Summary

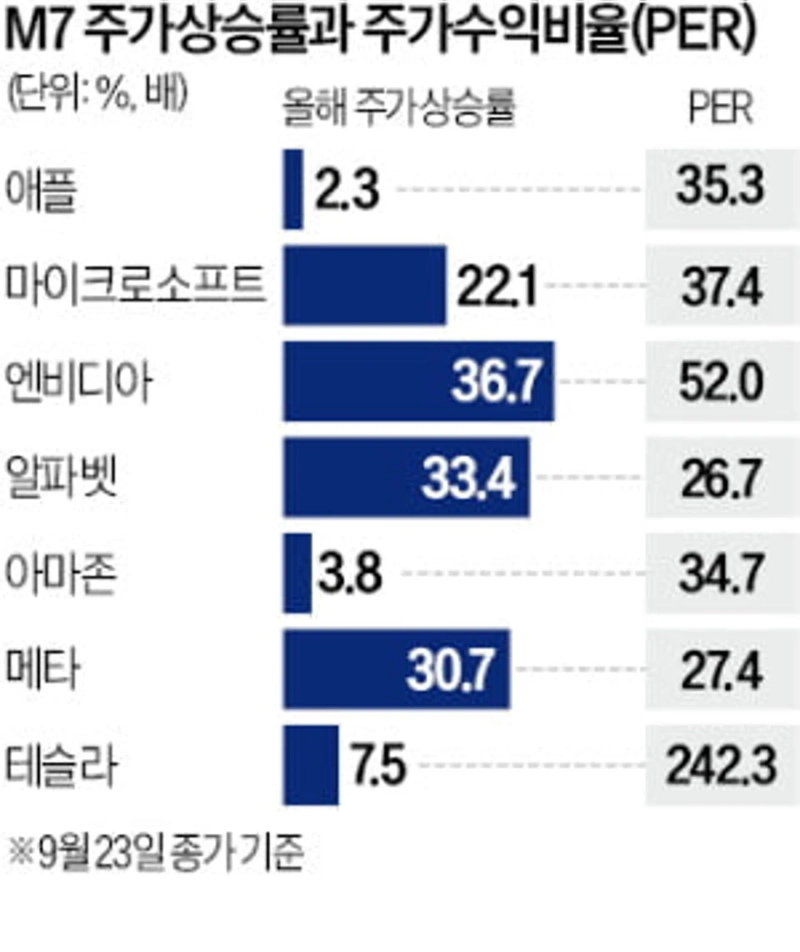

- M7's average price-to-earnings ratio (PER) is about 30x, close to twice the S&P500's 10-year average (18x).

- BoA's analysis team said M7 rose 223%% since the March 2023 low, approaching past stock market bubble peaks (average 244%%).

- Some argue that artificial intelligence (AI) is driving corporate earnings improvements, thus there are counterarguments that it is not a bubble.

M7, average price-to-earnings ratio 30x

Close to twice the S&P500 10-year average

Some argue "AI is improving earnings"

As the U.S. New York stock market repeatedly hits record highs, concerns about a bubble in the large tech stocks leading the rally—the "Magnificent Seven (M7)"—are resurfacing. This is based on analysis that, when comparing historical broad bull markets and collapse cases, M7's price level relative to earnings has approached those levels.

On the 22nd (local time), CNBC reported that an analysis team led by Michael Hartnett, a strategist at Bank of America (BoA), said, "Observing stock market bubble cases such as the 2000s dot-com bubble and the 2007 China A-share crash, the average rise from trough to peak was 244%," and "M7 has risen 223% since the March 2023 low, coming quite close to that."

M7 refers to NVIDIA, Microsoft, Apple, Alphabet, Amazon, Meta, and Tesla. This month, as the U.S. central bank (Fed) resumed interest rate cuts, M7 stock prices caught fire. Apple closed up 4.38% at $256.26 that day, approaching last December's record high ($260.10).

NVIDIA also surged 3.93% on news of entering a strategic partnership with OpenAI and making large-scale investments. Tesla's stock has risen 35.64% over the past month.

Overheating indicators are found in many places. M7's average price-to-earnings ratio (PER) is about 30x, close to twice the S&P500's 10-year average (18x). Their share of total market capitalization also exceeded 30%. Emily Roland, chief strategist at John Hancock Investments, noted, "This rally can be seen as a kind of honeymoon rally relying on rate cuts amid a weakening labor market," adding, "the market is selectively listening only to good news."

There are also strong counterarguments that the M7 rally is not a bubble. Jeff Crumpelman, chief strategist at Mariner Wealth Advisors, emphasized, "Artificial intelligence (AI) is boosting productivity and driving corporate earnings improvements," adding, "we are merely on the threshold of the AI era." A manager at a hedge fund asset management firm said, "The M7 bubble narrative has been repeated for years, but earnings improvements based on the AI ecosystem have muted it."

Mansu Choi, reporter bebop@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)