[Exclusive] Lee Hae-jin's big picture… heralds 'Next Naver' led by Song Chi-hyung

Summary

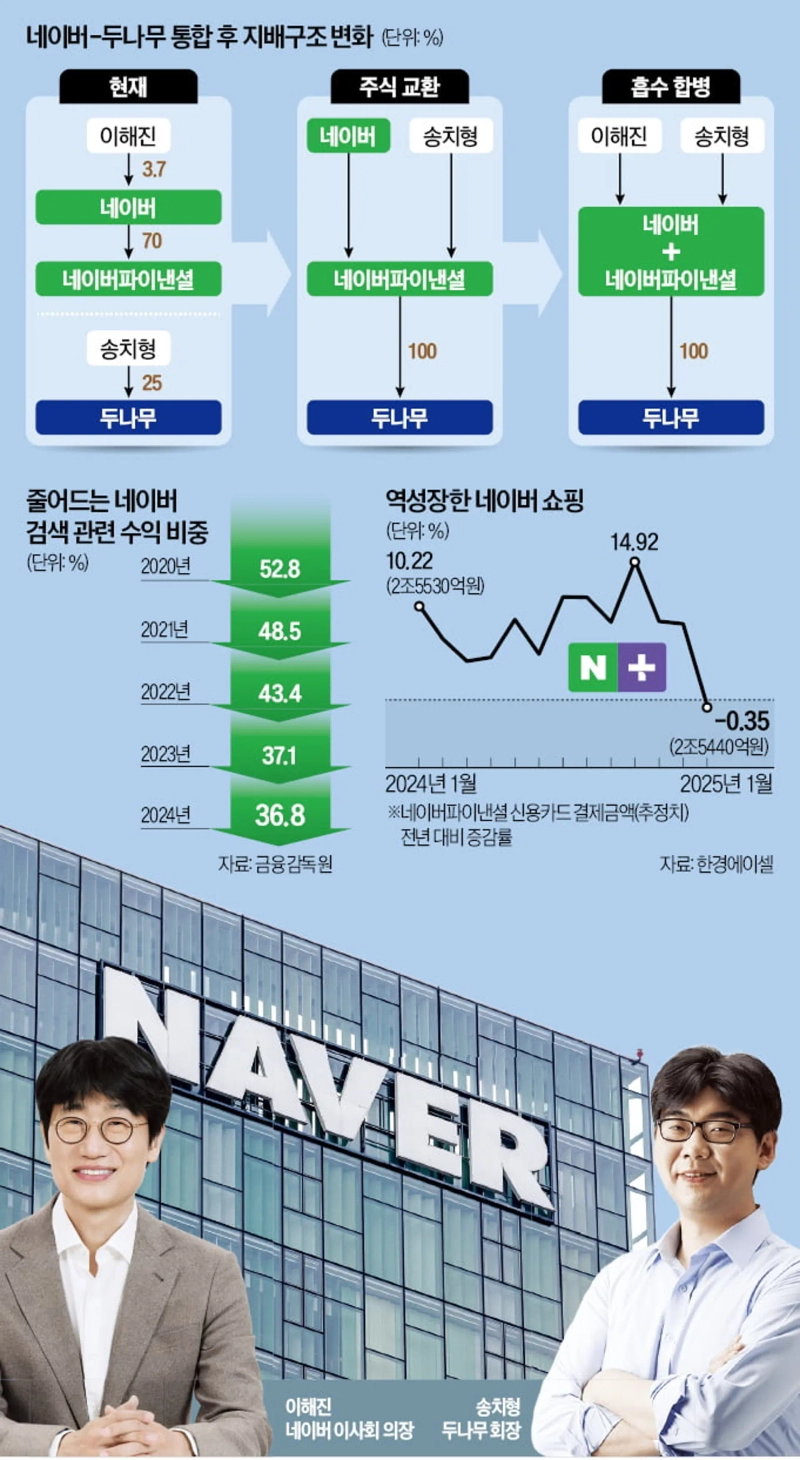

- Naver is planning to transform its governance and future business structure by pursuing a share swap with Dunamu and a merger with Naver Financial.

- It plans to adopt stablecoins as a new growth engine, recruit Dunamu chairman Song Chi-hyung as the next-generation leader, and pursue digital financial innovation.

- There is a possibility that Naver could evolve into a genuine financial player by linking stablecoins issued via Upbit infrastructure with points, enabling the company to utilize them across services.

Naver's governance structure changing dramatically

Dunamu's Song Chi-hyung as largest shareholder

After completing share swap with Dunamu

Financial arm to pursue merger with Naver

The 'big deal' between Naver Financial and Dunamu is seen as a step to simultaneously transform Naver's core business and governance structure. As search and shopping, which had been Naver's main businesses for 26 years since its founding, have been shaken by the AI boom, the plan is to adopt stablecoins as a future growth engine and to position Dunamu chairman Song Chi-hyung as Naver's next-generation leader. Ultimately, Song is expected to become Naver's new major shareholder.

According to investment banking (IB) industry sources on the 26th, Naver plans to complete a share swap between its subsidiary Naver Financial and Dunamu, and then pursue a merger of Naver Financial with Naver. It is reported that Dunamu major shareholders, including Chairman Song, have agreed to this plan.

