KOSPI, did it run too far…short-selling standby funds have sharply increased

Summary

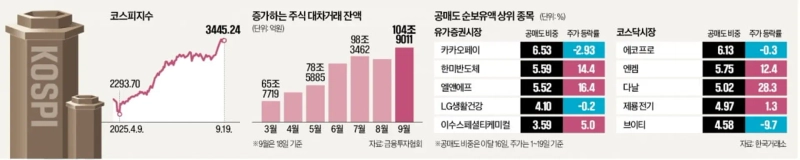

- This year the securities lending balance reached a record high of 104.9 trillion won.

- The net short-selling holdings have risen significantly, increasing the short-selling ratios among major KOSPI and KOSDAQ stocks.

- With the rise in short selling, some stocks may face short squeeze risk and increased price volatility.

Securities lending balance at highest this year

Securities lending balance 104.9 trillion won

Increased by 40 trillion won in about six months

High ranking in net short-selling holdings ratio

Hanmi Semiconductor·L&F stock prices surge

Short sellers, possibility of a short squeeze

Some say "Worth targeting excessively fallen stocks"

The securities lending balance, which represents funds standing by for short selling, has reached its highest level this year. As the KOSPI index broke through ceilings and exceeded the record 3,400 level, investors betting on price declines or seeking to reduce related risks increased. If the rally continues, this could act as a factor that increases stock price volatility.

◇ Sharp increase in 'short selling' as KOSPI hits record high

According to the Korea Financial Investment Association, the securities lending balance as of the previous day was totaled at 104.9011 trillion won. After hitting this year's high of 105.8281 trillion won on the 15th of this month, it has remained in the 100 trillion won range. Compared with 65.7719 trillion won at the end of March when short selling resumed, it grew by more than 40 trillion won in about six months. Securities lending is mainly used by foreign investors and institutional investors for short-selling when they expect stock prices to fall. As the lending balance soars, short-selling trading volume tends to increase correspondingly.

This month, as the KOSPI index repeatedly hit record highs on expectations of a US rate cut and a recovery in the semiconductor sector, the number of investors engaging in short selling has also been rising. Short selling is an investment method of borrowing stocks to sell them. It is frequently done when investors think prices have risen too much. As sellers increase, short selling typically exerts downward pressure on stock prices.

The net short-selling holdings balance in the KOSPI market is also at its highest level this year. As of the 16th, it stood at 11.7657 trillion won, steadily increasing since the end of March (3.9155 trillion won). The share of net short-selling holdings in the market capitalization of the KOSPI market rose from 0.19% to 0.42% over the same period, marking its highest level this year.

Net short-selling holdings in the KOSDAQ market surged 145% from the end of March to 4.3993 trillion won. Net short-selling holdings refer to the volume of shares that were borrowed and sold relative to the total listed shares and remain unpaid and held. A higher amount means more investors expect the relevant stocks to fall further.

◇ Possibility of a 'short squeeze'

Among KOSPI market stocks with high net short-selling holdings ratios are Kakao Pay (6.53%), Hanmi Semiconductor (5.59%), L&F (5.52%), and LG Household & Health Care (4.10%).

Recently, there have been many cases of stocks that experienced short-term rapid rises or prolonged weak trends. Kakao Pay soared from around 30,000 won on May 3 to 90,000 won within a month, attracting the attention of short-selling investors. L&F, a materials company for secondary batteries, rose 51.12% over the past three months. LG Household & Health Care's stock fell 17.63% over the past year. Hanmi Semiconductor's stock rose 14.4% so far this month.

Enchem and Danal, which rank high in net short-selling holdings ratio in the KOSDAQ market, also saw steep recent price increases.

If prices rise further, volatility may increase. If stocks with heavy short positions rise, short-selling investors may be forced to buy shares at expensive prices to "short cover" (buy shares to return borrowed ones). This can instead amplify price increases, causing a "short squeeze"—a phenomenon in which rising prices force short sellers to repurchase at higher prices, triggering a sharp rally.

A securities industry source said, "Short selling can dampen the overall upward trend of the index, but when a rally does not falter, it can also bring about unexpectedly strong rises."

Ryu Eun-hyuk, reporter ehryu@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)