Foreigners are scooping up Korean stocks... won–dollar exchange rate nears 1,400 won, why?

Summary

- This month foreign investors have aggressively net-bought Korean stocks worth KRW 7.2 trillion, but the won–dollar exchange rate has not easily fallen from the high-1,300 won range.

- It explained that domestic investors' US stock investment and Treasury purchases have increased dollar demand, offsetting foreign investors' demand for won.

- It stated that the interest rate gap with the United States and concerns about foreign exchange outflows such as the US$350 billion investment negotiation are factors preventing further appreciation of the won.

When foreigners sell dollars to buy Korean stocks

Generally, the exchange rate goes down

'Concerns over foreign exchange outflows' from US-bound investment funds

As 'Seohak gaemi' increase, dollar demand surges

This month foreign investors have aggressively bought Korean stocks, but the won–dollar exchange rate has not easily fallen from the high-1,300 won range. This is interpreted as reflecting market concerns that large foreign exchange outflows could occur due to a sharp increase in overseas investment by retail and institutional investors and tariff negotiations.

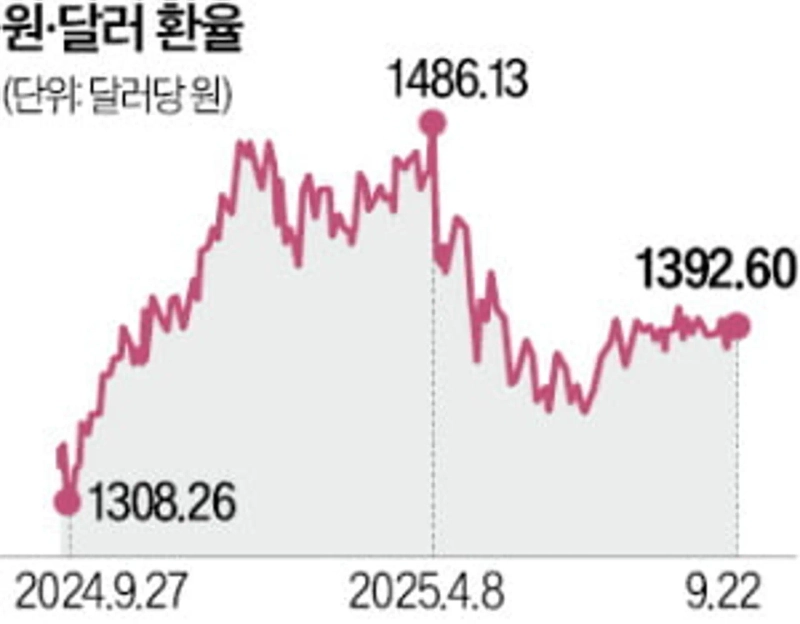

On the 22nd in the Seoul foreign exchange market, the won–dollar exchange rate (as of 3:30 p.m.) closed the weekly session at 1,392.60 won, down 1 won (won appreciated) from the previous trading day. The exchange rate, which at one point that morning rose to 1,399 won and attempted to breach 1,400 won, turned downward after Asian foreign exchange markets such as Hong Kong opened around 10 a.m. The won–dollar exchange rate fell to the 1,350 won range in June but broke through the 1,390 won range in July and has been fluctuating in the high-1,300 won range. This foreign exchange market behavior is seen as unusual given the recent parade of foreign investors accumulating domestic stocks. In the past, when foreigners sold dollars to buy domestic stocks and purchased won, the exchange rate tended to fall.

The KOSPI closed at 3,468.65 that day, up 23.41 from the previous day, marking another record high following the record set the previous trading day. This month foreign investors' net purchases on the KOSPI market totaled about 7.2 trillion won. Since the KOSPI began to rise in earnest in June, the cumulative net purchases by foreign investors up to that day amount to 16.1 trillion won.

Experts analyze that the reason the foreign exchange and stock markets are showing different patterns from the past is that overseas investment has structurally increased. Domestic investors buying dollars to invest in the United States offset the won conversion demand of foreign investors. Amin Kwon, an analyst at NH Investment & Securities, explained, "Domestic investors who were net sellers in May–June for US stocks switched to net buyers after August, and as expectations of US rate cuts grew, demand for US Treasury purchases also expanded."

In addition to increased overseas investment, the interest rate differential with the United States and tariff negotiations are cited as factors preventing the won from appreciating. The Korea–US interest rate gap narrowed to 1.75 percentage points after the US central bank (Fed) lowered rates by 0.25 percentage points on the 17th, but many view it as still a large gap. Recently, worries have been added that foreign exchange outflows of around US$35 million could occur depending on tariff negotiations with the United States. Jaehyun Wi, an economist at NH Futures, said, "Even the concern alone has been confirmed by an unusual phenomenon of foreigners buying dollars." A foreign exchange authority official also said, "Concerns about the US$350 billion investment negotiation are to some extent already reflected in the current exchange rate."

Jinkyu Kang / Kwangsik Lee reporters josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)