This transaction is Chairman Lee's 'final gambit' to bring Dunamu executives such as Chairman Song into Naver to build a new leadership. Sources close to Chairman Song expect that, through the share swap, he will become the controlling shareholder of Naver Financial and ultimately secure Naver shares that far exceed Chairman Lee's stake (3.73%) through a merger with Naver or an additional share swap.

Chairman Lee's willingness to give up major shareholder status and recruit new leadership reflects a sense of crisis surrounding Naver. Naver's dominant position in search and e-commerce has been shaken. It is interpreted that the ambition is for new leadership, led by Chairman Song, to make financial innovation starting with stablecoins Naver's future growth engine.

Naver's experiment is likely to offer implications to the business community. Chairman Lee introduced a professional management system to build a governance structure similar to global companies. If the leadership change is completed, it is evaluated that a new 'succession paradigm' will be presented.

Naver to transform governance and future business at once

Rewriting the playbook through phased integration… virtual assets as Naver's 'future'

Naver Board Chairman Lee Hae-jin repeatedly proposed mergers with Naver to Dunamu chairman Song Chi-hyung and Krafton chairman Jang Byung-kyu, whom he has been close to for years. The first idea was to quickly fill Naver's lack of crypto and gaming businesses through large M&A, but underneath that was concern about Naver's future leadership. Chairman Lee was convinced that founders who built their groups from scratch joining the Naver ecosystem and interacting to inject momentum is the direction Naver should take.

◇ Song Chi-hyung accepted 'Lee Hae-jin's proposal'

The 'big deal' between Naver and Dunamu gained momentum when Chairman Song accepted Chairman Lee's proposal. As the two leaders, who are former seniors and juniors in Seoul National University's Department of Computer Science (formerly Department of Electronic Computing), formed a consensus, both sides immediately formed a task force (TF) and began procedures. The initial plan was a direct equity swap between Naver headquarters and Dunamu. However, this was scrapped considering that Dunamu became subject to regulatory scrutiny earlier this year due to sanctions by the Financial Intelligence Unit (FIU) and the potential unrest among Naver's listed shareholders.

The alternative proposed was a phased integration using the subsidiary Naver Financial. The two sides are coordinating detailed terms on the premise of a merger between Naver and Naver Financial after the share swap with Dunamu. The proposal suggests that Chairman Song would first oversee Naver Financial's management to solidify his position within the group, and then secure a large amount of Naver shares through a merger between Naver and Naver Financial or an additional share swap.

Industry watchers say Naver's unique governance structure led to such flexible decisions. Chairman Lee oversees Naver's overall management, but his stake is only 3.7%. He is the third-largest shareholder after the National Pension Service (8.98%) and BlackRock (6.05%), and the market capitalization based on the closing price that day stood at about 1.5 trillion won. His stake was as high as 12% in the early days of the company's founding but fell to the current level through external investment and business expansion. Instead, Naver has built its ecosystem by exchanging stakes with firms like Mirae Asset (fintech), CJ (logistics), and HYBE (content). The deal with Dunamu is the final stage of the mutual alliance experiment evolving into leadership succession.

◇ Pivot to digital finance as search wobbles

Chairman Lee's acceleration of leadership infusion also reflects a sense of urgency not to miss the timing for Naver's business transformation amid an existential crisis. Naver dominated the domestic search engine market for 26 years since its founding, but its lead has been shaken by the rise of big tech fueled by the recent AI boom. Global competitor Google announced plans to invest USD 75 billion (about 100 trillion won) to expand AI infrastructure, and in China, cost-effective generative AI 'DeepSeek' has emerged, destabilizing the ecosystem.

The e-commerce sector, which grew on the back of a vast user base, is also not what it used to be. Competition with Coupang, along with pressure from China-origin C-commerce platforms like AliExpress and Temu, has led to assessments that the industry's growth potential is limited.

Amid this crisis, Naver has chosen stablecoins linked with Dunamu as a new growth avenue. If Dunamu's Upbit, which accounts for about 80% of domestic trading volume, issues a won-denominated stablecoin and links it with Naver Pay and points, it could be used across portals, e-commerce, and content in daily life. By leveraging Upbit's infrastructure to expand into DeFi (decentralized finance), a model could emerge to liquidate inactive assets like points and gift certificates via stablecoins, presenting a blueprint for Naver to evolve into a genuine financial player.

◇ Building new ownership under a professional management system

The professional management–centered ownership that Chairman Lee built is expected to be maintained under Chairman Song's regime. Within Naver, Kim Jun-gu, CEO of Naver Webtoon, and Kim Chang-wook, CEO of Snow and Cream, are cited as next-generation executives. After CEO Choi Soo-yeon, who is serving as the interim managed CEO and acting as the bridge for leadership change, it is expected that CEOs with expertise in each business will support Naver's management centered on Chairman Song.

Convincing Dunamu shareholders remains the final task. A share swap requires a special resolution at the shareholders' meeting with approval from two-thirds of the shareholders present.

Cha Jun-ho/Choi Da-eun/Go Eun-yi reporters chacha@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)