Ki Young Ju "Corporate Bitcoin accumulation strategy has limits with PIPE… only seeks short-term gains"

Summary

- Ki Young Ju, CEO of CryptoQuant, pointed out that the private investment in public equity (PIPE) used by some Bitcoin (BTC)-holding companies has limitations.

- He stated that PIPE investors move to seek short-term gains only, which is not appropriate for companies' long-term treasury strategies.

- The market evaluated that while PIPE can be useful for securing short-term liquidity, it is at odds with long-term Bitcoin accumulation strategies.

Ki Young Ju, CEO of CryptoQuant, recently pointed out that the 'private investment in public equity (PIPE)' used by some Bitcoin (BTC)-holding companies to raise funds has limitations.

On the 26th, Ki Young Ju said on X·formerly Twitter, "PIPE is not suitable for operating a Bitcoin treasury company. Investors move only to seek short-term gains."

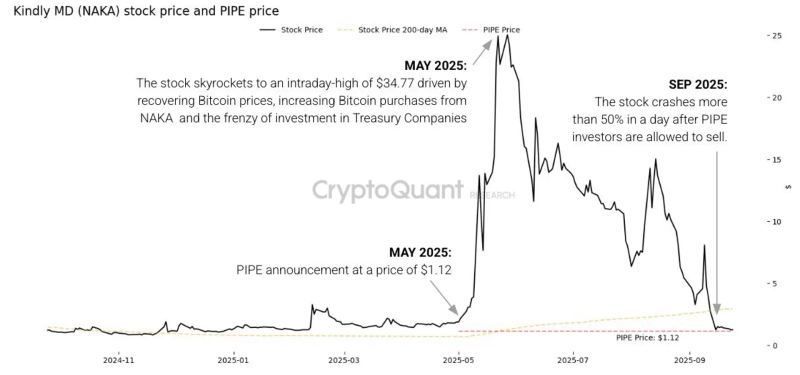

He cited the share price movement of Bitcoin treasury company Kindly MD (Kindly MD·NAKA) as an example. According to CryptoQuant research, NAKA soared intraday to $34.77 in May amid increased Bitcoin buying and a corporate investment boom. However, when the PIPE investor lockup was lifted last September, it plunged more than 50% in a single day, starkly revealing investors' short-term selling pressure.

The market notes that while PIPE structures may be useful for securing short-term liquidity, they diverge from companies' long-term Bitcoin treasury strategies.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)