stage 1 (June 2022–May 2024): to curb inflation, it kept tightening at a high speed of up to $95 billion per month (Treasuries $60 billion + MBS $35 billion).

Stage 2 (June 2024–March 2025) was the first slowdown. The amount of Treasuries being reduced was significantly lowered to up to $25 billion per month. Stage 3 (April 2025–present) further reduced the pace for the second time, cutting Treasuries by only up to $5 billion per month. Analysts say this is a stage of 'ultra-slow QT' to reduce market shock.

This 'very slow QT' policy affects the market differently from a typical rate cut. Rather than lowering rates directly to influence the market, it quietly eases conditions to make the market more comfortable. Hence it is also called 'stealth easing' (an invisible easing policy).

QT means the Fed gradually withdraws from buying U.S. Treasuries that it had purchased for the market. The Fed is the largest purchaser of Treasuries in the world. If the Fed stops buying Treasuries, private investors (banks, funds, individual investors, etc.) must fill that gap. Generally, when the Fed reduces Treasury purchases, private investors need to buy more Treasuries. Treasury prices fall, and as a result long-term Treasury yields (long-term interest rates) tend to rise.

However, if the Fed slows QT very gradually as it is doing now, private markets do not have to bear a sudden heavy burden. Market pressure is reduced, and this helps prevent a sharp rise in Treasury yields. Therefore, the current 'ultra-slow QT' can act as an 'invisible easing policy' that helps money flow in the market without directly cutting interest rates.

Thawing of global dollar liquidity

The Fed reduced Treasuries by up to $60 billion per month in September 2022. Now it has sharply reduced that to about $5 billion per month. Calculated over a year, this reduction means private financial markets do not have to absorb an additional about $660 billion of Treasuries.

As a result, the burden on the U.S. Treasury when issuing new debt is reduced, helping prevent long-term borrowing costs from rising sharply. The Fed's 'ultra-slow QT' policy plays a very important role in maintaining the stability of short-term financial markets, the 'plumbing' of the financial system. If this market remains stable, dollar funding flows worldwide also become smoother. Dollar supply to global distribution channels, which had been strained, can be reactivated.

Conversely, if QT proceeds rapidly, banks may be reluctant to increase assets they hold to meet regulations. This could lead to banks failing to supply sufficient dollars to domestic and foreign markets, causing the global dollar market to seize (money flow blockage).

But if the 'ultra-slow QT' with a greatly reduced pace continues as now, banks can hold funds more comfortably and supply dollars stably to domestic and foreign markets. This lowers the cost of dollar funding and helps companies worldwide conduct trade more easily. It also has the positive effect of easing the burden on emerging markets when they repay dollar-denominated debts.

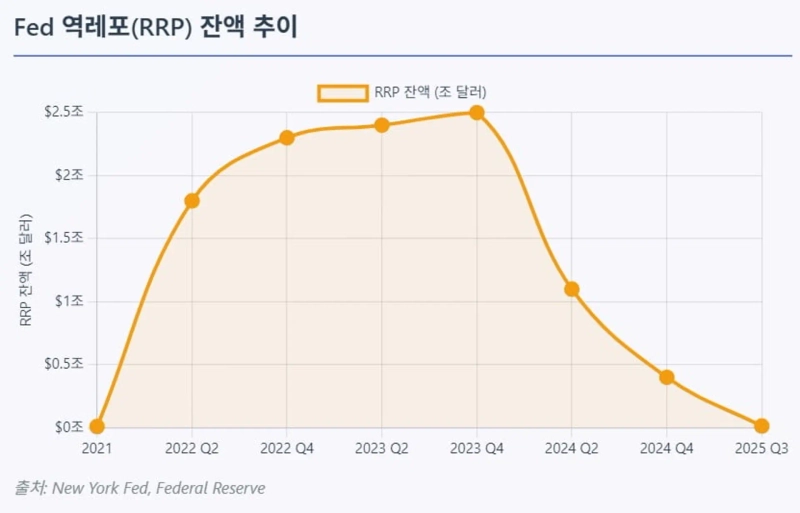

Some express concern that 'there is still a shortage of money in the market (liquidity is tight).' This is because the funds in the reverse repurchase program (RRP), which has played an important role in smoothing money flows in financial markets, are almost exhausted. The reverse repurchase agreement (RRP) is a tool by which the Fed accepts excess funds from financial institutions.

Simply put, when too much money is circulating, the Fed would temporarily take some back to maintain financial stability. Especially during QT, RRP acted as a 'buffer' to moderate shocks by controlling cash flows.

At the end of 2023, money deposited in RRP was as high as $2 trillion. But balances have rapidly declined, falling to about $14 billion this month. This is the lowest level since 2021. The reason RRP funds decreased is that market funds moved from RRP to U.S. government short-term Treasuries, which offered higher yields.

The near exhaustion of RRP funds means that in the event of a sudden financial crisis, liquidity (cash) may be more likely to be insufficient. In the past, even when the Fed reduced money through QT, funds tied up in RRP could flow back into the market to cushion shocks.

But now that money is almost gone, if the Fed continues QT, banks' excess reserves will inevitably decrease quickly.

This change means that if the Fed continues QT for too long, financial markets may suddenly become unstable, as in 2019. Therefore, the market is paying attention to the possibility that the Fed might stop QT earlier than expected.

The Fed's recent policy also signals major changes in foreign exchange markets. The Fed's decision to lower rates and slow QT reduces the attractiveness of the U.S. dollar. This could mark the start of a long-term weakening trend for the dollar. The Fed officials' dot plot released this time shows they expect two more rate cuts this year. If so, the U.S. policy rate is likely to fall to around 3.50–3.75% by year-end.

As this expectation spread in the market, the dollar actually weakened. The dollar index (DXY), which measures the dollar's value against six major currencies, fell to the mid-96 level in mid-September. Instead, other major currencies like the euro and the yen began to gain against the dollar.

Karl Schamotta, strategist at Canada’s Copia (Copay?), explained, "Markets interpreted the Fed's announcement as a dovish signal toward rate cuts, prompting increased positioning for a weaker dollar." He particularly forecasted that if Fed Chair Powell continues to focus on economic and employment recovery, the likelihood of continued rate cuts would increase.

A weaker dollar trend could help emerging market economies. Currencies of emerging markets, which have suffered from a strong dollar, may have a chance to stabilize. The Chinese yuan has seen downward pressure ease as the interest rate gap between the U.S. and China narrows. The Japanese yen has also shown stabilization as USD/JPY has fallen to the 147 yen level.

In financial markets, investors' risk appetite is reviving while demand for safe-haven assets like gold is also increasing. International gold prices recently hit record highs and then eased slightly, showing a mixed picture. This is interpreted as Fed policy changes and dollar weakness stimulating demand for gold as a hedge against long-term inflation.

The Fed's 'ultra-slow QT (slow quantitative tightening)' policy and the trend of rate cuts will also have a major impact on South Korea's economy and financial markets. As the interest rate gap between Korea and the U.S. narrows and dollar funding flows improve, positive effects for the Korean economy are expected. In particular, the biggest benefit is reduced costs (currency hedging costs) when Korean companies and financial institutions borrow dollars. However, there are concerns that if the won strengthens too much, it could negatively affect exports.

[Global Money X-File examines important but little-known global money flows. If you want to comfortably receive necessary global economic news, please subscribe to the reporter page]

Reporter Kim Ju-wan kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)