Trump family coin company "will collaborate with South Korean game, payment and platform firms"

Summary

- WLFI's stablecoin USD1 is said to be pursuing collaborations with South Korean game, payment, and platform companies.

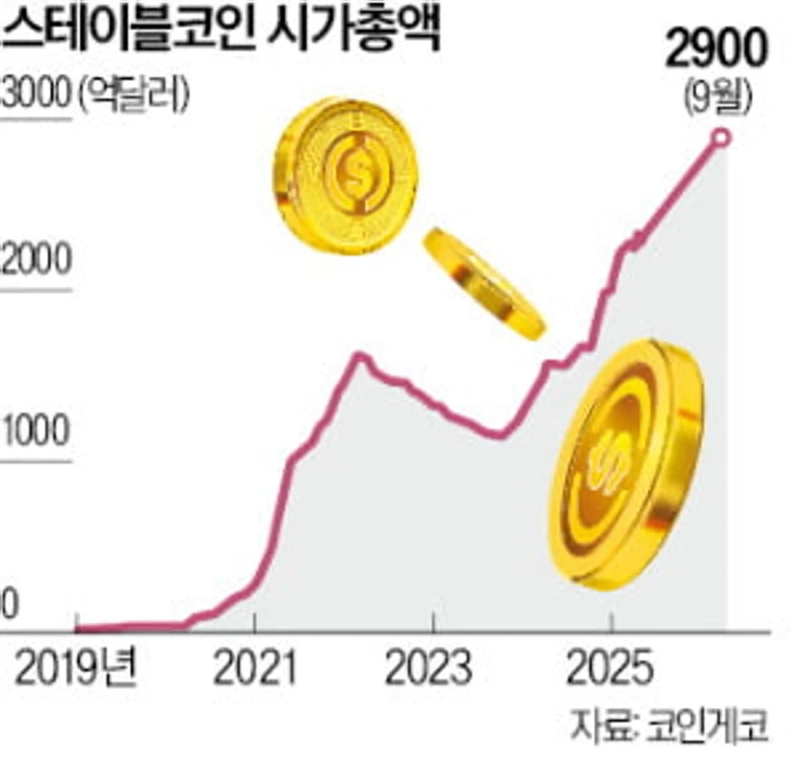

- USD1 recorded US$3 billion market capitalization within six months of its launch and is growing rapidly.

- Differences in regulations by country and the smooth conversion structure of stablecoins were cited as challenges to market expansion.

WLFI targeting South Korea

USD1, market cap US$3 billion in six months

"South Korea, with its developed digital culture and gaming industry

is the optimal place for stablecoin experiments

Building models such as game reward payments"

Different regulations by country are a challenge

Large regulatory differences among South Korea, Japan, Hong Kong, etc.

Limits to grouping the Asia‑Pacific region as one

Mutual cooperation among national authorities is needed

"South Korea is the optimal place for stablecoin payment experiments due to its developed digital culture and gaming industry."

Jack Forkman, co-founder and chief operating officer (COO) of World Liberty Financial (WLFI), said at 'Eastpoint Seoul 2025' held on the 22nd at the Grand Hyatt Seoul in Hannam-dong, Seoul, "We are pursuing various collaborations with major domestic cryptocurrency exchanges as well as game companies, payment firms, and platforms."

Eastpoint Seoul 2025 is a global conference discussing digital assets and changes in the global financial system, hosted jointly for the first time this year by Hankyung Media Group, global blockchain investor Hashed, and WLFI, the virtual asset finance firm founded by the family of U.S. President Donald Trump. COO Forkman is a co-founder of WLFI and a figure closely connected to the Trump family. In his keynote speech, Forkman said, "I have met several partner companies and regulatory authorities since coming to South Korea," and "I felt that South Korea is very forward-looking regarding stablecoins."

◇ Trump-branded USD1 targeting South Korea

Forkman emphasized that WLFI's stablecoin USD1, launched last March, can create various partnership opportunities with South Korean companies. USD1 recorded a market capitalization of US$3 billion (about 4 trillion won) within six months of its launch. Although smaller in scale compared with existing stablecoins such as Tether (USDT) and USD Coin (USDC), it has been growing rapidly amid expectations of policy support from the Trump administration. Forkman said, "USD1 is a digital dollar that institutions and individuals can use with confidence based on regulatory compliance and transparency," and "By expanding merchant payment integration, USD1 will be naturally used from everyday payments like buying a cup of coffee to global commerce."

He also indicated intentions to actively target the South Korean market. He said, "South Korea is a market with high retail investor participation," and "We will introduce models in Korea such as game reward payments, creator payments, and integrated online-offline commerce models."

Participants at the event agreed that use cases for stablecoins are expanding globally and that the market size will grow rapidly. Alan Du, partner at PayPal Ventures, said, "Stablecoins have recently been applied not only to U.S. Treasury management but also to new areas such as payments between AI agents and streaming payments." Sergio Mello, head of the stablecoin division at Anchorage Digital, said, "In the past stablecoins were used mainly for retail payments in emerging markets, but now they are also used for institutional investor lending, crypto custody, etc.," and predicted, "At least US$10 trillion will flow into the stablecoin market within five years."

◇ Complex conversion structures also a challenge

The fact that regulations differ by country was cited as an issue to be solved. Caroline Pham, acting chair of the U.S. Commodity Futures Trading Commission (CFTC), said, "Governments must mutually recognize so that businesses licensed under one country's regulations can operate in other countries without separate procedures." Rahul Advani, co-head of global policy at Ripple, the world's third-largest cryptocurrency, emphasized, "The speed of legislation and the content of regulations differ widely in South Korea, Japan, Singapore, Hong Kong, etc., making it difficult to group the Asia‑Pacific region as one," and "Mutual cooperation among national regulators is necessary."

How smoothly stablecoins can be converted into actual fiat currency was also mentioned as a point to be resolved. Ashok Venkateswaran, vice president at Mastercard, pointed out, "Asia has stablecoins linked to local currencies in various countries, so the conversion structure is complex," and "How to buy stablecoins and convert them back into fiat currency remains a tough problem."

Reporters Jinseong Kim/Mihyeon Cho jskim1028@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)