Fear and Greed Index falls to 48… virtual asset market maintains 'neutral' stance

Minseung Kang

Summary

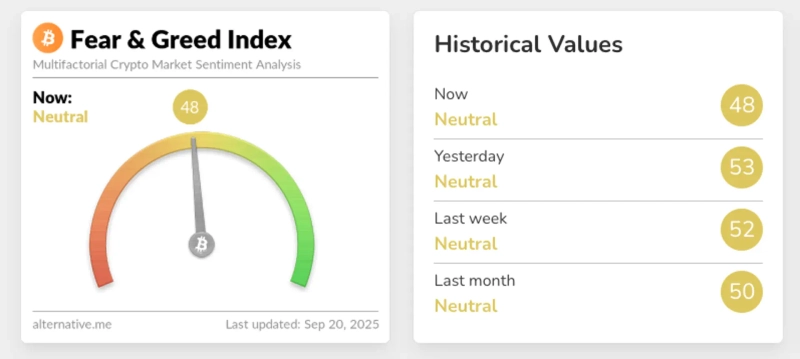

- The Fear and Greed Index fell to 48, showing that the virtual asset market is in a neutral stance.

- The index slightly fell from 53 the previous day, and the recent one-week average remained at 52.

- The index is calculated reflecting various factors such as price volatility, trading volume, and social media mentions.

The Fear and Greed Index, which gauges investor sentiment for virtual assets (cryptocurrencies), fell compared to the previous day, and the market continues in a neutral phase.

On the 20th, the Fear and Greed Index compiled by virtual asset analytics firm Alternative recorded 48. It slightly fell from 53 the previous day, and the recent one-week average was 52.

The index is calculated on a scale of 0 to 100; lower values indicate weakened investor sentiment, while higher values indicate overheating. Detailed components include price volatility (25%), trading volume (25%), social media mentions (15%), market surveys (15%), Bitcoin dominance (10%), and Google Trends searches (10%).

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)