South Korea's foreign exchange market depth ranks among the world's 'lowest'... Bank of Korea "Intervention needed"

Summary

- South Korea's foreign exchange market depth was analyzed as 16th out of 17 countries, placing it among the lowest.

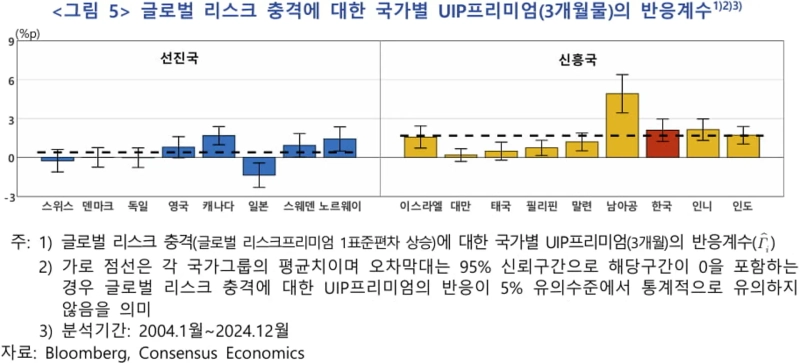

- It stated that under global shocks the exchange rate and interest rate spread show large fluctuations, and the UIP premium also showed one of the largest increases.

- The Bank of Korea said that a combination of foreign exchange market intervention and macroprudential policies is needed to minimize negative shocks.

An analysis found that the depth of South Korea's financial and foreign exchange markets is among the world's lowest. It was identified as one of the countries where the exchange rate and interest rate spread rise the most when a global shock occurs. Considering this, the Bank of Korea emphasized the need for a policy mix including foreign exchange market intervention and strengthening macroprudential measures.

The BOK said on the 22nd in a BOK Issue Note titled "Analysis of policy responses considering financial and foreign exchange market depth" that this was the case. According to the report written by Bank of Korea officials Kim Ji-hyun and Kim Min, South Korea's financial and foreign exchange market depth ranked 16th among 17 major countries that have adopted a floating exchange rate (Switzerland, Denmark, Germany, the United Kingdom, Canada, Japan, Sweden, Norway, Israel, Taiwan, Thailand, the Philippines, Malaysia, South Africa, Indonesia, India, South Korea).

Kim measured market depth based on the volatility of the uncovered interest parity (UIP) premium when a global risk shock occurs. The UIP premium refers to the additional cost domestic economic agents must pay to global investors when borrowing funds from abroad.

In South Korea's case, it was analyzed that the UIP premium rises by 2.11 percentage points when a global shock occurs. This means it is a country that faces higher funding costs in a crisis. Except for South Africa, where the UIP premium rise is around 5 percentage points, South Korea's rise was the largest. Indonesia was found to be at a similar level to South Korea.

Switzerland, Denmark, Germany, and Taiwan were countries where the UIP premium did not change, while Japan was classified as a safe asset whose UIP premium actually falls in the event of a global shock.

The impact of global shocks on the exchange rate and interest rate spreads differed according to market depth. The exchange rate increase in countries evaluated as having shallow markets, such as South Korea, was 1.05 percentage points larger than in countries judged to be "deep." It was 0.39 percentage points higher than the middle group. Interest rate spreads fell by 0.0718 percentage points in "deep" countries, whereas in "shallow" countries such as South Korea they widened by 0.0714 percentage points.

The shallower the market depth, the more a global shock leads to a larger depreciation of the currency and a wider spread in the domestic short-term financial market, amplifying the negative spillovers of the shock. Evaluating the impact of a global shock on the Korean economy with the International Monetary Fund (IMF)'s integrated policy model, consumption contracted, increasing the decline in gross domestic product (GDP), and exchange rate increases were passed through to prices, expanding inflation. However, it was analyzed that if the exchange rate is somewhat stabilized through foreign exchange market intervention and macroprudential policies, about 18.3 percentage points of these negative effects can be recovered.

Kim said, "To minimize negative shocks, it is necessary to improve the depth of financial and foreign exchange markets," and added, "Ongoing measures to improve the structure of the foreign exchange market and inclusion in the World Government Bond Index (WGBI) will help expand market depth." He added, "Since a shallow market depth can amplify the negative effects of global shocks, a policy mix including macroprudential policies and foreign exchange market intervention, along with monetary policy, is necessary."

Reporter Kang Jin-kyu josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)