Summary

- It reported that international gold prices recently hit record highs, sharpening investors' preference for safe assets.

- At the same time, it said that prices of major cryptocurrencies such as Bitcoin and Ethereum plunged, and related stocks also fell sharply.

- Experts forecast that gold's strength will continue due to expectations of the Federal Reserve's rate cuts and geopolitical risks.

Gold prices set record highs day after day…cryptocurrencies plunge

Tariff risk from Trump continues

As expectations for additional U.S. rate cuts grow

Gold futures price hits $3775.1

Citi "Will reach $3,800 in three months"

Bitcoin down 2%·Ethereum down 6%

Cryptocurrency stocks such as Bitmain also 'plummet'

Safe-asset bull market likely to continue

As international gold prices hit record highs day after day, some observers say global funds are moving en masse from cryptocurrencies to gold. Against the backdrop of investors' clear preference for safe assets amid the Trump administration's uncertain tariff policy, expectations that the U.S. central bank (Fed) will cut interest rates further by year-end are pushing up gold prices.

◇ Gold soars more than 40% this year

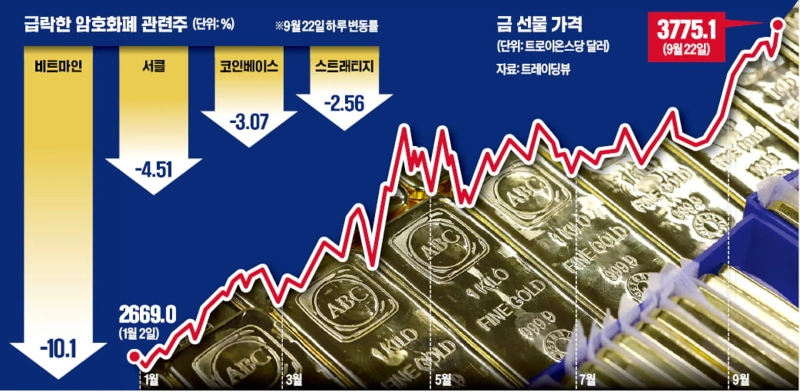

On the 22nd (local time) at the New York Mercantile Exchange, December-delivery gold futures rose 1.98% to close at $3,775.1 per troy ounce, marking another record high. Gold futures, which started the year at $2,669 on January 2, have climbed 41.4% to date. This rise exceeds the increases seen during the COVID-19 crisis and around the 2008 financial crisis. Spot gold also closed at $3,757.18 that day, also a record high.

Cryptocurrencies showed the opposite trend to gold. According to crypto market aggregator CoinMarketCap, as of 6 a.m. KST on the 23rd, Bitcoin traded at $112,847.55, down 2.23% from 24 hours earlier. At the same time, Ethereum fell 6.6% and Ripple dropped 4.51%.

Investors appear to have withdrawn funds, expecting the cryptocurrency market to remain weak for the time being. According to Business Insider, about $1.5 billion of long positions were liquidated that day, the largest since the end of March. Crypto outlet CoinDesk said, "The Bitcoin price decline and gold price rise occurred together," and diagnosed that "profits from Bitcoin sales may have moved into gold." Cryptocurrency-related stocks such as Bitmain (-10.1%), Circle (-4.51%), and Coinbase (-3.07%) also plunged sharply that day.

◇ U.S. rate cuts…Gold's strength continues

Since the Trump administration took office, investors have flocked to gold, a safe asset this year, as uncertain tariff policies have continued. The Wall Street Journal (WSJ) said, "The reason gold has reached record highs is not the financial crisis but the White House," and added, "From large investors to small ones, everyone has rushed to protect themselves from uncertainty in the U.S. economy and the United States' uncertain role on the international stage."

Last week, the Fed's decision to cut the policy rate made the upward curve of gold prices steeper. Fed officials, in the economic projections released last week, expected the Fed to cut rates two more times this year. According to the CME's FedWatch tool, the interest rate futures market reflects a 75% probability that the Fed will lower the policy rate by 0.5 percentage points at the December Federal Open Market Committee (FOMC) meeting.

On the day, Steven Myron, known as President Trump's 'economic strategist' and a Fed governor, said in a speech to the New York Economic Club that it is necessary to cut the policy rate aggressively. He said, "Changes in tax and immigration policy, rent relief, deregulation, and increased tax revenues from tariffs are creating a new economic environment that could lower the Fed's policy rate by about 2 percentage points from its current level."

Experts forecast that the rally in gold prices will continue for months. Citigroup set a three-month gold price target of $3,800. Jim Wyckoff, senior analyst at metal information firm Kitco Metals, told Reuters, "Demand continues to flow into safe assets amid unresolved geopolitical tensions such as the Russia-Ukraine war," and added, "Expectations of Fed rate cuts and further cuts are also factors supporting the price."

Silver also rose along with gold. Spot silver closed at $43.99 per troy ounce, up 2.1% that day, marking the highest level in 14 years. Han Tan, senior market analyst at Nemo.money, analyzed, "The gold-silver ratio, the ratio of gold price to silver, is 86, still above the five-year average of 82, indicating room for further upside." This means that because silver is relatively cheap compared to gold, silver prices could rise further.

Han Kyungje reporter hankyung@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)