Editor's PiCK

LayerZero to invest heavily across Asia… "'Eastpoint' to expand cooperation with South Korea" [Eastpoint 2025]

Summary

- LayerZero said it views the Asian region, especially the Korean market, as a testbed for global financial innovation and announced plans for full-scale investment and team expansion.

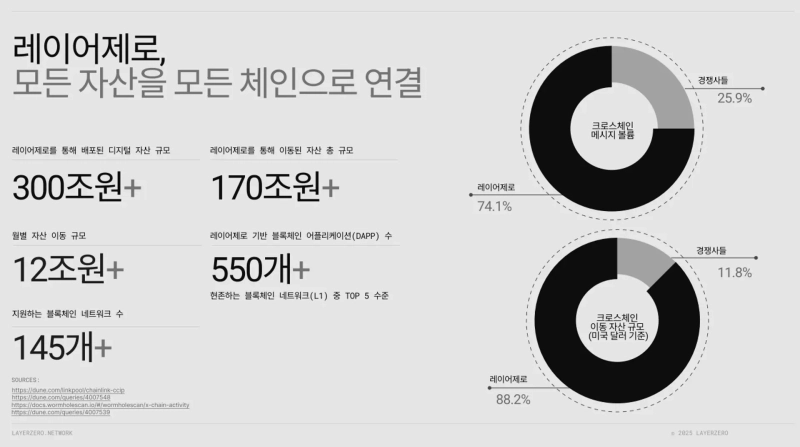

- LayerZero's cross-chain messaging protocol and its own token standard OFT support about 140 chains and around 500 assets, and it claimed a 70~80%% share of cross-chain transactions.

- It said it will focus on stablecoins and real-world assets (RWA) businesses and actively pursue collaborations with financial institutions and fintech firms in Korea.

Interview with Lim Jong-kyu, Head of LayerZero Asia-Pacific

Developing next-generation cross-chain token standard 'OFT'

Pushing forward stablecoin and RWA businesses

Full-scale investment in Asia… "Korean market is important"

Sponsor participant at 'Eastpoint'… Targeting Korean institutions

"LayerZero plans to invest broadly across Asia and expand our team. In particular, Korea's payment and fintech services are top-tier globally, and as discussions on stablecoin regulation are becoming substantive, it can serve as a testbed for global financial innovation."

Alex Jongkyu Lim, Head of LayerZero (ZRO) Asia-Pacific (APAC) (photo) told Bloomingbit in an interview on the 20th, "We want to contribute to Korea taking a central role in Asia's financial innovation."

LayerZero is a cross-chain messaging protocol that enables different blockchains to send and receive assets and data. Lim has recently served as the head of the Korean market and, from this month, has expanded his role to oversee the entire APAC region.

'Next-generation cross-chain infrastructure' beyond bridge limitations

LayerZero provides "cross-chain services" by installing smart-contract-style receivers on each blockchain to send and receive messages. To date it has connected about 140 chains and is transferring about 500 OFT (Omnichain Fungible Token) assets on top of them.

In particular, LayerZero designed the industry's first cross-chain decentralized verification network (DVN) to achieve a higher level of security. It fundamentally removes the existing token bridge or swap structures that have been criticized as vulnerable to hacking due to a "single point of failure."

It also allows asset issuers or application developers to configure the verification network themselves. Users can choose a desired combination from various providers such as Google, Animoca, BitGo, PayPal and set policies like "approved when 3 out of 5 validators sign," and external verification resources like Chainlink or Axelar can also be included in the DVN to strengthen security.

In particular, OFT is a token standard developed by LayerZero that serves as a core pillar of the message-based cross-chain architecture. Tokens issued under this standard can be transferred or used across chains as the same asset without being fragmented, improving user experience (UX) and reducing costs.

Lim emphasized, "OFT-based assets have grown to around 500, and we've expanded connections not only to EVM ecosystems but also to Move VM families such as Solana VM, TON VM, and Aptos," adding, "The number of blockchain networks and asset transfer volume supported by LayerZero exceeds the combined total of competitors."

Focusing on stablecoins and RWA using OFT

Global stablecoin markets and traditional financial institutions are collaborating with LayerZero. Lim said, "We have collaborated with PayPal, Ondo Finance, Franklin Templeton, BitGo, and are continuing collaborations with undisclosed global large banks and financial institutions, as well as the state of Wyoming." He added, "We are also working on collaborations where LayerZero handles the multi-chain expansion of major stablecoins like USDT0 and PYUSD0."

LayerZero's share and transaction volume in cross-chain services are also surging. Lim said, "Looking only at cross-chain messaging volume share, LayerZero accounts for around 70~80%," and "According to internal analytics, about 90% of all dollar-denominated value transfers on-chain, i.e., exchanges, are processed through the LayerZero messaging protocol." He added, "Currently about 430 applications run on LayerZero, and monthly asset movement reaches US$10 billion (about 14–15 trillion won)."

LayerZero plans to concentrate on stablecoins and real-world assets (RWA) using OFT. Lim said, "On-chain foreign exchange and currency conversion will become mainstream," explaining, "For example, if a Japanese subsidiary pays in a yen stablecoin, a Philippine subsidiary could receive an OFT-based Philippine stablecoin in seconds with fees of only a few dozen won for B2B payments."

Meanwhile, LayerZero recently launched a new OFT-based service called 'OVault.' This service is characterized by not being tied to a specific chain and allowing free choice of deposit/withdrawal assets. Users only need to hold USDT0 on any network to deposit or withdraw assets to their desired chain, greatly improving staking and asset management convenience.

Full-scale investment in Asia… "We will announce various collaborations"

LayerZero has unveiled a blueprint to expand investments across the Asia-Pacific region and make Korea a key hub. Lim said, "We plan to invest heavily and expand teams across Asia, including Hong Kong and Japan," adding, "We will establish dedicated marketing, business, and development personnel to pursue full localization."

He also said, "The Korean market is particularly important to LayerZero," and "we plan to actively pursue collaborations with stablecoin issuers and traditional financial institutions." He hinted, "Such collaborations are underway across Asia, and various new partnership announcements will be made in the future."

Lim said, "It may take time for a won-denominated stablecoin to become commercialized," but "now is the right time for financial institutions, fintechs, startups, and crypto firms to collaborate." He emphasized, "If Korea's fintech and finance integrate with stablecoins, it can become a central pillar of Asia strategy, and LayerZero wants to provide the technical infrastructure to connect and support all of that."

Seeking collaboration with Korean financial sector at Eastpoint

LayerZero will participate as a sponsor in the global Web3 private conference 'Eastpoint Seoul 2025' to be held on the 22nd, actively seeking collaboration with Korean companies and institutional investors.

Lim said, "At this Eastpoint event, we will hold a panel discussion with executives from Ondo, PayPal, and the Wyoming Stable Token Committee, who are also major LayerZero clients," adding, "We hope to share the experience LayerZero has accumulated in creating a global stablecoin playbook and uncover collaborative cases."

He said, "As part of the event, strategic meetings are scheduled with Korea's major banks, financial firms, and payment companies," and "we aim to find application points suited to Korea's market realities and vision based on global cases, share technical insights, and discover collaboration opportunities."

He added, "Co-host Hashed has not only invested but has also carried out meaningful activities in policy and regional dimensions, and we also resonate with that direction," adding, "This Eastpoint participation will be an opportunity for LayerZero to publicly showcase its cross-chain achievements and the clients and investors it has secured."

Kang Min-seung, Bloomingbit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)