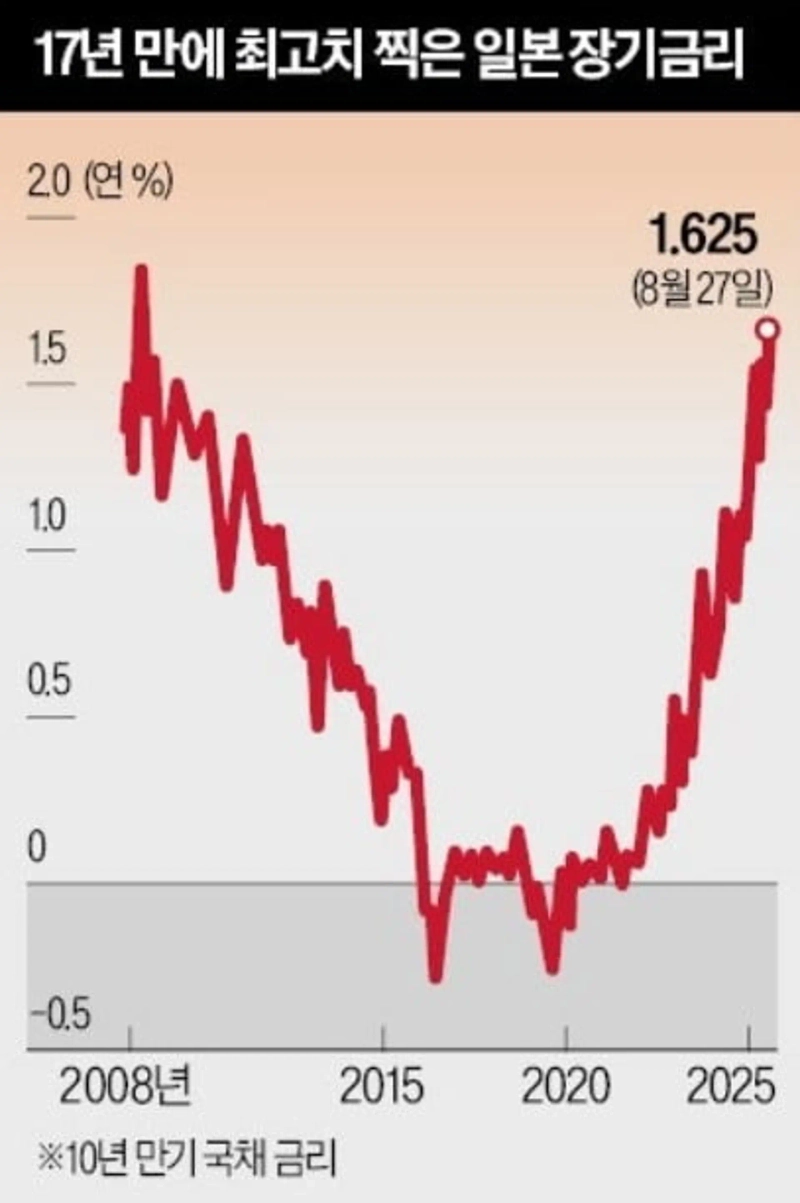

Japan, 60% chance of a rate hike in October… Government bond yields at highest since the financial crisis

Summary

- Reported that the BOJ's probability of a policy rate hike in October surged recently from 30% to 60%.

- Stated that 10-year government bond yields reached their highest level since 2008, expanding volatility in government bond yields and bond prices.

- Reported that the LDP leadership election is widely expected not to have a major impact on the BOJ's monetary policy decisions.

Rate-hike probability doubles in one month

Bond yields jump to a 17-year high

Will respect Koizumi's judgment on the BOJ

The Bank of Japan (BOJ)'s chances of a policy rate hike in October are rising sharply. With forecasts that could breach the '0.5% policy rate wall' that had stood unbroken for 30 years, 10-year government bond yields have hit their highest level since 2008, and financial markets are also showing turbulence. Analysts say the LDP leadership election scheduled for the 4th next month is unlikely to stop the BOJ's move.

Probability of an October rate hike doubles

On the 29th, the Nihon Keizai Shimbun reported that the 10-year government bond yield briefly reached 1.665% on the 22nd, marking the highest level since July 2008. On the same day, the 2-year government bond yield rose to 0.93%, its highest since June 2008.

Both long-term yield indicators and medium-term yields, which are sensitive to BOJ policy, rose to levels not seen in 17 years. A rise in government bond yields means a fall in bond prices.

The sharp rise in government bond yields is due to expectations that the BOJ will raise rates at the monetary policy meeting to be held on the 29th–30th of next month. In the overnight index swap (OIS) market, which exchanges fixed and floating rates for a certain period, the probability of a rate hike in October was priced at 60%. This is a rapid increase from about 30% at the previous September monetary policy meeting.

The BOJ raised its policy rate from 0.25% to 0.5% in January this year and then left the rate unchanged at all five Monetary Policy Meetings held through September.

Analysts say that two policy board members effectively expressing 'hike' opinions at the meeting on the 19th influenced bond market expectations. Policy board member Naoki Tamura argued, "We should raise rates closer to neutral to stabilize prices."

The market interprets that the BOJ is using the voices of the two members to signal an earlier hike and manage market sentiment. In fact, Tamura was the one who proposed a rate hike at the December 2024 meeting that could take effect at the January 2025 meeting.

The BOJ's decision at the September meeting to sell ETFs with a market value of about 70 trillion yen (roughly 660 trillion won) was also read as a signal foreshadowing a rate hike. The Nikkei reported that "this move, aimed at highlighting normalization of monetary policy, is also being interpreted as groundwork for an earlier rate increase."

The market is watching whether long-term yields will break through 1.7%. Naoya Hasegawa, a bond strategist at Okasan Securities, forecasted, "If October's hike probability is priced in at 80–90%, long-term yields could exceed 1.7%."

LDP leadership election unlikely to be a variable

Analysts say the LDP leadership election on the 4th next month to decide the next prime minister is also unlikely to greatly affect the BOJ's moves. Among the two leading candidates, Agriculture, Forestry and Fisheries Minister Shinjiro Koizumi and former Minister of Economy, Trade and Industry Sanae Takaichi have not voiced particular opinions on interest rates.

Takaichi, who has been called the "female Abe," previously said, "Raising rates now would be foolish." But analysts say she has been holding back her comments recently because the Japanese public is sensitive to price increases. Koizumi is widely expected to respect the BOJ's policy judgment.

The Nihon Keizai Shimbun reported that in a telephone survey of 915 people conducted with TV Tokyo from the 26th–28th, 34% named Takaichi as the most suitable candidate for the next LDP president, followed by Koizumi (25%) and Hayashi (14%). Among respondents who support the LDP, Koizumi received 33%, Takaichi 28%, and Hayashi 20%.

Reporter Mansu Choi bebop@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)