Party and government retreat from 'splitting financial authorities' amid Political Affairs Committee halt and concerns over a financial vacuum

Summary

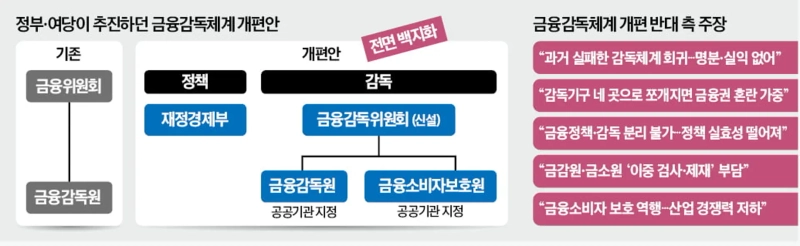

- The government and ruling party announced that they have withdrawn their plan to reorganize financial policy and supervisory bodies and decided to maintain the current system.

- The financial sector reacted with relief, saying that the scrapping of the supervisory system reform is expected to quickly resolve confusion.

- It was pointed out that the party and government's unilateral push for organizational reorganization created uncertainty in the investment environment.

Party, government and Presidential Office decide to maintain the current system

The Democratic Party of Korea, the government, and the Presidential Office withdrew the financial policy and supervision organizational reform they had initially pursued on the 25th.

Han Jeong-ae, chair of the Democratic Party Policy Committee, held a briefing at the National Assembly after an emergency high-level meeting of party, government and Presidential Office and said, "The party, government and Presidential Office have decided not to include the separation of the Financial Services Commission's policy and supervisory functions and the establishment of a Financial Consumer Agency in this government organization reorganization, which we had intended to process as a fast-track item." The Democratic Party planned to pass a revision to the Government Organization Act including the separation of the Ministry of Economy and Finance and the reorganization of the Financial Services Commission at that day's plenary session, and at the same time designate related bills such as the bill to establish a Financial Supervisory Commission as fast-track. Since bills such as the Financial Supervisory Commission establishment bill were to be handled by the Political Affairs Committee, which is chaired by the People Power Party, and thus could not realistically be processed through the committee, the plan was to send them to the fast-track under the ruling party's leadership and handle them months later.

However, as the People Power Party warned of a filibuster on the Government Organization Act and strong opposition from stakeholders continued, analyses emerged that the decision turned toward maintaining the current system.

'Reversal of financial supervisory system reform' withdrawn at emergency high-level party-government-Presidential Office meeting

After four months of discussion, "back to square one"…Financial sector criticizes that "only confusion remains"

"We spent four months using all our energy on discussions to reform the financial supervisory system. The ruling party pushed this forward unilaterally without a single round of consultation, and now if they cancel it, who will take responsibility for the confusion until now?"

As the government and ruling party decided on the 25th to re-examine from square one the reform plan centered on "dissolving the Financial Services Commission and separating the Financial Supervisory Service," financial-related government organizations will maintain the current system. The designation of the Financial Supervisory Service as a public institution, which provoked strong opposition from FSS employees, also became "as if it never happened." The financial sector, which feared the supervisory system reform, evaluated that the scrapping "prevented deterioration." Some pointed out that the government and ruling party abruptly reversed the supervisory system reform they had pushed unilaterally, leaving only confusion and wounds in the financial sector.

'Back to square one' after four months of discussion

Discussions on reforming the financial supervisory system began with a single remark by President Lee Jae-myung. During campaign events in May, the president said, "The Financial Services Commission mixes supervisory and policy functions, so it needs to be separated and organized." The State Affairs Planning Committee, launched in June, immediately began work on reforming the supervisory system. The committee drafted a reform proposal, and on the 15th of this month a bill to partially amend the Act on the Establishment of the Financial Services Commission and others was submitted in the names of all ruling party lawmakers.

The core of the reform was to transfer the Financial Services Commission's domestic financial policy functions to the Ministry of Economy and Finance and to create a Financial Supervisory Commission dedicated solely to supervising financial companies. It also included separating the FSS's Consumer Protection Office and establishing a separate Financial Consumer Agency.

The tide began to turn when the People Power Party applied the brakes. Yoon Han-hong, a People Power Party lawmaker and chair of the Political Affairs Committee, said, "The Democratic Party of Korea did not seek prior cooperation even once," and refused to table the Financial Services Commission establishment bill. The Democratic Party intended to designate the bill as a fast-track item. If processed as a fast-track, it could only pass the Political Affairs Committee after 180 days, i.e., after April next year.

On the day of the National Assembly plenary session on the 25th, the situation changed rapidly. Han Jeong-ae told reporters that "we have decided not to include the separation of the Financial Services Commission's policy and supervisory functions and the establishment of a Financial Consumer Agency in this government organization reorganization." It is reported that the Democratic Party found it burdensome to push through an organizational reorganization facing strong opposition from stakeholders ahead of next June's local elections. A ruling party official said, "Local elections are a very important test early in an administration, and continuing to carry the organizational reorganization issue forward would not help the election."

Within the ruling party, some view this as the aftershock of the collapse of the bipartisan agreement on the special prosecutor law amendment and the Government Organization Act revision on the 11th. A Democratic Party lawmaker said, "The party is paying a high price for reversing an agreement after being swept up by hardline party members."

"The financial sector's confusion must be resolved quickly"

The financial sector has repeatedly argued that the supervisory system reform would weaken the competitiveness of the financial industry. There were also concerns that splitting financial supervisory organizations into multiple bodies would significantly weaken crisis response capabilities.

For this reason, the scrapping of the supervisory system reform brought sighs of relief in the financial sector. Lee Byung-rae, president of the Non-Life Insurance Association, said, "I hope the market confusion related to the organizational reform will be resolved quickly and efforts for productive finance will gain momentum."

The government and ruling party will likely not be able to avoid responsibility for the confusion that emerged during the supervisory system reform process. A financial authority official criticized, "There are many financial tasks that must be advanced early in the new administration, but too much energy was wasted on discussions of organizational reform," and added, "The conflicts over organizational reform between senior officials and working-level staff have left irreparable scars."

The ember of supervisory system reform remains. If the Democratic Party secures the chairmanship of the Political Affairs Committee in the second half organization of the 22nd National Assembly next year, there is talk that re-pursuing organizational reform may be possible.

Choi Hyung-chang / Seo Hyung-kyo reporters calling@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)